Question: BUSN 5200 Homework Assignment for Week 3: For Week 3, please complete the following for Joe's Fly-By-Night Oil Company, whose latest income statement and balance

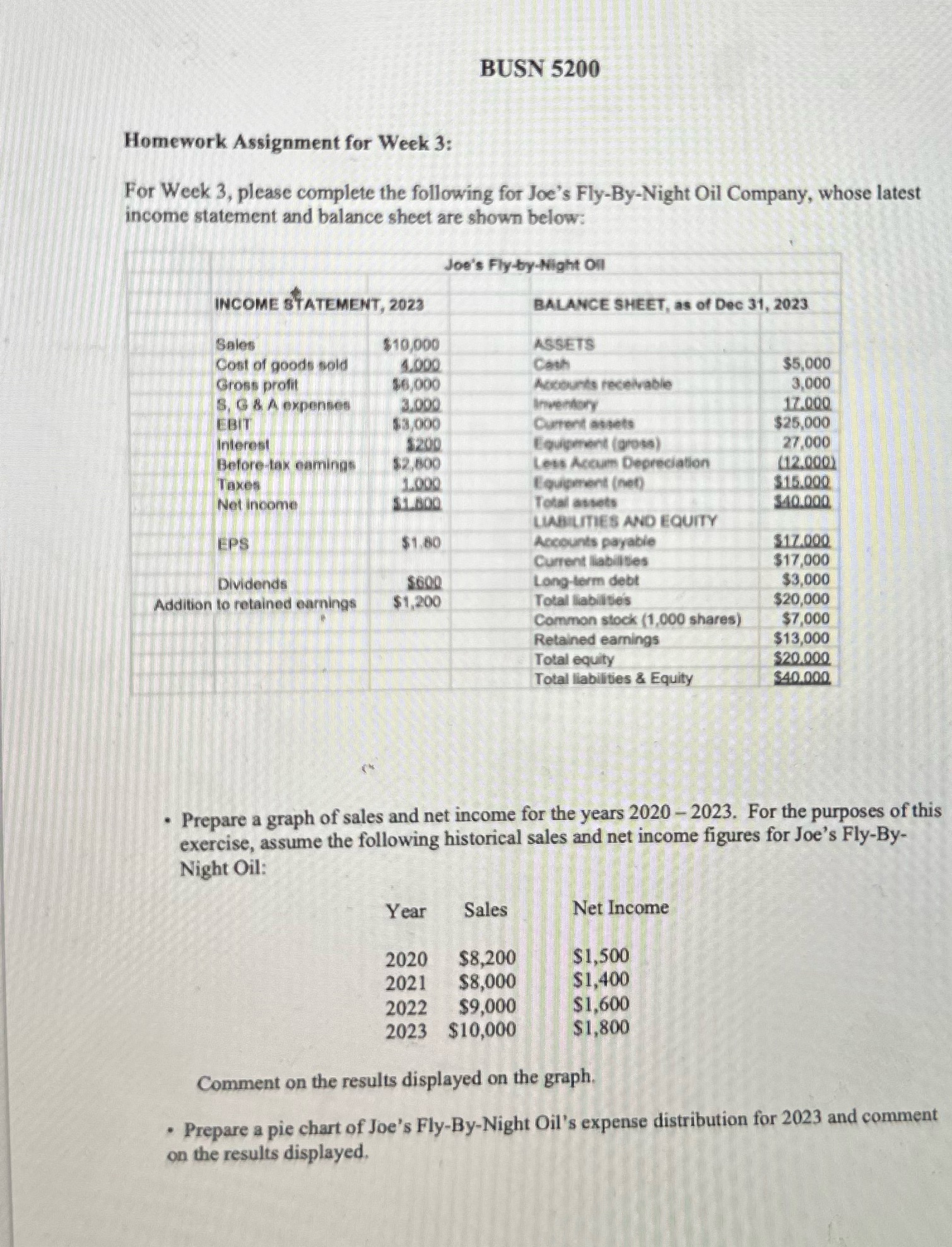

BUSN 5200 Homework Assignment for Week 3: For Week 3, please complete the following for Joe's Fly-By-Night Oil Company, whose latest income statement and balance sheet are shown below: Joe's Fly-by-Night Oil INCOME STATEMENT, 2023 BALANCE SHEET, as of Dec 31, 2023 Sales $10,000 ASSETS Cost of goods sold 4.000 Cash $5,000 Gross profit $6,000 Accounts receivable 3,000 S. G & A expenses 3.000 Inventory 17.000 EBIT 13,000 Current assets $25,000 Interest 1200 Equipment (gross) 27,000 Before-lax camings Less Accum Depreciation (12.000) Taxes 1000 Equipment (net) $15.090 Net income Total assets $40.000 LIABILITIES AND EQUITY EPS $1.80 Accounts payable $17.000 Current liabilities $17,000 Dividends $600 Long-term debt $3,000 Addition to retained earnings $1,200 Total liabilities $20,000 Common stock (1,000 shares) $7,000 Retained earnings $13,000 Total equity $20.000 Total liabilities & Equity $40.000 . Prepare a graph of sales and net income for the years 2020 - 2023. For the purposes of this exercise, assume the following historical sales and net income figures for Joe's Fly-By- Night Oil: Year Sales Net Income 2020 $8,200 $1,500 2021 $8,000 $1,400 2022 $9,000 $1,600 2023 $10,000 $1,800 Comment on the results displayed on the graph. . Prepare a pie chart of Joe's Fly-By-Night Oil's expense distribution for 2023 and comment on the results displayed

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts