Question: Buying on Margin: Example Share Price Initial Margin Cost of Margin Loan Shares Purchased Maintenance Margin What is the initial market value of the

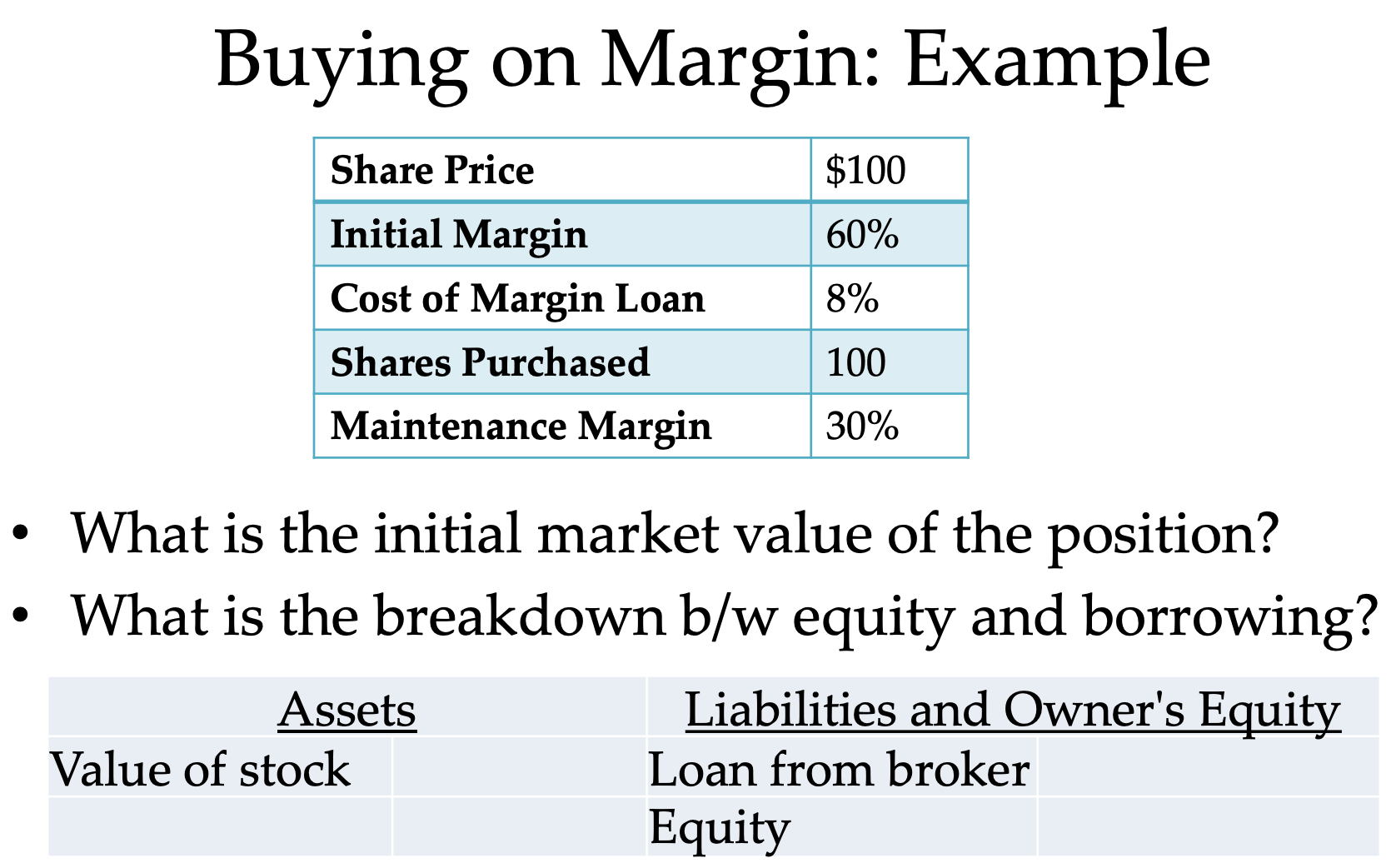

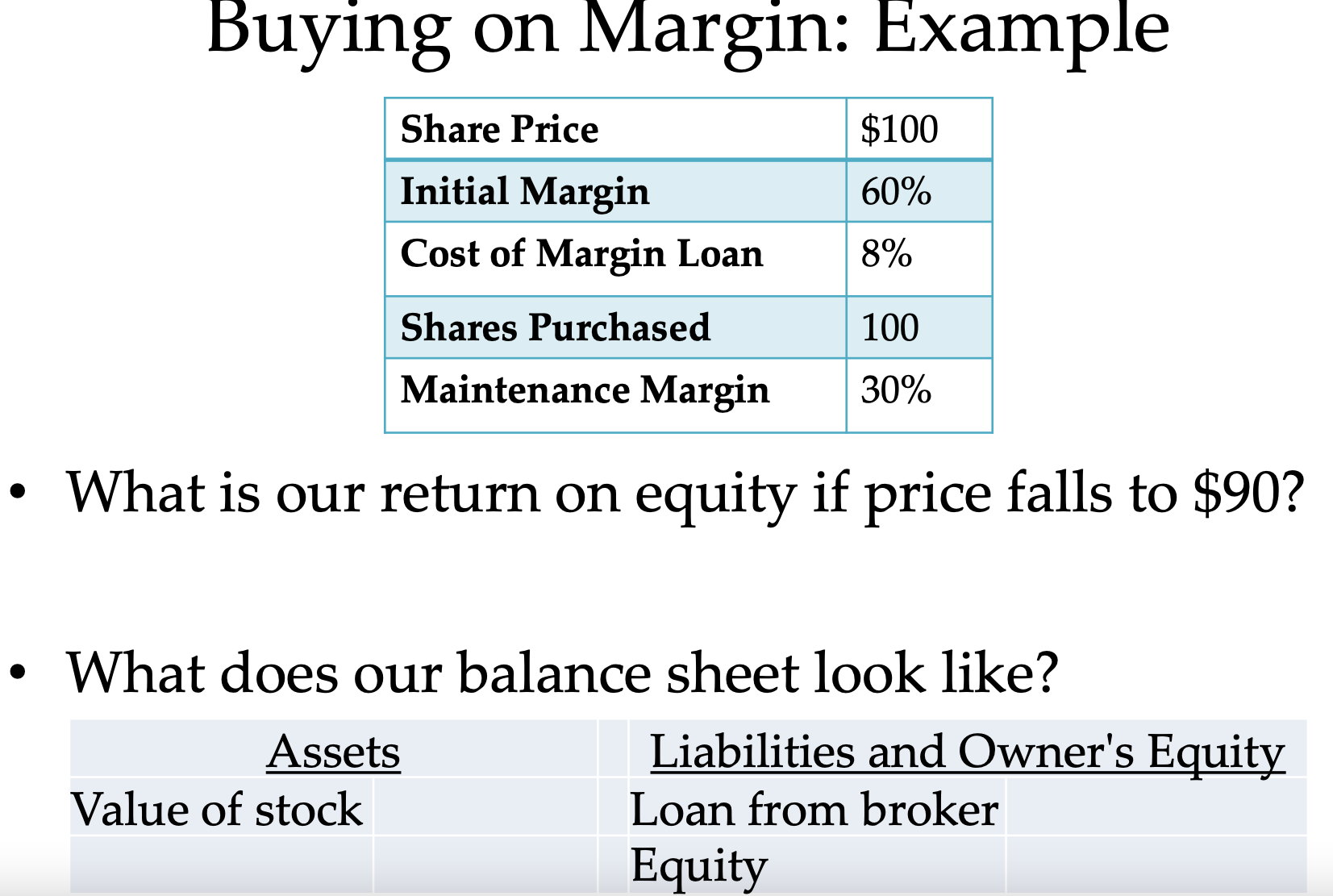

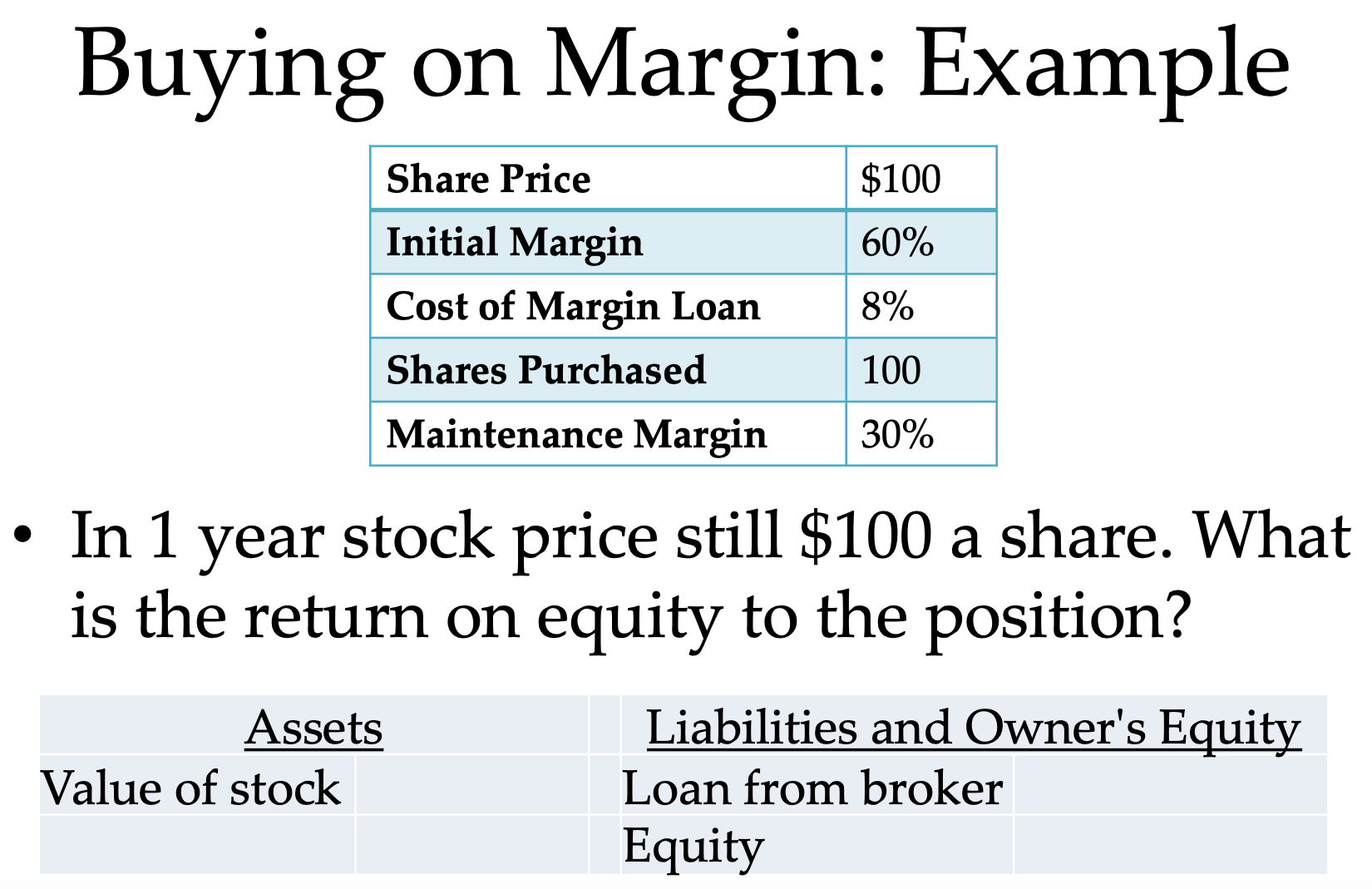

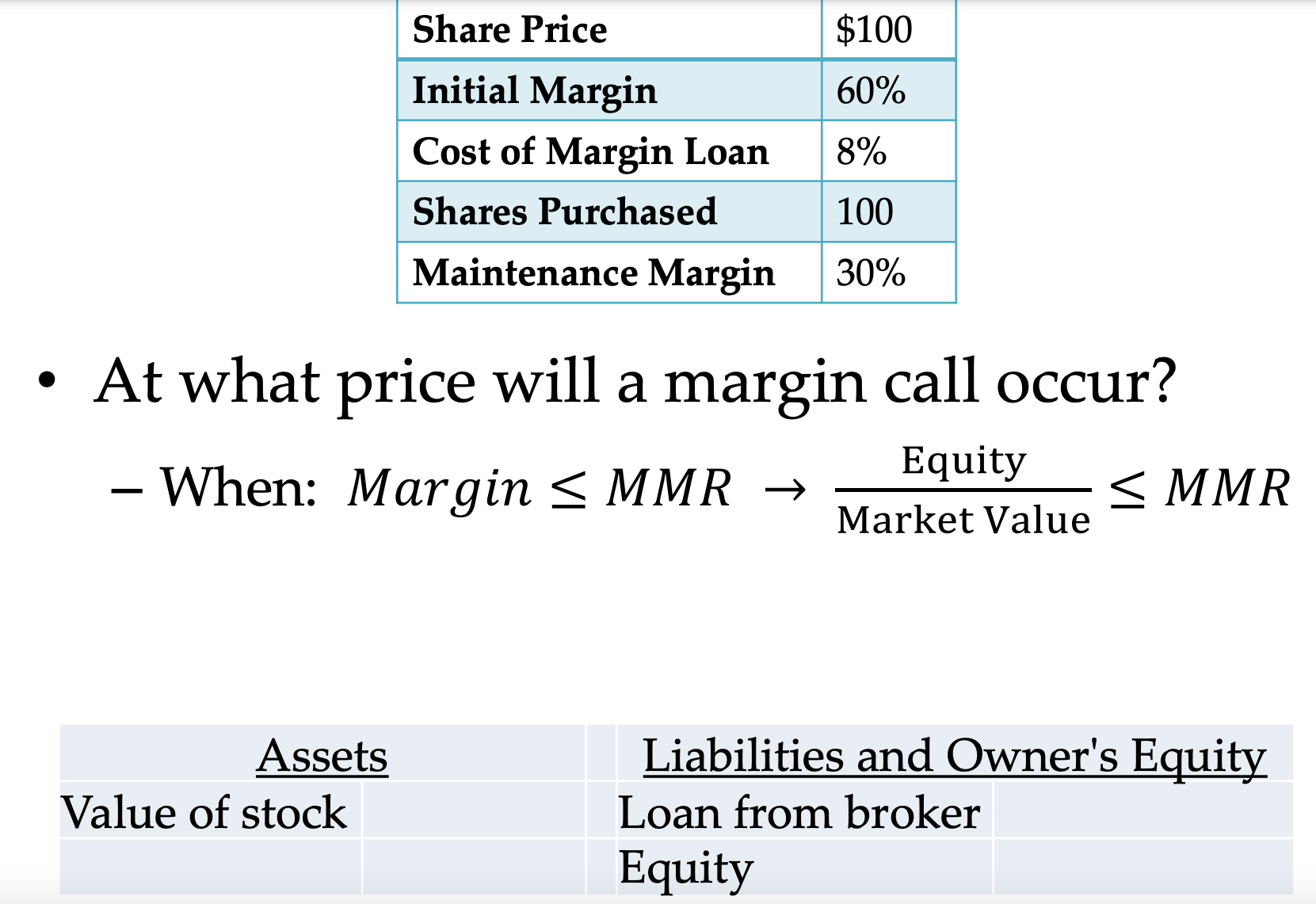

Buying on Margin: Example Share Price Initial Margin Cost of Margin Loan Shares Purchased Maintenance Margin What is the initial market value of the position? What is the breakdown b/w equity and borrowing? Assets $100 60% 8% 100 30% Value of stock Liabilities and Owner's Equity Loan from broker Equity Buying on Margin: Example Share Price Initial Margin Cost of Margin Loan Shares Purchased Maintenance Margin What is our return on equity if price falls to $90? Assets $100 60% 8% What does our balance sheet look like? Value of stock 100 30% Liabilities and Owner's Equity Loan from broker Equity Buying on Margin: Example Share Price Initial Margin Cost of Margin Loan Shares Purchased Maintenance Margin In 1 year stock price still $100 a share. What is the return on equity to the position? Assets Value of stock $100 60% 8% 100 30% Liabilities and Owner's Equity Loan from broker Equity Assets $100 60% 8% 100 Maintenance Margin 30% At what price will a margin call occur? - When: Margin MMR Equity Market Value < MMR Value of stock Share Price Initial Margin Cost of Margin Loan Shares Purchased Liabilities and Owner's Equity Loan from broker Equity

Step by Step Solution

There are 3 Steps involved in it

Answer Okay lets break down this problem stepbystep Given Share Price 100 Initial Margin 60 Cost of ... View full answer

Get step-by-step solutions from verified subject matter experts