Selected ledger account balances for Business Solutions follow. Office equipment Accumulated depreciation-Office equipment Computer equipment Accumulated...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

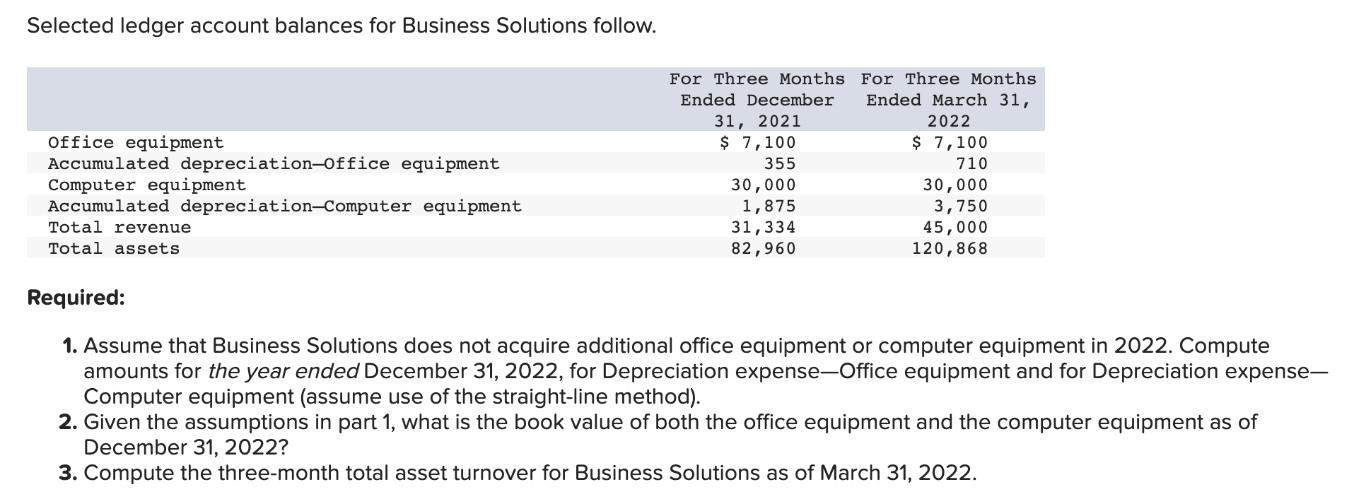

Selected ledger account balances for Business Solutions follow. Office equipment Accumulated depreciation-Office equipment Computer equipment Accumulated depreciation-Computer equipment Total revenue Total assets For Three Months Ended December 31, 2021 $ 7,100 355 30,000 1,875 31,334 82,960 For Three Months. Ended March 31, 2022 $ 7,100 710 30,000 3,750 45,000 120,868 Required: 1. Assume that Business Solutions does not acquire additional office equipment or computer equipment in 2022. Compute amounts for the year ended December 31, 2022, for Depreciation expense-Office equipment and for Depreciation expense- Computer equipment (assume use of the straight-line method). 2. Given the assumptions in part 1, what is the book value of both the office equipment and the computer equipment as of December 31, 2022? 3. Compute the three-month total asset turnover for Business Solutions as of March 31, 2022. Selected ledger account balances for Business Solutions follow. Office equipment Accumulated depreciation-Office equipment Computer equipment Accumulated depreciation-Computer equipment Total revenue Total assets For Three Months Ended December 31, 2021 $ 7,100 355 30,000 1,875 31,334 82,960 For Three Months. Ended March 31, 2022 $ 7,100 710 30,000 3,750 45,000 120,868 Required: 1. Assume that Business Solutions does not acquire additional office equipment or computer equipment in 2022. Compute amounts for the year ended December 31, 2022, for Depreciation expense-Office equipment and for Depreciation expense- Computer equipment (assume use of the straight-line method). 2. Given the assumptions in part 1, what is the book value of both the office equipment and the computer equipment as of December 31, 2022? 3. Compute the three-month total asset turnover for Business Solutions as of March 31, 2022.

Expert Answer:

Answer rating: 100% (QA)

1 To calculate Depreciation expense for Office equipment and Computer equipment using the straightli... View the full answer

Related Book For

Advanced Accounting

ISBN: 978-0538480284

11th edition

Authors: Paul M. Fischer, William J. Tayler, Rita H. Cheng

Posted Date:

Students also viewed these finance questions

-

The rig shown consists of a 5.4-kN horizontal member ABC and a vertical member DBE welded together at B. The rig is being used to raise a 16.2-kN crate at a distance x = 4.8 m from the vertical...

-

The rig shown consists of a 1200-lb horizontal member ABC and a vertical member DBE welded together at B. The rig is being used to raise a 3600-lb crate at a distance x = 12 ft from the vertical...

-

The truck rests on the scale, which consists of a series of compound levers. If a mass M1 is placed on the pan P and it is required that the weight is located at a distance x to balance the "beam"...

-

Two thousand kg of water, initially a saturated liquid at 150C, is heated in a closed, rigid tank to a final state where the pressure is 2.5 MPa. Determine the final temperature, in C. the volume of...

-

Air flowing steadily in a nozzle experiences a normal shock at a Mach number of Ma = 2.5. If the pressure and temperature of air are 10.0 psia and 440.5 R, respectively, upstream of the shock,...

-

A social intrapreneur is someone who provides funding for those in Third World countries who want to begin their own businesses but have no capital with which to do so. True or False

-

Jerome M. Eisenberg is an antiquities dealer and a self-proclaimed expert in classical antiquities with a doctorate in Roman, Egyptian, and Near Eastern art. Maurice E. Hall Jr. is an art dealer who...

-

Hastings estimates that if it acquires Vandell, interest payments will be $1,500,000 per year for 3 years after which the current target capital structure of 30 percent debt will be maintained....

-

Adama Is A French Manufacturer Of Photovoltaic Panels. The Company Has A Production Plant In Rennes, Which Supplies Four Warehouses Located In Angers, Bourges, Clermont-Ferrand And Montauban. The...

-

Since London is north of Paris and south of Edinburgh, it follows that Paris is south of Edinburgh. The following arguments are deductive. Determine whether each is valid or invalid, and note the...

-

Solve: (x sin (4)) cly - (y sin 1 ) - x) dx = 0 y

-

1. what impact is covid 19 having on effective Communication within an organization. 2. what are the merit and demerit

-

You graduated from SJSU and immediately began work as an accounting consultant at a large private company that provides accounting consultancy services. One of your new clients is interested in your...

-

As a financial adviser, you are recommending a well-diversified fund with an expected rate of return of 25% and a standard deviation of 43% to your clients. A client would like to split her...

-

Gold sells for about $1300 per ounce. The density of gold is19.3 g/cm 3. How much would a brick of gold, 215 mm x 102.5 mm x 65mm, be worth?

-

An auditor is performing an audit for a jewellery store, but does not have any expertise in the valuation of diamonds. What should auditor do?

-

The Wild West is a lawless and dangerous place to be! At any wrong turn, you could find yourself in pretty sticky situations. Per the writings ofGary Cokins forTRG International, I can understand his...

-

A condenser (heat exchanger) brings 1 kg/s water flow at 10 kPa quality 95% to saturated liquid at 10 kPa, as shown in Fig. P4.91. The cooling is done by lake water at 20C that returns to the lake at...

-

Record the following endowment activity events of Private University: 1. An alumnus donates $250,000 to the endowment fund. The cash is fully invested in bonds with a face value of $242,000 that are...

-

Prior to liquidation, the following information relates to the partnership: Partnership trial balance: On June 30, other assets with a book value of $160,000 were sold for $120,000, and all available...

-

The chief operating decision maker of a publicly traded company has defined segments around four product/service groups. Various revenues, profits or losses, and assets associated with the segments...

-

Classify the following topics as primarily macroeconomic or microeconomic: 1. The impact of a tax increase on aggregate output. 2. The relationship between two competing firms pricing behavior. 3. A...

-

Use the high and low volatility scenarios that we used for the call option to show that put options also are worth more when stock price volatility is higher.

-

In light of this discussion, explain why the put-call parity relationship is valid only for European options on non-dividend-paying stocks. If the stock pays no dividends, what inequality for...

Study smarter with the SolutionInn App