Question: Business Application Cases Target The Business Application cases for chapters 3 through 8 are based on the Form 10-K for Target Corp. The cases allow

Business Application Cases Target The Business Application cases for chapters 3 through 8 are based on the Form 10-K for Target Corp. The cases allow you to apply the concepts from the text to a live case. The text Business Application cases reference the 2018 Fiscal Year reports, but we will use the more current 2021 Fiscal Year reports. You will find the complete 10-K report in a pdf file as well as an excel workbook with the financial statements posted on the Canvas course site for convenience. But I encourage you to locate them either through the SEC Edgar database (See Appendix A, Chapter 3 in the text), or by going to the Target Investor Relations web site. Chapter 3 Assignment (Adapted from ATC 3-1 in Text) Use the Target Corporation Form 10-K to answer the following questions related to Targets 2021 Fiscal Year. Note that Targets Fiscal Year ends in late January or early February, so the 2021 Fiscal Year ends January 29, 2022. You will need to use the financial statements as well as notes to the financial statements to answer the questions. Show your calculations and extend all decimal points at least 2 places.

Business Application Cases Target The Business Application cases for chapters 3 through 8 are based on the Form 10-K for Target Corp. The cases allow you to apply the concepts from the text to a live case. The text Business Application cases reference the 2018 Fiscal Year reports, but we will use the more current 2021 Fiscal Year reports. You will find the complete 10-K report in a pdf file as well as an excel workbook with the financial statements posted on the Canvas course site for convenience. But I encourage you to locate them either through the SEC Edgar database (See Appendix A, Chapter 3 in the text), or by going to the Target Investor Relations web site. Chapter 3 Assignment (Adapted from ATC 3-1 in Text) Use the Target Corporation Form 10-K to answer the following questions related to Targets 2021 Fiscal Year. Note that Targets Fiscal Year ends in late January or early February, so the 2021 Fiscal Year ends January 29, 2022. You will need to use the financial statements as well as notes to the financial statements to answer the questions. Show your calculations and extend all decimal points at least 2 places.

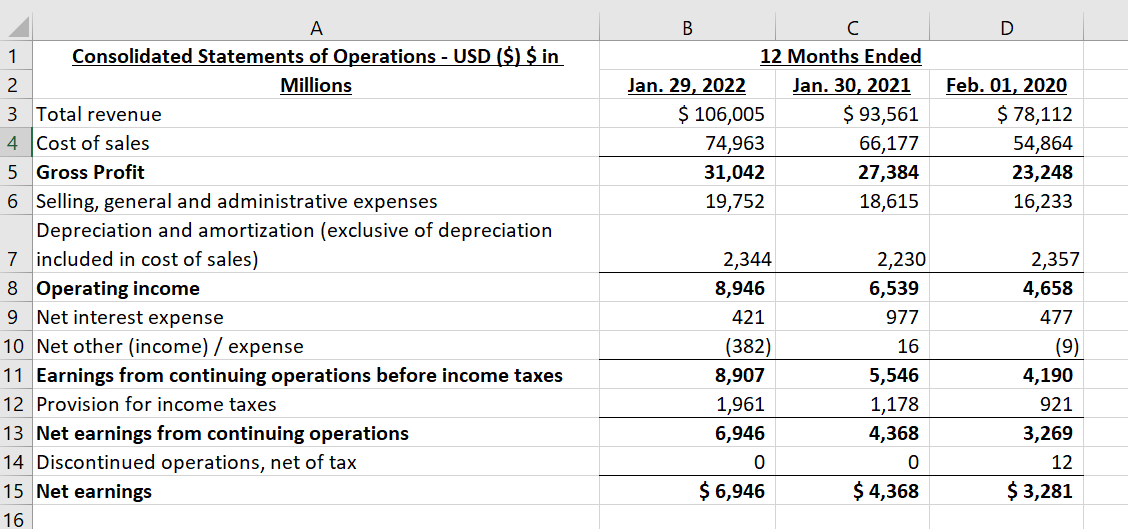

a) What percentage of Targets total revenues end up as net earnings for the most recent year? (Hint: use the Statement of Operations)

b) What percentage of Targets sales go to pay for the costs of the goods being sold? (Hint: use the Statement of Operations)

c) Calculate the Cost of Sales and the Gross Margin as a percentage of Targets Sales for the 2021, 2020 and 2019 Fiscal Years. Comment on the changes and the significance of changes in these ratios. (Hint: use the Statement of Operations)

d) What costs does Target include in its Cost of Sales account? (Hint: use the Notes to the Financial Statements starting on page 40 of the 10-K) e) When does Target recognize revenue from the sale of gift cards? (Hint: use the Notes to the Financial Statements starting on page 40 of the 10- K)

A 1 Consolidated Statements of Operations - USD ($) $ in Millions 2 3 Total revenue 4 Cost of sales 5 Gross Profit 6 Selling, general and administrative expenses Depreciation and amortization (exclusive of depreciation 7 included in cost of sales) 8 Operating income 9 Net interest expense 10 Net other (income) / expense 11 Earnings from continuing operations before income taxes 12 Provision for income taxes 13 Net earnings from continuing operations 14 Discontinued operations, net of tax 15 Net earnings 16 B Jan. 29, 2022 12 Months Ended Jan. 30, 2021 $ 93,561 66,177 27,384 18,615 2,230 $ 106,005 74,963 31,042 19,752 2,344 8,946 421 (382) 8,907 1,961 6,946 $ 6,946 6,539 977 16 5,546 1,178 4,368 $ 4,368 D Feb. 01, 2020 $ 78,112 54,864 23,248 16,233 2,357 4,658 477 (9) 4,190 921 3,269 12 $ 3,281

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts