Question: Business Analytics 6th Edition, Chapter 15, Problem 32. There is an expert solution already but I am struggling to see why they chose 6,000 units

Business Analytics 6th Edition, Chapter 15, Problem 32. There is an expert solution already but I am struggling to see why they chose 6,000 units instead of 60,000 units and I am finding it difficult to understand the instructions on how to come up with the calculations in part a and b especially. Could this problem be re-worked with more detailed descriptions and screenshots of the excel sheet, formulas, and Risk setup. Thanks.

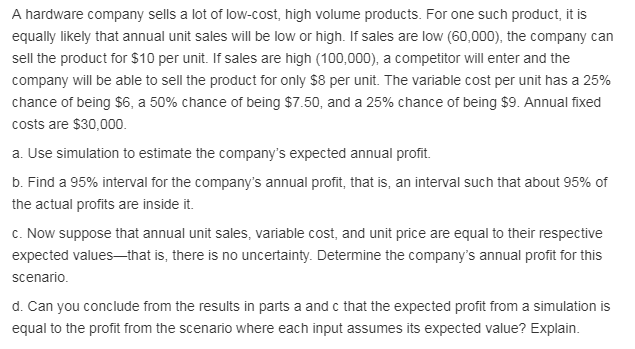

A hardware company sells a lot of low-cost, high volume products. For one such product, it is equally likely that annual unit sales will be low or high. If sales are low (60,000), the company can sell the product for $10 per unit. If sales are high (100,000), a competitor will enter and the company will be able to sell the product for only $8 per unit. The variable cost per unit has a 25% chance of being $6, a 50% chance of being $7.50, and a 25% chance of being $9. Annual fixed costs are $30,000. a. Use simulation to estimate the company's expected annual profit. b. Find a 95% interval for the company's annual profit, that is, an interval such that about 95% of the actual profits are inside it. C. Now suppose that annual unit sales, variable cost, and unit price are equal to their respective expected values-that is, there is no uncertainty. Determine the company's annual proft for this scenarid d. Can you conclude from the resulits in parts a and c that the expected proft from a simulation is equal to the profit from the scenario where each input assumes its expected value? Explain A hardware company sells a lot of low-cost, high volume products. For one such product, it is equally likely that annual unit sales will be low or high. If sales are low (60,000), the company can sell the product for $10 per unit. If sales are high (100,000), a competitor will enter and the company will be able to sell the product for only $8 per unit. The variable cost per unit has a 25% chance of being $6, a 50% chance of being $7.50, and a 25% chance of being $9. Annual fixed costs are $30,000. a. Use simulation to estimate the company's expected annual profit. b. Find a 95% interval for the company's annual profit, that is, an interval such that about 95% of the actual profits are inside it. C. Now suppose that annual unit sales, variable cost, and unit price are equal to their respective expected values-that is, there is no uncertainty. Determine the company's annual proft for this scenarid d. Can you conclude from the resulits in parts a and c that the expected proft from a simulation is equal to the profit from the scenario where each input assumes its expected value? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts