Question: Buying on Margin Example. Consider a stock priced at $40 that pays an annual dividend of $1 per share. An investor purchases the stock on

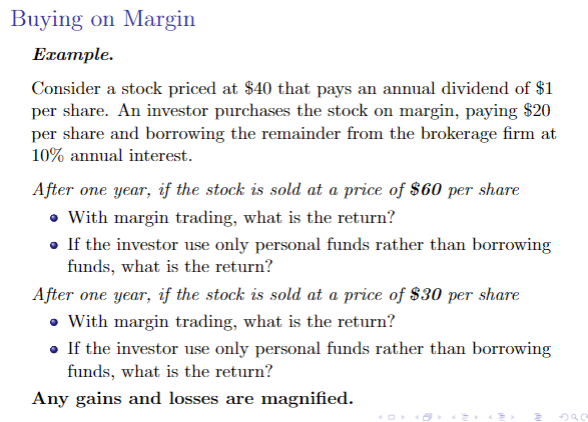

Buying on Margin Example. Consider a stock priced at $40 that pays an annual dividend of $1 per share. An investor purchases the stock on margin, paying $20 per share and borrowing the remainder from the brokerage firm at 10% annual interest. After one year, if the stock is sold at a price of $60 per share With iwekinon? funds, what is the return? With margin trading, what is the return? funds, what is the return? o If the investor use only personal funds rather than borrowing After one year, if the stock is sold at a price of $30 per share o If the investor use only personal funds rather than borrowing Any gains and losses are magnified

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts