Question: business analytics question please answer fully and correctly. thank you A put option in finance atons you to seil a share of stock at a

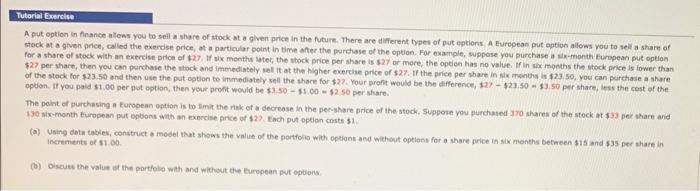

A put option in finance atons you to seil a share of stock at a given price in the future. There are different types of put eptions. A Eurepean put eption allows you to sell a share of stock at a given price, called the exerdse price, of a particular point in time after the purchase of the option. For example, suppose you purchase a six-month European put option for a share of stock with an exercise price of 127 . If wik months latel, the stock price per share is s27 or more, the option has no value. If in alk monthis the stock price is lower than $27 per shart, then you can purchase the stock and immedintely lel it at the higher everche price of s27. If the price per share in six months is 123.50, you can purchase a share of the stock for $23.50 and then use the put -option to imumediately sell the share for $27, Your profit would be the difference, 127$23.50=$3.50 per share, less the cost of the option. If you paid s1.00 per pot option, then your profit would be $3.5011.00=$2.50 per share. The point of purchasing a European option is to amit the riak of a decrease in the pershare price of the stock. Suppose you purchased a7o shares of the stock at 133 per ahare and 130 six-month furbpean put options wath an exercise price of 327 . tach put option costs 51 . (a) Using dota tabies, construat a modet that shows the value of the porttolio with optlont and without options for a share price in six months between 315 and s3s per ahare in increments of s1.00. (b) Discues the value of the partfole with and without the European put options

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts