Question: Butted later. Your answers are saved automatically. Question Completion Status: SA on TE 92 TO 11 12 13 14 16 1817 18 197205 Moving to

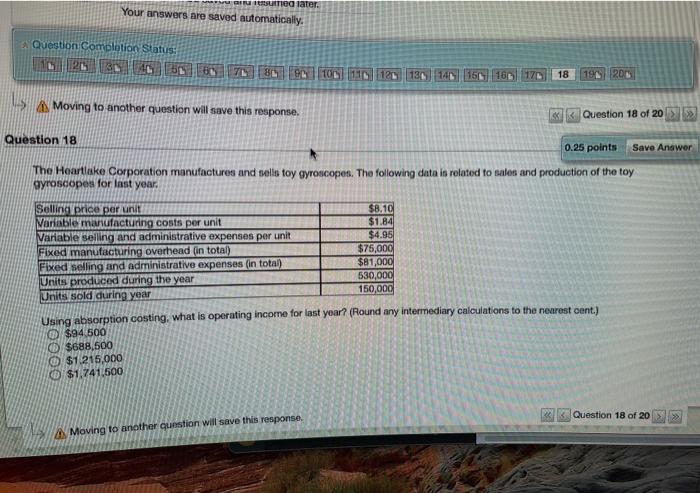

Butted later. Your answers are saved automatically. Question Completion Status: SA on TE 92 TO 11 12 13 14 16 1817 18 197205 Moving to another question will save this response. s Question 18 of 20 Save Answer Question 18 0.25 points The Heartlake Corporation manufactures and tells toy gyroscopes. The following data in related to sales and production of the toy gyroscopes for last year, Selling price per unit $8.10 Variable manufacturing costs per unit $1.84 Variable selling and administrative expenses per unit $4.95 Fixed manufacturing overhead (in total) $75,000 Fixed selling and administrative expenses (in total) $81,000 Units produced during the year 530,000 Units sold during year 150,000 Using absorption costing, what is operating income for last year? (Round any intermediary calculations to the nearest cent.) $94 500 $688,500 $1215,000 D$1,241 500 >> Moving to another question will save this response

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts