Question: By using excel, you are given the following data to calculate the Internal Rate of Return (IRR) of a 5-year store investment: - Annual

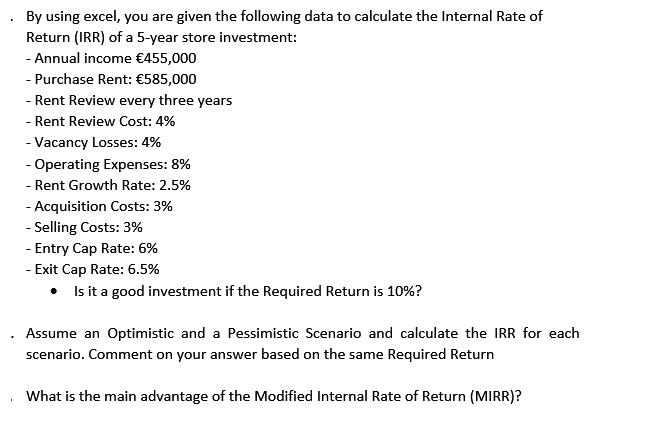

By using excel, you are given the following data to calculate the Internal Rate of Return (IRR) of a 5-year store investment: - Annual income 455,000 - Purchase Rent: 585,000 - Rent Review every three years - Rent Review Cost: 4% - Vacancy Losses: 4% - Operating Expenses: 8% - Rent Growth Rate: 2.5% - Acquisition Costs: 3% - Selling Costs: 3% - Entry Cap Rate: 6% - Exit Cap Rate: 6.5% Is it a good investment if the Required Return is 10%? Assume an Optimistic and a Pessimistic Scenario and calculate the IRR for each scenario. Comment on your answer based on the same Required Return What is the main advantage of the Modified Internal Rate of Return (MIRR)?

Step by Step Solution

3.40 Rating (147 Votes )

There are 3 Steps involved in it

CWhat Is Modified Internal Rate of Return MIRR The modified internal rate of return MIRR assumes tha... View full answer

Get step-by-step solutions from verified subject matter experts