Question: By using Payback method and The Net Present Value (NPV) analysis. Which project (A, B or C) should be chosen considering the initial cost (land

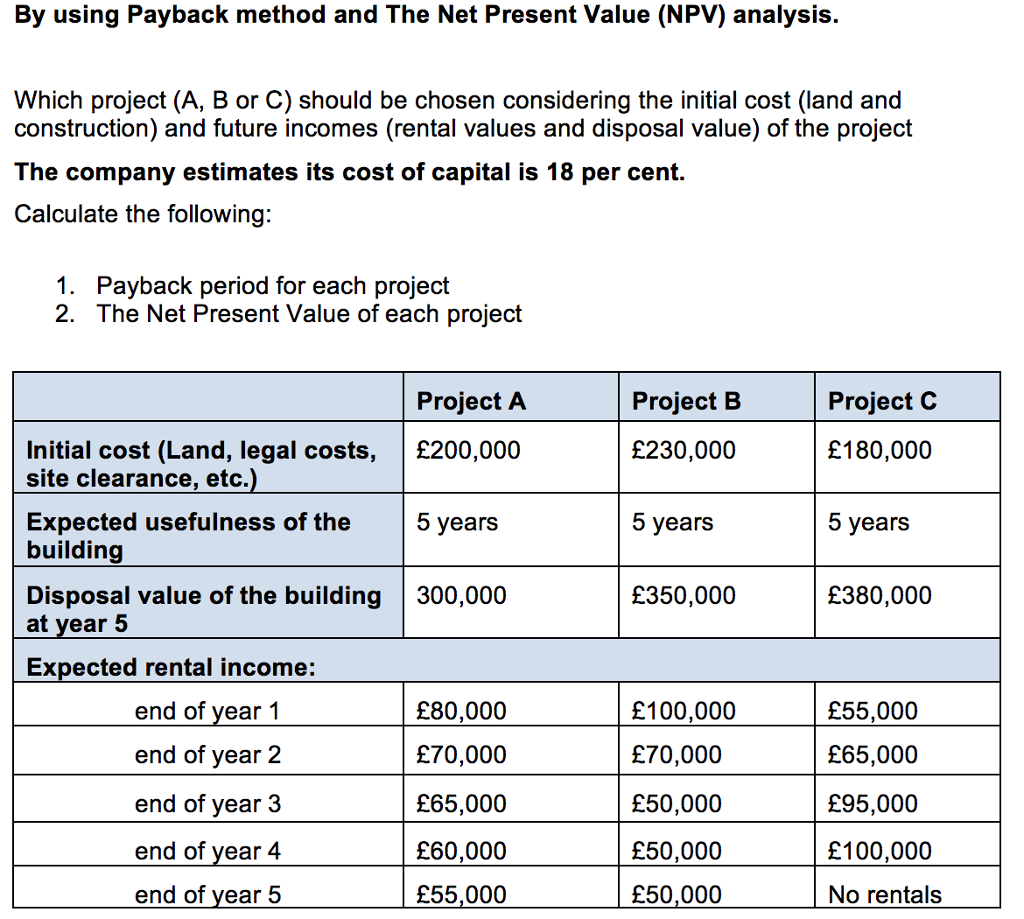

By using Payback method and The Net Present Value (NPV) analysis. Which project (A, B or C) should be chosen considering the initial cost (land and construction) and future incomes (rental values and disposal value) of the project The company estimates its cost of capital is 18 per cent. Calculate the following: 1. Payback period for each project 2. The Net Present Value of each project Project A Project B Project C 230,000 180,000 Initial cost (Land, legal costs, 200,000 site clearance, etc Expected usefulness of the building 5 years 5 years 5 years 350,000 380,000 Disposal value of the building 300,000 at year 5 Expected rental income: end of year 1 end of year 2 end of year 3 end of vear 4 end of year 5 80,000 70,000 65,000 60,000 55,000 100,000 70,000 50,000 50,000 50,000 55,000 65,000 95,000 100,000 No rentals

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts