Question: Business Strategy Problem Note: This is a long problem, I will give a helpful rating to who solves the problem Instructions Refer to Wallace Case

Business Strategy Problem

Note: This is a long problem, I will give a helpful rating to who solves the problem

Instructions

Refer to Wallace Case Pages 1-4.png

Any further questions please comment

Wallace Case Pages1-4.png

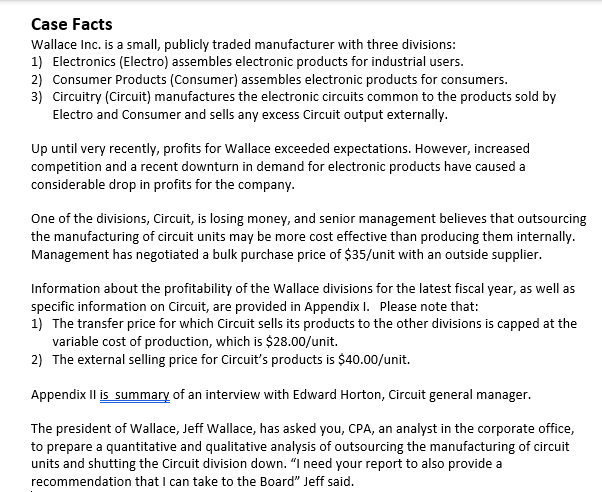

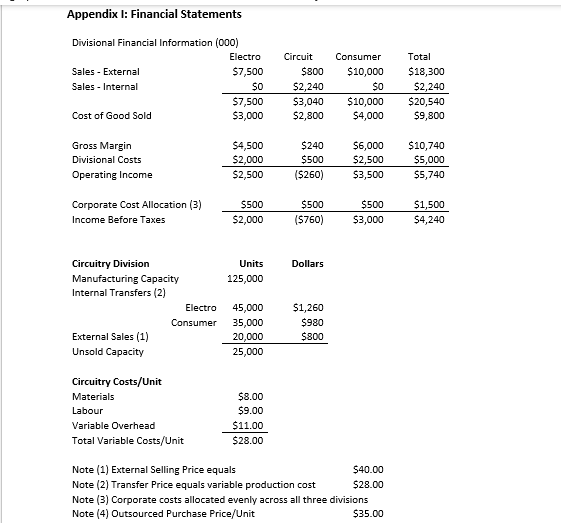

Wallace Inc. Winter 2022: Version A Application Case Instructions 1} Summarize your analysis and recommendations in no more than three [3} pages in length: 2} Write in short bullet point sentenoes. 3} Use 'side by side" tables where appropriate to support your analysis. 4} Embed any relevant Excel Spreadsheet analysis as an Appendix in your IWord Document. a} Be sure and reference your Appendix in the body of your report. 5} Proofread your work to make sure it makes sense, and that the reader {me} can follow your logic and reasoning. Case Facts Wallace Inc. is a small, publicly traded manufacturer with three divisions: 1) Electronics (Electro) assembles electronic products for industrial users. 2) Consumer Products (Consumer) assembles electronic products for consumers. 3) Circuitry (Circuit) manufactures the electronic circuits common to the products sold by Electro and Consumer and sells any excess Circuit output externally. Up until very recently, profits for Wallace exceeded expectations. However, increased competition and a recent downturn in demand for electronic products have caused a considerable drop in profits for the company. One of the divisions, Circuit, is losing money, and senior management believes that outsourcing the manufacturing of circuit units may be more cost effective than producing them internally. Management has negotiated a bulk purchase price of $35/unit with an outside supplier. Information about the profitability of the Wallace divisions for the latest fiscal year, as well as specific information on Circuit, are provided in Appendix I. Please note that: 1) The transfer price for which Circuit sells its products to the other divisions is capped at the variable cost of production, which is $28.00/unit. 2) The external selling price for Circuit's products is $40.00/unit. Appendix II is summary of an interview with Edward Horton, Circuit general manager. The president of Wallace, Jeff Wallace, has asked you, CPA, an analyst in the corporate office, to prepare a quantitative and qualitative analysis of outsourcing the manufacturing of circuit units and shutting the Circuit division down. "I need your report to also provide a recommendation that I can take to the Board" Jeff said.Appendix I: Financial Statements Divisional Financial Information (000) Electro Circuit Consumer Total Sales - External $7,500 $800 $10,000 $18,300 Sales - Internal SO $2,240 $0 $2,240 $7,500 53,040 $10,000 $20,540 Cost of Good Sold $3,000 $2,800 $4,000 59,800 Gross Margin $4,500 $240 $6,000 $10,740 Divisional Costs $2,000 $500 52,500 $5,000 Operating Income $2,500 ($260) $3,500 $5,740 Corporate Cost Allocation (3) $500 $500 $500 $1,500 Income Before Taxes $2,000 ($760) 53,000 $4,240 Circuitry Division Units Dollars Manufacturing Capacity 125,000 Internal Transfers (2) Electro 45,000 $1,260 Consumer 35,000 $980 External Sales (1) 20,000 $800 Unsold Capacity 25,000 Circuitry Costs/Unit Materials $8.00 Labour 59.00 Variable Overhead $11.00 Total Variable Costs/Unit $28.00 Note (1) External Selling Price equals 540.00 Note (2) Transfer Price equals variable production cost $28.00 Note (3) Corporate costs allocated evenly across all three divisions Note (4) Outsourced Purchase Price/Unit 535.00Appendix II: Summary of meeting with Edward Horton, Circuit General Manager Edward Horton explained that Wallace is a decentralized organization, and that each division is run independently by a general manager. Edward made the following points: 1] The other divisions are allowed to buy and sell as they wish, but we must ensure that Wallace's internal requirements are met before we can sell outside. 2] The price we receive from our internal sales isn't even close to what we receive when we sell our product to external buyers. 3] The transfer price is based only on the variable cost of production. 4] There is a robust external market for the circuitry. 5] We have unsold capacity that we could make revenue on if management would let us. Edward compiled some information about the proposed closure of Circuit. He indicated that: 1] Most of the manufacturing overhead costs would be saved if Circuit was shut down. a} Circuit supervisors would be transferred to other divisions. b} Their total salaries are about $250,000 per year. 2] There would be no savings in corporate costs even if Circuit is closed. 3] Wallace would also have to discontinue sale-s o'fcircuitryr to external parties. 4] There would probably be some layoffs of hourlyrated manufacturing personnel

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts