Question: Business Policy- Thumbs Up Will Be Given for Answer. Question: CASE 16 HEINEKEN Dutch brewer Heineken was expanding its presence around the globe in response

Business Policy- Thumbs Up Will Be Given for Answer.

Question:

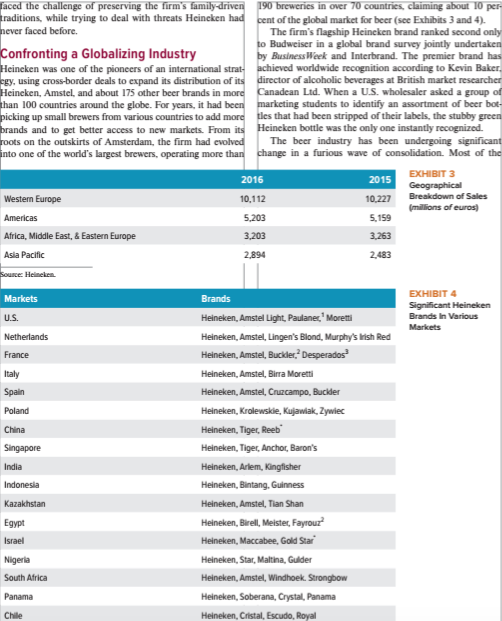

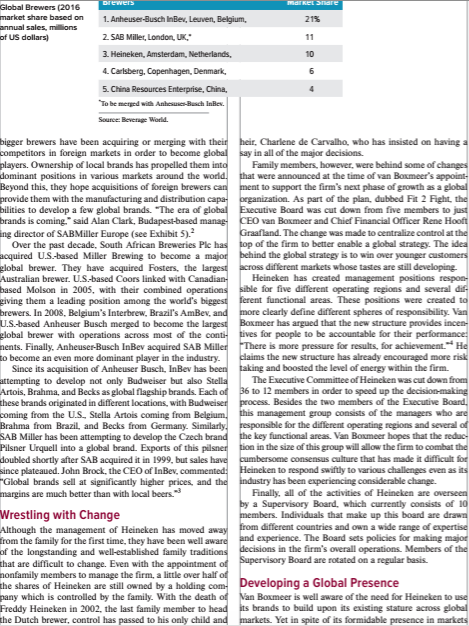

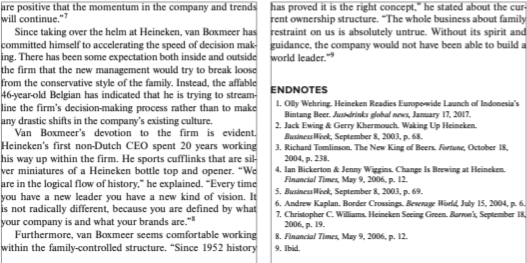

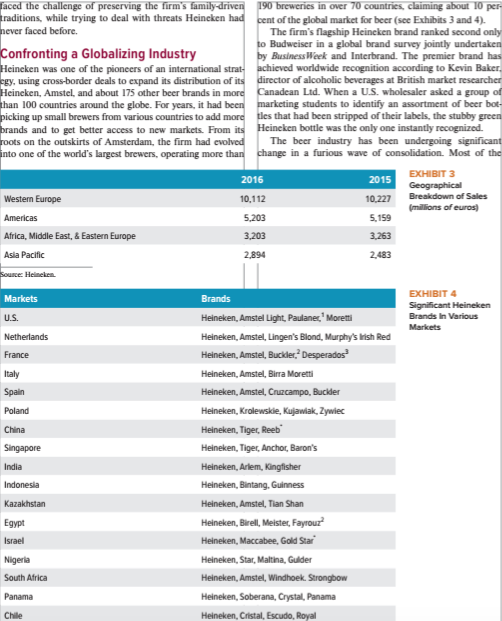

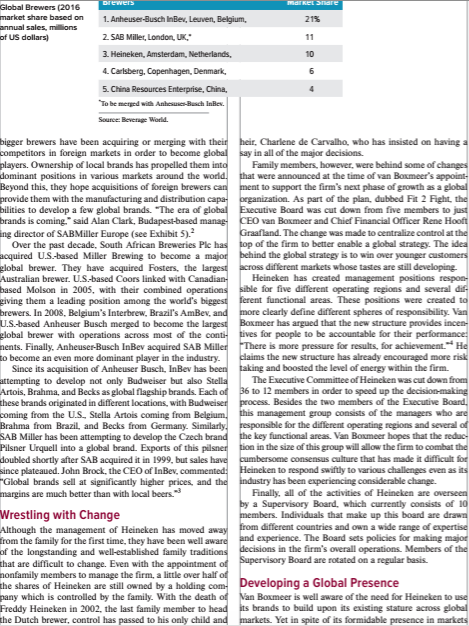

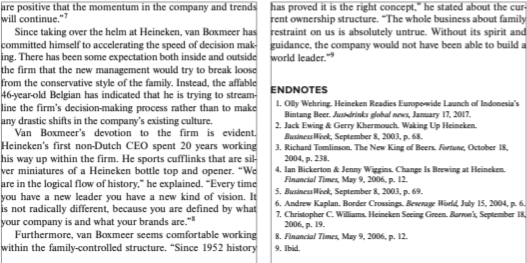

CASE 16 HEINEKEN Dutch brewer Heineken was expanding its presence around the globe in response to the merger of Anheuser-Busch InBev with SAB Miller giving the combined firm a com- manding 30 percent of global beer sales. Heineken was in talks to buy the Brazilian unit of Kirin, which the Japanese parent was planning to sell. The addition of Kirin beer would double Heineken's share in Brazil to 20 percent. The firm was also planning to launch Bintang, its biggest selling beer brand in Indonesia, into the UK and select European markets. An industry spokesman was positive about the move: "There is clearly significant demand for premium world beers. We believe Bintang is perfectly suited to meet this demand." These moves came on the heels of acquisitions and kapacity investments that Heineken had been making in bother developing markets. In 2013, the firm had strength- kned its position as the world's third largest brewer by tak- ng full ownership of Asian Pacific Breweries, the owner of Tiger, Bintang, and other popular Asian beer brands. With this deal, Heineken added 30 breweries across several coun- tries in the Asia Pacific region. A few years earlier, the firm had acquired Mexican brewer FEMSA Cervesa, producer of Dos Equis, Sol, and Tecate beers, to become a stronger, more competitive player in Latin America. At the same time. Heineken maintained its leading posi tion across Europe. It had made a high profile acquisition in 2008 of Scottish-based brewer Scottish & Newcastle, the brewer of well-known brands such as Newcastle Brown Ale and Kronenbourg 1664. Although the purchase had been made in partnership with Carlsberg, Heineken was able to gain control of Scottish & Newcastle's operations in several crucial European markets such as the United Kingdom, Ireland, Portugal, Finland, and Belgium These decisions to acquire brewers that operate in dif ferent parts of the world have been a part of a series of changes that the Dutch brewer has been making to raise its stature in the various markets and to respond to grow ing consolidation within the industry and changes that are occurring in the global market for beer. Even as sales of beer have stagnated in the US and Europe, demand has been growing elsewhere, especially in developing countries This has led the largest brewers to expand across the globe through acquisitions of smaller regional and national play ers (see Exhibits 1 and 2). The need for change was clearly reflected in the appoint- ment in October 2005 of Jean-Francois van Boxmeer as Heineken's first non-Dutch CEO. He was brought in to replace Thorny Ruys, who had decided to resign because of his failure to show much improvement in performance. Prior to the appointment of Ruys in 2002. Heineken had been run by three generations of Heineken ancestors, whose portraits still adorn the dark paneled office of the CEO in its Amsterdam headquarters. Like Ruys, van Boxmeer C e prepared by Jamal Shamsi, Michigan State University, with the wstance of Alan il. Einer, Pace University. Material has been trawn from punished sources to be used for purposes of class discussion Copyright 2017 Jumal Shams and Alan Esmer 2015 2013 EXHIBIT 1 Income Statement millions of Puros) Revenue 20,511 19.203 2016 20,792 2.993 1.540 2014 19.257 2,814 1.516 EBIT 2.785 2,484 Net profit 1354 SH EXHIBIT 2 Balance Sheet millions of uros) Assets 2016 39,321 24,748 14,573 2015 40,122 25,052 15,070 2014 34,830 17,869 13.452 2013 33,337 17.797 12,356 2012 35.979 9.250 12.805 Liabilities Equity faced the challenge of preserving the firm's family driven traditions, while trying to deal with threats Heineken had never faced before Confronting a Globalizing Industry Heineken was one of the pioneers of an international strat egy, using cross-border deals to expand its distribution of its Heineken, Amstel and about 175 other beer brands in more than 100 countries around the globe. For years, it had been picking up small browers from various countries to add more brands and to get better access to new markets. From its roots on the outskirts of Amsterdam, the firm had evolved into one of the world's largest brewers, operating more than 190 breweries in over 70 countries, claiming about 10 per cent of the global market for beer (see Exhibits 3 and 4). The firm's flagship Heineken brand ranked second only to Budweiser in a global brand survey jointly undertaken by Business Week and Interbrand. The premier brand has achieved worldwide recognition according to Kevin Baker director of alcoholic beverages at British market researchet Canadean Lid. When a US, wholesaler asked a group of marketing students to identify an assortment of beer bot ties that had been stripped of their labels, the stubby green Heineken bottle was the only one instantly recognized The beer industry has been undergoing significant change in a furious wave of consolidation. Most of the 2016 EXHIBIT 3 Geographical Breakdown of Sales millions of euros Western Europe Americas 10.112 5.203 3,203 2015 10.227 5.159 3.263 2,483 Africa, Middle East, & Eastern Europe Asia Pacific 2,894 Rue Henke Markets EXHIBIT 4 Significant Heineken Brands in Various Markets Brands Heineken, Amstel Light, Paulaner.' Moretti Heineken, Amstel. Lingen's Blond, Murphy's Irish Red Heineken, Amstel, Buckler. Desperados U.S. Netherlands France Italy Spain Heineken, Amstel, Birra Moretti Heineken, Amstel. Cruzcampo. Buckler Poland China Singapore India Indonesia Kazakhstan Heineken, Krolewskie, Kujawiak. Zywiec Heineken, Tiger Reeb Heineken, Tiger, Anchor, Baron's Heineken, Arlem, Kingfisher Heineken, Bintang. Guinness Heineken, Amstel Tian Shan Heineken, Birell, Meister Fayrouz Heineken, Maccabee, Gold Star Heineken, Star, Maltina, Gulder Heineken, Amstel, Windhoek Strongbow Heineken, Soberana, Crystal Panama Heineken, Cristal, Escudo, Royal Egypt Israel Nigeria South Africa Panama Chile EWELS STRELSE Global Brewers (2016 market share based on annual sales, millons of US dollars 1. Anheuser-Busch InBev. Leuven, Belgium 2. SABMiller. London, UK 3. Heineken, Amsterdam, Netherlands. 4. Carlsberg. Copenhagen, Denmark 5. China Resources Enterprise. China 10 See bigger brewers have been acquiring or merging with their heir. Charlene de Carvalho, who has insisted on having a competitors in foreign markets in order to become global ay in all of the major decisions players. Ownership of local brands has propelled them into Family members, however, were behind some of changes dominant positions in various markets around the world that were announced at the time of van Boxmeer's appoint Beyond this, they hope acquisitions of foreign brewers can ment to support the firm's next phase of growth as a global provide them with the manufacturing and distribution capa organization. As part of the plan, dubbed Fit 2 Fight, the bilities to develop a few global brands. "The era of global Executive Board was cut down from five members to just brands is coming." said Alan Clark, Budapest-based manap CEO van Boxmeer and Chief Financial Officer Rene Hooft ing director of SABMiller Europe (see Exhibit 5). Graafland. The change was made to centralize control at the Over the past decade, South African Breweries Plc has top of the firm to better enable a global strategy. The idea mcquired U.S.-based Miller Brewing to become a major behind the global strategy is to win over younger customers clobal brewer. They have acquired Fosters, the lareest across different markets whose tastes are will developing Australian brewer, US-based Coors linked with Canadian Heineken has created management positions respon based Molson in 2005, with their combined operationsible for five different operating regions and several dif giving them a leading position among the world's biggest ferent functional areas. These positions were created to brewers. In 2008, Belgium's Interbrew, Brazil's AmBex, and more clearly define different spheres of responsibility. Van U.S.-based Anheuser Busch merged to become the largest Boxmeer has argued that the new structure provides ingen global brewer with operations across most of the contitives for people to be accountable for their performance nents. Finally, Anheuser Busch InBev acquired SAB Miller "There is more pressure for results, for achievement. He lo become an even more dominant player in the industry. claims the new structure has already encouraged more risk Since its acquisition of Anheuser Busch, InBev has been taking and boosted the level of energy within the firm. attempting to develop not only Budweiser but also Stella The Executive Committee of Heineken was cut down from Artois, Brahma and Becks as global flagship brands. Each of 36 to 12 members in order to speed up the decision-making these brands originated in different locations, with Budweiser process. Besides the two members of the Executive Board coming from the U.S., Stella Artois coming from Belgium, this management group consists of the managers who are Brahma from Brazil, and Becks from Germany. Similarly, responsible for the different operating regions and several of SAB Miller has been attempting to develop the Czech brand the key functional areas Van Boxmeer hopes that the reduce Pilsner Urquell into a global brand. Exports of this pilsnertion in the size of this group will allow the form to combat the doubled shortly after SAB acquired it in 1999, but sales have cumbersome consensus culture that has made it difficult for since plateaued. John Brock, the CEO of InBev. commented: Heineken to respond swiftly to various challenges cenasi "Global brands sell at significantly higher prices and the industry has been experiencing considerable change margins are much better than with local beers. Finally, all of the activities of Heineken are over een by a Supervisory Board which currently consists of 10 Wrestling with Change members. Individuals that make up this board are drawn Although the management of Heineken has moved away from different countries and own a wide range of expertise from the family for the first time, they have been well aware and experience. The Board sets policies for making major of the longstanding and wellestablished family traditions decisions in the firm's overall operations. Members of the decisions in th that are difficult to change. Even with the a i ment Supervisory Board are notated on a regular basis nonfamily members to manage the firm, a little over half of the shares of Heineken are still owned by a holding com Developing a Global Presence pany which is controlled by the family. With the death of Van Boxmeer is well aware of the need for Heineken to use Freddy Heineken in 2002, the last family member to head its brands to build upon its existing stature across global the Dutch brewer, control has passed to his only child and markets. Yet in spite of its formidable presence in markets has proved it is the right concept." he stated about the cur- rent ownership structure. The whole business about family restraint on us is absolutely untrue. Without its spirit and guidance, the company would not have been able to build a world leader." are positive that the momentum in the company and trends will continue." Since taking over the helm at Heincken, van Boxmeer has committed himself to accelerating the speed of decision mak- ing. There has been some expectation both inside and outside the firm that the new management would try to break loose from the conservative style of the family. Instead, the affable 46-year-old Belgian has indicated that he is trying to stream line the firm's decision-making process rather than to make any drastic shifts in the company's existing culture. Van Boxmeer's devotion to the firm is evident. Heineken's first non-Dutch CEO spent 20 years working his way up within the firm. He sports cufflinks that are sil- ver miniatures of a Heineken bottle top and opener. "We are in the logical flow of history," he explained. Every time you have a new leader you have a new kind of vision. It is not radically different, because you are defined by what your company is and what your brands are.** Furthermore, van Boxmeer seems comfortable working within the family-controlled structure. "Since 1952 history ENDNOTES 1. Olly Wehring. Heineken Readies Europowide Launch of Indonesia's Bintang Beer. Judrinks global January 17, 2017 2. Jack Ewing & Gerry Khermouch. Waking Up Heineken Bus Wik, September 8, 2003, p. 68 3. Richard Tomlinson. The New King of Beers Forum, October 18 2004. p. 238. 4. lan Bickerton & Jenny Wiggins. Change Is Brewing at Heineken Financial Times, May 9, 2006, p. 12. 5. Business Week, September 2003.p. 69. 6. Andrew Kaplan. Border Crossing. Berserage World July 15, 2004. p. 6 7. Christopher C. Williams. Heineken Seeing Green. Baru September 18 2006, p. 19. 8. Financial Times, May 9, 2006, p. 12 9. Ibid. For each case analysis, you should answer the following questions about the focal company in the case. Be sure to use/apply relevant concepts or frameworks that have been covered thus far in the class. (a) What factors have enabled the company to deliver strong performance in the past? (b) What are some of the important issues confronting this company? What is/are the cause(s) of these issues? What external developments and/or internal actions might have caused these issues? (c) If you were taking over as CEO of the company at the end of the case, what courses of action would you pursue to address these issues? Explain how you would implement these, how they would address each issue, and what potential risks may exist. CASE 16 HEINEKEN Dutch brewer Heineken was expanding its presence around the globe in response to the merger of Anheuser-Busch InBev with SAB Miller giving the combined firm a com- manding 30 percent of global beer sales. Heineken was in talks to buy the Brazilian unit of Kirin, which the Japanese parent was planning to sell. The addition of Kirin beer would double Heineken's share in Brazil to 20 percent. The firm was also planning to launch Bintang, its biggest selling beer brand in Indonesia, into the UK and select European markets. An industry spokesman was positive about the move: "There is clearly significant demand for premium world beers. We believe Bintang is perfectly suited to meet this demand." These moves came on the heels of acquisitions and kapacity investments that Heineken had been making in bother developing markets. In 2013, the firm had strength- kned its position as the world's third largest brewer by tak- ng full ownership of Asian Pacific Breweries, the owner of Tiger, Bintang, and other popular Asian beer brands. With this deal, Heineken added 30 breweries across several coun- tries in the Asia Pacific region. A few years earlier, the firm had acquired Mexican brewer FEMSA Cervesa, producer of Dos Equis, Sol, and Tecate beers, to become a stronger, more competitive player in Latin America. At the same time. Heineken maintained its leading posi tion across Europe. It had made a high profile acquisition in 2008 of Scottish-based brewer Scottish & Newcastle, the brewer of well-known brands such as Newcastle Brown Ale and Kronenbourg 1664. Although the purchase had been made in partnership with Carlsberg, Heineken was able to gain control of Scottish & Newcastle's operations in several crucial European markets such as the United Kingdom, Ireland, Portugal, Finland, and Belgium These decisions to acquire brewers that operate in dif ferent parts of the world have been a part of a series of changes that the Dutch brewer has been making to raise its stature in the various markets and to respond to grow ing consolidation within the industry and changes that are occurring in the global market for beer. Even as sales of beer have stagnated in the US and Europe, demand has been growing elsewhere, especially in developing countries This has led the largest brewers to expand across the globe through acquisitions of smaller regional and national play ers (see Exhibits 1 and 2). The need for change was clearly reflected in the appoint- ment in October 2005 of Jean-Francois van Boxmeer as Heineken's first non-Dutch CEO. He was brought in to replace Thorny Ruys, who had decided to resign because of his failure to show much improvement in performance. Prior to the appointment of Ruys in 2002. Heineken had been run by three generations of Heineken ancestors, whose portraits still adorn the dark paneled office of the CEO in its Amsterdam headquarters. Like Ruys, van Boxmeer C e prepared by Jamal Shamsi, Michigan State University, with the wstance of Alan il. Einer, Pace University. Material has been trawn from punished sources to be used for purposes of class discussion Copyright 2017 Jumal Shams and Alan Esmer 2015 2013 EXHIBIT 1 Income Statement millions of Puros) Revenue 20,511 19.203 2016 20,792 2.993 1.540 2014 19.257 2,814 1.516 EBIT 2.785 2,484 Net profit 1354 SH EXHIBIT 2 Balance Sheet millions of uros) Assets 2016 39,321 24,748 14,573 2015 40,122 25,052 15,070 2014 34,830 17,869 13.452 2013 33,337 17.797 12,356 2012 35.979 9.250 12.805 Liabilities Equity faced the challenge of preserving the firm's family driven traditions, while trying to deal with threats Heineken had never faced before Confronting a Globalizing Industry Heineken was one of the pioneers of an international strat egy, using cross-border deals to expand its distribution of its Heineken, Amstel and about 175 other beer brands in more than 100 countries around the globe. For years, it had been picking up small browers from various countries to add more brands and to get better access to new markets. From its roots on the outskirts of Amsterdam, the firm had evolved into one of the world's largest brewers, operating more than 190 breweries in over 70 countries, claiming about 10 per cent of the global market for beer (see Exhibits 3 and 4). The firm's flagship Heineken brand ranked second only to Budweiser in a global brand survey jointly undertaken by Business Week and Interbrand. The premier brand has achieved worldwide recognition according to Kevin Baker director of alcoholic beverages at British market researchet Canadean Lid. When a US, wholesaler asked a group of marketing students to identify an assortment of beer bot ties that had been stripped of their labels, the stubby green Heineken bottle was the only one instantly recognized The beer industry has been undergoing significant change in a furious wave of consolidation. Most of the 2016 EXHIBIT 3 Geographical Breakdown of Sales millions of euros Western Europe Americas 10.112 5.203 3,203 2015 10.227 5.159 3.263 2,483 Africa, Middle East, & Eastern Europe Asia Pacific 2,894 Rue Henke Markets EXHIBIT 4 Significant Heineken Brands in Various Markets Brands Heineken, Amstel Light, Paulaner.' Moretti Heineken, Amstel. Lingen's Blond, Murphy's Irish Red Heineken, Amstel, Buckler. Desperados U.S. Netherlands France Italy Spain Heineken, Amstel, Birra Moretti Heineken, Amstel. Cruzcampo. Buckler Poland China Singapore India Indonesia Kazakhstan Heineken, Krolewskie, Kujawiak. Zywiec Heineken, Tiger Reeb Heineken, Tiger, Anchor, Baron's Heineken, Arlem, Kingfisher Heineken, Bintang. Guinness Heineken, Amstel Tian Shan Heineken, Birell, Meister Fayrouz Heineken, Maccabee, Gold Star Heineken, Star, Maltina, Gulder Heineken, Amstel, Windhoek Strongbow Heineken, Soberana, Crystal Panama Heineken, Cristal, Escudo, Royal Egypt Israel Nigeria South Africa Panama Chile EWELS STRELSE Global Brewers (2016 market share based on annual sales, millons of US dollars 1. Anheuser-Busch InBev. Leuven, Belgium 2. SABMiller. London, UK 3. Heineken, Amsterdam, Netherlands. 4. Carlsberg. Copenhagen, Denmark 5. China Resources Enterprise. China 10 See bigger brewers have been acquiring or merging with their heir. Charlene de Carvalho, who has insisted on having a competitors in foreign markets in order to become global ay in all of the major decisions players. Ownership of local brands has propelled them into Family members, however, were behind some of changes dominant positions in various markets around the world that were announced at the time of van Boxmeer's appoint Beyond this, they hope acquisitions of foreign brewers can ment to support the firm's next phase of growth as a global provide them with the manufacturing and distribution capa organization. As part of the plan, dubbed Fit 2 Fight, the bilities to develop a few global brands. "The era of global Executive Board was cut down from five members to just brands is coming." said Alan Clark, Budapest-based manap CEO van Boxmeer and Chief Financial Officer Rene Hooft ing director of SABMiller Europe (see Exhibit 5). Graafland. The change was made to centralize control at the Over the past decade, South African Breweries Plc has top of the firm to better enable a global strategy. The idea mcquired U.S.-based Miller Brewing to become a major behind the global strategy is to win over younger customers clobal brewer. They have acquired Fosters, the lareest across different markets whose tastes are will developing Australian brewer, US-based Coors linked with Canadian Heineken has created management positions respon based Molson in 2005, with their combined operationsible for five different operating regions and several dif giving them a leading position among the world's biggest ferent functional areas. These positions were created to brewers. In 2008, Belgium's Interbrew, Brazil's AmBex, and more clearly define different spheres of responsibility. Van U.S.-based Anheuser Busch merged to become the largest Boxmeer has argued that the new structure provides ingen global brewer with operations across most of the contitives for people to be accountable for their performance nents. Finally, Anheuser Busch InBev acquired SAB Miller "There is more pressure for results, for achievement. He lo become an even more dominant player in the industry. claims the new structure has already encouraged more risk Since its acquisition of Anheuser Busch, InBev has been taking and boosted the level of energy within the firm. attempting to develop not only Budweiser but also Stella The Executive Committee of Heineken was cut down from Artois, Brahma and Becks as global flagship brands. Each of 36 to 12 members in order to speed up the decision-making these brands originated in different locations, with Budweiser process. Besides the two members of the Executive Board coming from the U.S., Stella Artois coming from Belgium, this management group consists of the managers who are Brahma from Brazil, and Becks from Germany. Similarly, responsible for the different operating regions and several of SAB Miller has been attempting to develop the Czech brand the key functional areas Van Boxmeer hopes that the reduce Pilsner Urquell into a global brand. Exports of this pilsnertion in the size of this group will allow the form to combat the doubled shortly after SAB acquired it in 1999, but sales have cumbersome consensus culture that has made it difficult for since plateaued. John Brock, the CEO of InBev. commented: Heineken to respond swiftly to various challenges cenasi "Global brands sell at significantly higher prices and the industry has been experiencing considerable change margins are much better than with local beers. Finally, all of the activities of Heineken are over een by a Supervisory Board which currently consists of 10 Wrestling with Change members. Individuals that make up this board are drawn Although the management of Heineken has moved away from different countries and own a wide range of expertise from the family for the first time, they have been well aware and experience. The Board sets policies for making major of the longstanding and wellestablished family traditions decisions in the firm's overall operations. Members of the decisions in th that are difficult to change. Even with the a i ment Supervisory Board are notated on a regular basis nonfamily members to manage the firm, a little over half of the shares of Heineken are still owned by a holding com Developing a Global Presence pany which is controlled by the family. With the death of Van Boxmeer is well aware of the need for Heineken to use Freddy Heineken in 2002, the last family member to head its brands to build upon its existing stature across global the Dutch brewer, control has passed to his only child and markets. Yet in spite of its formidable presence in markets has proved it is the right concept." he stated about the cur- rent ownership structure. The whole business about family restraint on us is absolutely untrue. Without its spirit and guidance, the company would not have been able to build a world leader." are positive that the momentum in the company and trends will continue." Since taking over the helm at Heincken, van Boxmeer has committed himself to accelerating the speed of decision mak- ing. There has been some expectation both inside and outside the firm that the new management would try to break loose from the conservative style of the family. Instead, the affable 46-year-old Belgian has indicated that he is trying to stream line the firm's decision-making process rather than to make any drastic shifts in the company's existing culture. Van Boxmeer's devotion to the firm is evident. Heineken's first non-Dutch CEO spent 20 years working his way up within the firm. He sports cufflinks that are sil- ver miniatures of a Heineken bottle top and opener. "We are in the logical flow of history," he explained. Every time you have a new leader you have a new kind of vision. It is not radically different, because you are defined by what your company is and what your brands are.** Furthermore, van Boxmeer seems comfortable working within the family-controlled structure. "Since 1952 history ENDNOTES 1. Olly Wehring. Heineken Readies Europowide Launch of Indonesia's Bintang Beer. Judrinks global January 17, 2017 2. Jack Ewing & Gerry Khermouch. Waking Up Heineken Bus Wik, September 8, 2003, p. 68 3. Richard Tomlinson. The New King of Beers Forum, October 18 2004. p. 238. 4. lan Bickerton & Jenny Wiggins. Change Is Brewing at Heineken Financial Times, May 9, 2006, p. 12. 5. Business Week, September 2003.p. 69. 6. Andrew Kaplan. Border Crossing. Berserage World July 15, 2004. p. 6 7. Christopher C. Williams. Heineken Seeing Green. Baru September 18 2006, p. 19. 8. Financial Times, May 9, 2006, p. 12 9. Ibid. For each case analysis, you should answer the following questions about the focal company in the case. Be sure to use/apply relevant concepts or frameworks that have been covered thus far in the class. (a) What factors have enabled the company to deliver strong performance in the past? (b) What are some of the important issues confronting this company? What is/are the cause(s) of these issues? What external developments and/or internal actions might have caused these issues? (c) If you were taking over as CEO of the company at the end of the case, what courses of action would you pursue to address these issues? Explain how you would implement these, how they would address each issue, and what potential risks may exist