Question: by randorm divs (c) Systematic Risk can usually be reduced (d) The Sharpe Performance Measure is better than the Treynor Performance Measure for evaluating the

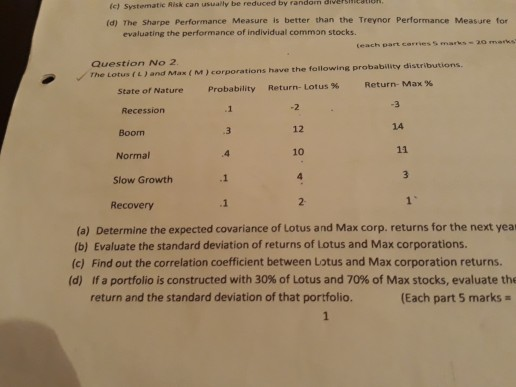

by randorm divs (c) Systematic Risk can usually be reduced (d) The Sharpe Performance Measure is better than the Treynor Performance Measure for evaluating the performance of individual common stocks. teach part corries s marks-3o Question No 2 The Lotus ( L ) and Max ( M) corporations have the foellowing probability distributions. Return-Max% -3 Probability Return-Lotus% State of Nature Recession Boorn Normal -2 12 10 14 Slow Growth Recovery (a) Determine the expected covariance of Lotus and Max corp. returns for the next year (b) Evaluate the standard deviation of returns of Lotus and Max corporations. (c) Find out the correlation coefficient between Lotus and Max corporation returns (d) if a portfolio is constructed with 30% of Lotus and 70% of Max stocks, evaluate the return and the standard deviation of that portfolio. (Each part 5 marks =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts