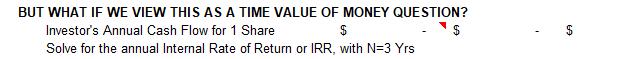

Question: BUT WHAT IF WE VIEW THIS AS A TIME VALUE OF MONEY QUESTION? Investor's Annual Cash Flow for 1 Share $ $ Solve for

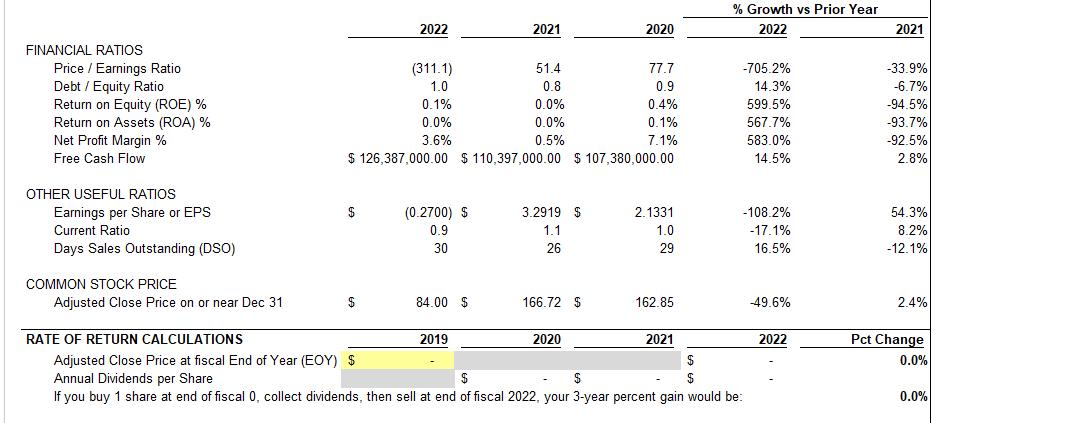

BUT WHAT IF WE VIEW THIS AS A TIME VALUE OF MONEY QUESTION? Investor's Annual Cash Flow for 1 Share $ $ Solve for the annual Internal Rate of Return or IRR, with N=3 Yrs 69 FINANCIAL RATIOS Price Earnings Ratio Debt/Equity Ratio Return on Equity (ROE) % Return on Assets (ROA) % Net Profit Margin % Free Cash Flow OTHER USEFUL RATIOS Earnings per Share or EPS Current Ratio Days Sales Outstanding (DSO) COMMON STOCK PRICE Adjusted Close Price on or near Dec 31 $ 2022 $ (311.1) 1.0 0.1% 0.0% 3.6% (0.2700) $ 0.9 30 84.00 $ 2021 $ 126,387,000.00 $ 110,397,000.00 $ 107,380,000.00 51.4 0.8 0.0% 0.0% 0.5% 2019 3.2919 $ 1.1 26 166.72 $ 2020 77.7 0.9 0.4% 2020 0.1% 7.1% 2.1331 1.0 29 162.85 RATE OF RETURN CALCULATIONS Adjusted Close Price at fiscal End of Year (EOY) $ Annual Dividends per Share $ $ If you buy 1 share at end of fiscal 0, collect dividends, then sell at end of fiscal 2022, your 3-year percent gain would be: 2021 % Growth vs Prior Year 2022 $ -705.2% 14.3% 599.5% 567.7% 583.0% 14.5% -108.2% -17.1% 16.5% -49.6% 2022 2021 -33.9% -6.7% -94.5% -93.7% -92.5% 2.8% 54.3% 8.2% -12.1% 2.4% Pct Change 0.0% 0.0%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts