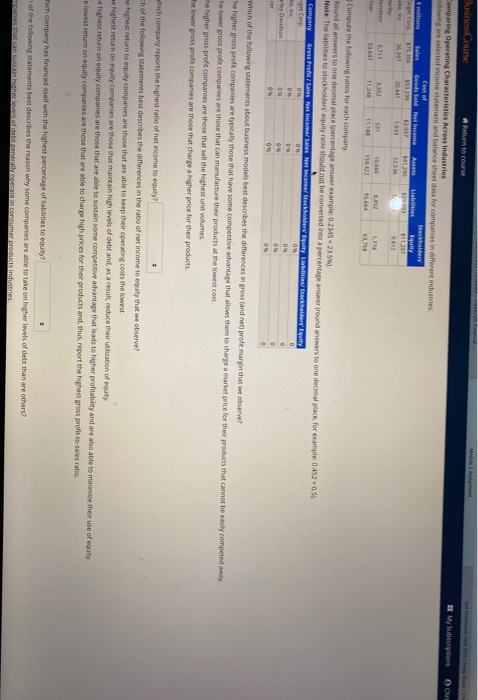

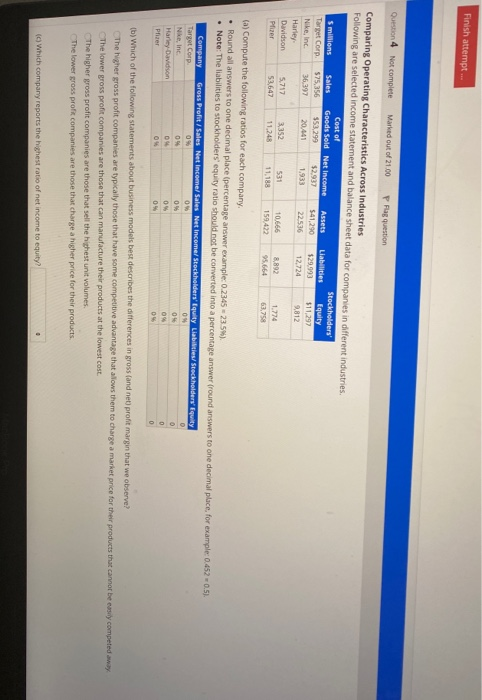

Question: Busines Course Return to course My Subscriptions O Chri Comparing Operating Characteristics Across Industries following are selected income statement and balance sheet data for companies

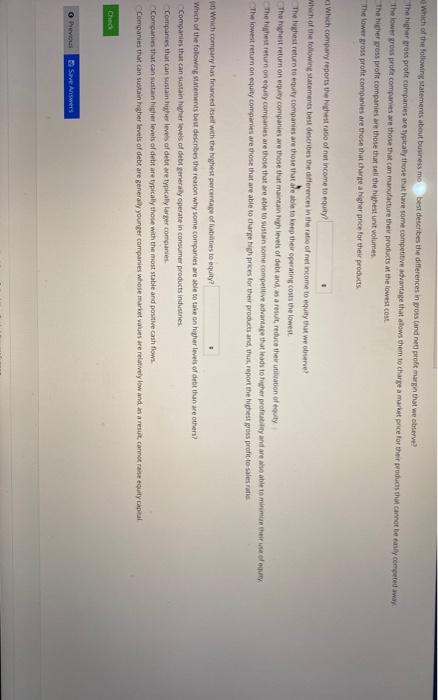

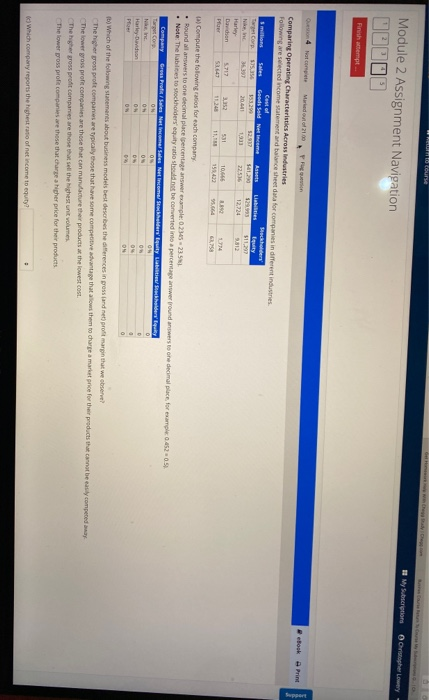

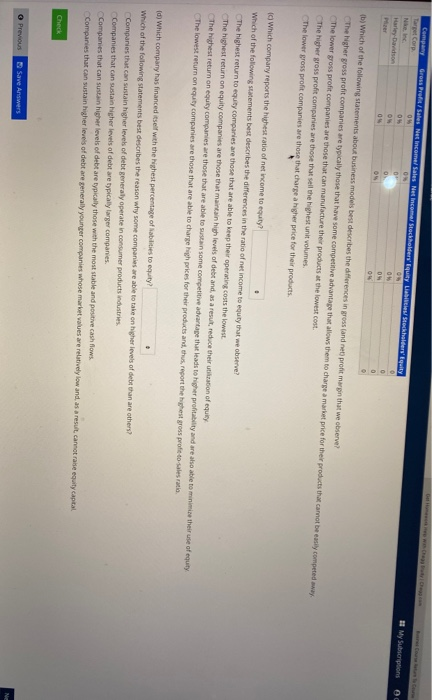

Busines Course Return to course My Subscriptions O Chri Comparing Operating Characteristics Across Industries following are selected income statement and balance sheet data for companies in different industries Center mine Sales Goods sold Net Income Stockholders Anets 1.16 12917 H420 19 12993 $11,297 20441 22.536 2012 5712 51642 352 ruar 531 11.13 1.774 12 Compute the following ratios for each company Round all answers to one decimal place percentage answer example: 0.2345 23.5M) Note: The liabilities to stockholders' equity ratio should not be converted into a percentage answer fround answers to one decimal place for example: 0452-05) Company Gross Profit/ Sales Net Income Sales Net Income Stockholders' Equity Liabilitieseckholders' Equity per Corp 0 ON Inc OM ON ON arley-Davidson ON 0 04 ON Which of the following statements about business models best describes the differences in gross and neprofit margin that we observe? The higher gross profit companies are typically those that have some competitive advantage that allows them to charge a market price for their products that cannot be easily competed away he lower gross profit companies are those that can manufacture their products at the lowest cost. he higher gross profit companies are those that sell the ghest unit volumes. the lower gross profit companies are those that charge a higher price for their products which company reports the highest ratio of net income to equity! ch of the following statements best describes the differences in the ratio of net income to equity that we observe? e highest return to equity companies are those that are able to keep their operating costs the lowest highest return on equity companies are those that maintain high levels of debt and, as a result, reduce their utilization of equity highest return on equity companies are those that are able to sustain some competitive advantage that leads to higher profitability and are also able to minimize their use of equity e lowest return on equity companies are those that are able to charge high prices for their products and thus, report the highest gross profit-to-sales ratio. hich company has financed itself with the highest percentage of abilities to equity? . of the following statements best describes the reason why some companies are able to take on higher levels of debt than are others? that can sustain higher levels of the enerally atin consuments industries a) Which of the following statements about business mo best describes the differences in gross (and net profit margin that we observe? The higher gross profit companies are typically those that have some competitive advantage that allows them to charge a market price for their products that cannot be easily competed away The lower gross profit companies are those that can manufacture their products at the lowest cost. The higher gross profit companies are those that sell the highest unit volumes. The lower gross profit companies are those that change a higher price for their products. Which company reports the light ratio of net income to equity? Which of the following statements best describes the differences in the ratio of net income to equity that we observe? The highest return to equity companies are those that de able to keep their operating costs the lowest The highest return on equity companies are those that maintain high levels of debt and as a result, reduce their utilization of equity The highest return on equity companies are those that are able to sustain some competitive advantage that leads to higher profitability and are also able to minimize their use of equity The lowest return on equity companies are those that are able to charge high prices for their products and thus, report the highest gross profitto sales ratio. (d) Which company has financed itself with the highest percentage of abilities to equity Which of the following statements best describes the reason why some companies are able to take on higher levels of debt than are others? Companies that can sustain higher levels of debt generally operate in consumer products industries Companies that can sustain higher levels of debt are typically larger companies Companies that can sustain higher levels of debt are typically those with the most stable and positive cash flows. Companies that can sustain higher levels of debt are generally younger companies whose market values are relatively low and, as a result, cannot rate equity capital Check O Previous Save Answers Nou My Subscriptions Oristopher Low- Module 2 Assignment Navigation QULDU 5 Fushatempt took Print PF Comparing Operating Characteristics Across Industries Following are selected income statement and balance sheet data for companies in different industries Cestol Sales Goods Sold Neeme Aases Stockholders Top 575.356 153.290 52:17 36.390 $11,297 20.04 1,933 22:36 12,724 Harley Dardan 5717 2.152 531 10,64 Per 158.402 95. Compute the following ratios for each company . Round all answers to one decimal place percentage answer example: 02345 23.5 Note: The liabilities to stockholders' equity ratio should not be converted into a percentage answer round answers to one decimal place for example 0.452 0.5 Company Gress Prats Sales Net.com/ Net Income holders beholdere quity Target con ON OS O O ON 0 Pro ON ON Which of the following statements about business models best descobes the differences in gress and et profit margin that we observe! The higher pros proft companies are typically those that have some competitive advantage that allows them to change market price for their products that cannot be easily competed The lower loss profit companies are those that can manufacture the products at the lowest cost The higher gross profit companies are those that sell the highest un volumes The lower gross profile companies are those that charge a higher price for their products Which company reports the highest ratio of net income to equity? Company Target Care Ne, ne Harley-Davidson Gross Profil / Sales Net income Sales Net Income Stockholders Equay Liabilities Stockholders' Equity ON O 0 O ON 0 0 04 My Sunstorptions oc Which of the following statements about business models best describes the differences in gross and net profit margin that we observe? The higher gross profit companies are typically those that have some competitive advantage that allows them to charge a market price for their products that cannot be easily competed The lower gross profit companies are those that can manufacture their products at the lowest cost. The higher gross profit companies are those that sell the highest unit volumes. The lower gross profit companies are those that charge a higher price for their products, Which company reports the highest ratio of net income to equity! Which of the following statements best describes the differences in the ratio of net income to equity that we observe! The highest return to equity companies are those that are able to keep the operating costs the lowest The highest return on equity companies are those that maintain high levels of debt and as a result, reduce their heation of equity The highest return on equity companies are those that are able to sustain some competitive advantage that leads to higher profitability and are also able to minimize their use of equity The lowest return on equity companies are those that are able to charge high prices for their products and thus report the highest gross profeto stes ratio (d) Which company has financed itself with the highest percentage of abilities to ty? Which of the following statements best describes the reason why some companies are able to take on higher levels of debt than are others? Companies that can sustain higher levels of debt generally operate in consumer products industries Companies that can sustain higher levels of debt are typically larger companies Companies that can sustain higher levels of debt are typically those with the most stable and positive cash flows. Companies that can sustain higher levels of debt are generally younger companies whose market values are relatively low and as a result, cannot raise equity capital Check o Previous Save Answers N Finish attempt Question 4 Not complete Marked out of 21.00 P Flag question Comparing Operating Characteristics Across Industries Following are selected income statement and balance sheet data for companies in different industries Cost of Smillions Sales Goods Sold Net Income Stockholders' Assets Liabilities Equity Target Corp 575.356 $53,299 $2.937 $41,290 $29.993 $11.297 Nike, Inc 36.397 20.441 1.933 22.536 12,724 Harley Davidson 5.717 3,352 531 10.666 8,892 1.774 Pfizer 53,647 11.248 11.188 159.422 95,664 63,758 9.812 (a) Compute the following ratios for each company Round all answers to one decimal place (percentage answer example: 0.2345 - 23.5). Note: The liabilities to stockholders' equity ratio should not be converted into a percentage answer (round answers to one decimal place, for example: 0.452 -0.5). Company Gross Profit/Sales Net Income/ Sales Net Income Stockholders' Equity Liabilities/Stockholders' Equity Target Corp O 09 09 Nike Inc 0% 04 Harley-Davidson 04 O 09 0 Pfizer O 0 0 (b) Which of the following statements about business models best describes the differences in gross (and net profit margin that we observe? The higher gross profit companies are typically those that have some competitive advantage that allows them to charge a market price for their products that cannot be easily competed away The lower gross profit companies are those that can manufacture their products at the lowest cost. The higher gross profit companies are those that sell the highest unit volumes. The lower gross prof companies are those that charge a higher price for their products. (c) Which company reports the highest ratio of net income to equity? Busines Course Return to course My Subscriptions O Chri Comparing Operating Characteristics Across Industries following are selected income statement and balance sheet data for companies in different industries Center mine Sales Goods sold Net Income Stockholders Anets 1.16 12917 H420 19 12993 $11,297 20441 22.536 2012 5712 51642 352 ruar 531 11.13 1.774 12 Compute the following ratios for each company Round all answers to one decimal place percentage answer example: 0.2345 23.5M) Note: The liabilities to stockholders' equity ratio should not be converted into a percentage answer fround answers to one decimal place for example: 0452-05) Company Gross Profit/ Sales Net Income Sales Net Income Stockholders' Equity Liabilitieseckholders' Equity per Corp 0 ON Inc OM ON ON arley-Davidson ON 0 04 ON Which of the following statements about business models best describes the differences in gross and neprofit margin that we observe? The higher gross profit companies are typically those that have some competitive advantage that allows them to charge a market price for their products that cannot be easily competed away he lower gross profit companies are those that can manufacture their products at the lowest cost. he higher gross profit companies are those that sell the ghest unit volumes. the lower gross profit companies are those that charge a higher price for their products which company reports the highest ratio of net income to equity! ch of the following statements best describes the differences in the ratio of net income to equity that we observe? e highest return to equity companies are those that are able to keep their operating costs the lowest highest return on equity companies are those that maintain high levels of debt and, as a result, reduce their utilization of equity highest return on equity companies are those that are able to sustain some competitive advantage that leads to higher profitability and are also able to minimize their use of equity e lowest return on equity companies are those that are able to charge high prices for their products and thus, report the highest gross profit-to-sales ratio. hich company has financed itself with the highest percentage of abilities to equity? . of the following statements best describes the reason why some companies are able to take on higher levels of debt than are others? that can sustain higher levels of the enerally atin consuments industries a) Which of the following statements about business mo best describes the differences in gross (and net profit margin that we observe? The higher gross profit companies are typically those that have some competitive advantage that allows them to charge a market price for their products that cannot be easily competed away The lower gross profit companies are those that can manufacture their products at the lowest cost. The higher gross profit companies are those that sell the highest unit volumes. The lower gross profit companies are those that change a higher price for their products. Which company reports the light ratio of net income to equity? Which of the following statements best describes the differences in the ratio of net income to equity that we observe? The highest return to equity companies are those that de able to keep their operating costs the lowest The highest return on equity companies are those that maintain high levels of debt and as a result, reduce their utilization of equity The highest return on equity companies are those that are able to sustain some competitive advantage that leads to higher profitability and are also able to minimize their use of equity The lowest return on equity companies are those that are able to charge high prices for their products and thus, report the highest gross profitto sales ratio. (d) Which company has financed itself with the highest percentage of abilities to equity Which of the following statements best describes the reason why some companies are able to take on higher levels of debt than are others? Companies that can sustain higher levels of debt generally operate in consumer products industries Companies that can sustain higher levels of debt are typically larger companies Companies that can sustain higher levels of debt are typically those with the most stable and positive cash flows. Companies that can sustain higher levels of debt are generally younger companies whose market values are relatively low and, as a result, cannot rate equity capital Check O Previous Save Answers Nou My Subscriptions Oristopher Low- Module 2 Assignment Navigation QULDU 5 Fushatempt took Print PF Comparing Operating Characteristics Across Industries Following are selected income statement and balance sheet data for companies in different industries Cestol Sales Goods Sold Neeme Aases Stockholders Top 575.356 153.290 52:17 36.390 $11,297 20.04 1,933 22:36 12,724 Harley Dardan 5717 2.152 531 10,64 Per 158.402 95. Compute the following ratios for each company . Round all answers to one decimal place percentage answer example: 02345 23.5 Note: The liabilities to stockholders' equity ratio should not be converted into a percentage answer round answers to one decimal place for example 0.452 0.5 Company Gress Prats Sales Net.com/ Net Income holders beholdere quity Target con ON OS O O ON 0 Pro ON ON Which of the following statements about business models best descobes the differences in gress and et profit margin that we observe! The higher pros proft companies are typically those that have some competitive advantage that allows them to change market price for their products that cannot be easily competed The lower loss profit companies are those that can manufacture the products at the lowest cost The higher gross profit companies are those that sell the highest un volumes The lower gross profile companies are those that charge a higher price for their products Which company reports the highest ratio of net income to equity? Company Target Care Ne, ne Harley-Davidson Gross Profil / Sales Net income Sales Net Income Stockholders Equay Liabilities Stockholders' Equity ON O 0 O ON 0 0 04 My Sunstorptions oc Which of the following statements about business models best describes the differences in gross and net profit margin that we observe? The higher gross profit companies are typically those that have some competitive advantage that allows them to charge a market price for their products that cannot be easily competed The lower gross profit companies are those that can manufacture their products at the lowest cost. The higher gross profit companies are those that sell the highest unit volumes. The lower gross profit companies are those that charge a higher price for their products, Which company reports the highest ratio of net income to equity! Which of the following statements best describes the differences in the ratio of net income to equity that we observe! The highest return to equity companies are those that are able to keep the operating costs the lowest The highest return on equity companies are those that maintain high levels of debt and as a result, reduce their heation of equity The highest return on equity companies are those that are able to sustain some competitive advantage that leads to higher profitability and are also able to minimize their use of equity The lowest return on equity companies are those that are able to charge high prices for their products and thus report the highest gross profeto stes ratio (d) Which company has financed itself with the highest percentage of abilities to ty? Which of the following statements best describes the reason why some companies are able to take on higher levels of debt than are others? Companies that can sustain higher levels of debt generally operate in consumer products industries Companies that can sustain higher levels of debt are typically larger companies Companies that can sustain higher levels of debt are typically those with the most stable and positive cash flows. Companies that can sustain higher levels of debt are generally younger companies whose market values are relatively low and as a result, cannot raise equity capital Check o Previous Save Answers N Finish attempt Question 4 Not complete Marked out of 21.00 P Flag question Comparing Operating Characteristics Across Industries Following are selected income statement and balance sheet data for companies in different industries Cost of Smillions Sales Goods Sold Net Income Stockholders' Assets Liabilities Equity Target Corp 575.356 $53,299 $2.937 $41,290 $29.993 $11.297 Nike, Inc 36.397 20.441 1.933 22.536 12,724 Harley Davidson 5.717 3,352 531 10.666 8,892 1.774 Pfizer 53,647 11.248 11.188 159.422 95,664 63,758 9.812 (a) Compute the following ratios for each company Round all answers to one decimal place (percentage answer example: 0.2345 - 23.5). Note: The liabilities to stockholders' equity ratio should not be converted into a percentage answer (round answers to one decimal place, for example: 0.452 -0.5). Company Gross Profit/Sales Net Income/ Sales Net Income Stockholders' Equity Liabilities/Stockholders' Equity Target Corp O 09 09 Nike Inc 0% 04 Harley-Davidson 04 O 09 0 Pfizer O 0 0 (b) Which of the following statements about business models best describes the differences in gross (and net profit margin that we observe? The higher gross profit companies are typically those that have some competitive advantage that allows them to charge a market price for their products that cannot be easily competed away The lower gross profit companies are those that can manufacture their products at the lowest cost. The higher gross profit companies are those that sell the highest unit volumes. The lower gross prof companies are those that charge a higher price for their products. (c) Which company reports the highest ratio of net income to equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts