Question: By using the beginning balances on row 3 and the prompts in column C, please explain how to allocate the correct numbers in the correct

By using the beginning balances on row 3 and the prompts in column C, please explain how to allocate the correct numbers in the correct columns.

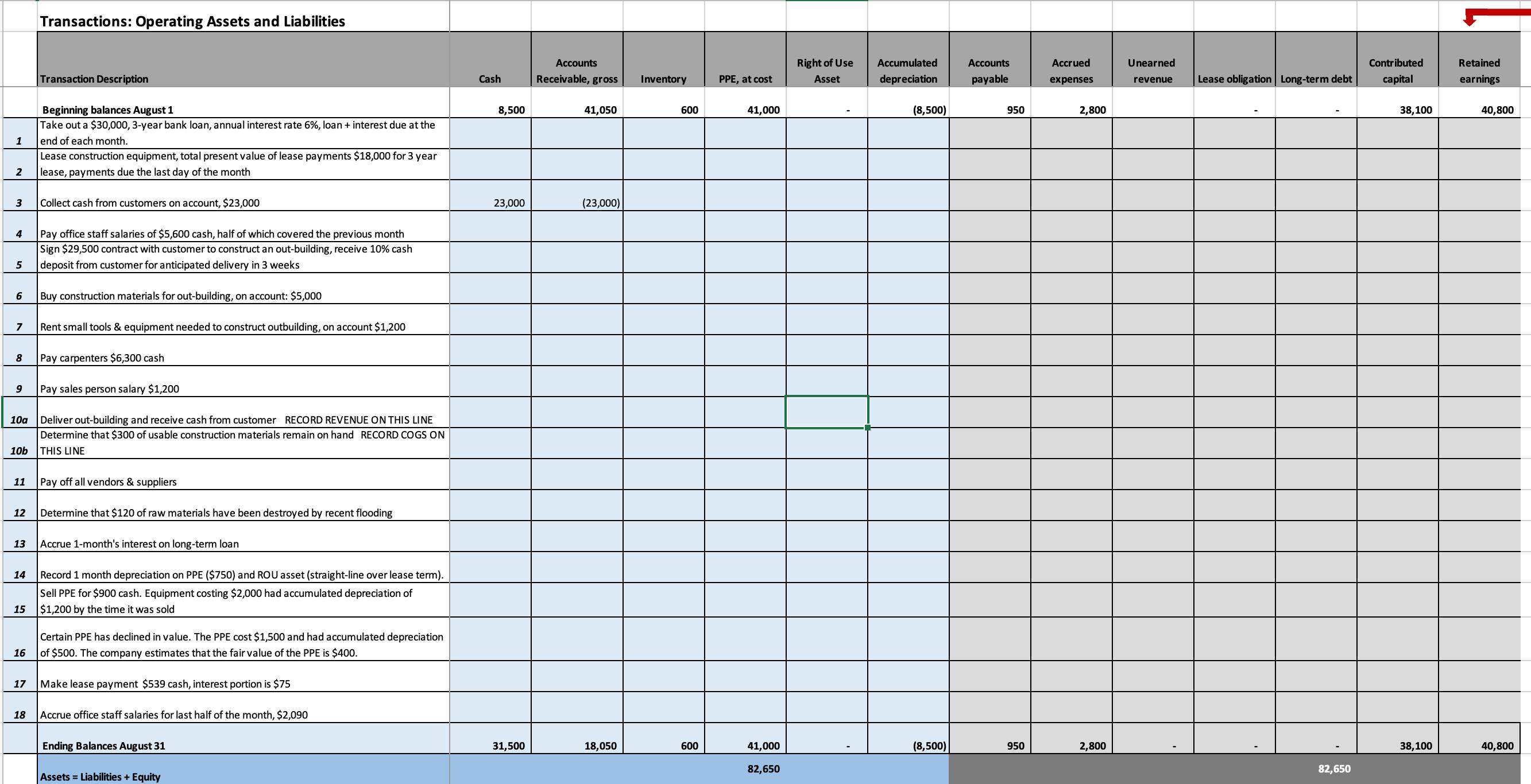

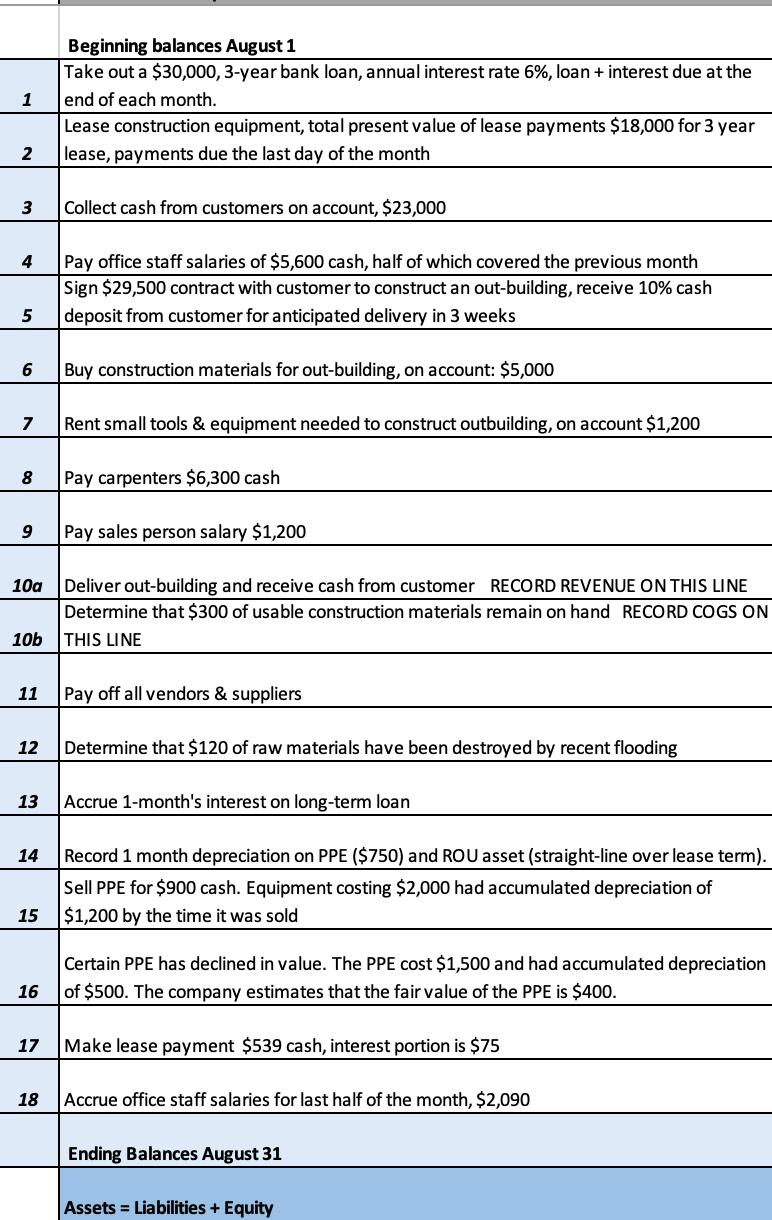

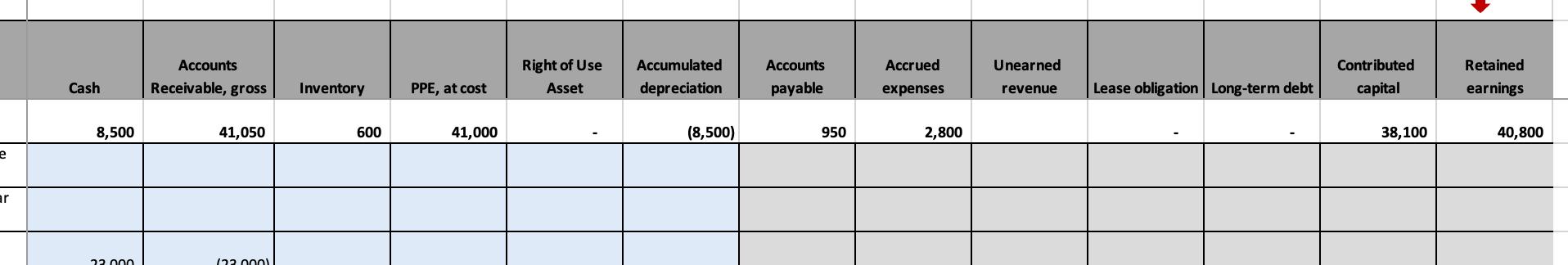

Transactions: Operating Assets and Liabilities Accounts Transaction Description Cash Receivable, gross Inventory Beginning balances August 1 8,500 41,050 600 1 Take out a $30,000, 3-year bank loan, annual interest rate 6%, loan + interest due at the end of each month. 2 Lease construction equipment, total present value of lease payments $18,000 for 3 year lease, payments due the last day of the month 3 Collect cash from customers on account, $23,000 23,000 (23,000) 4 Pay office staff salaries of $5,600 cash, half of which covered the previous month Sign $29,500 contract with customer to construct an out-building, receive 10% cash 5 deposit from customer for anticipated delivery in 3 weeks 6 Buy construction materials for out-building, on account: $5,000 7 Rent small tools & equipment needed to construct outbuilding, on account $1,200 8 Pay carpenters $6,300 cash 9 Pay sales person salary $1,200 10a 10b Deliver out-building and receive cash from customer RECORD REVENUE ON THIS LINE Determine that $300 of usable construction materials remain on hand RECORD COGS ON THIS LINE 11 Pay off all vendors & suppliers 12 Determine that $120 of raw materials have been destroyed by recent flooding 13 Accrue 1-month's interest on long-term loan 14 Record 1 month depreciation on PPE ($750) and ROU asset (straight-line over lease term). 15 Sell PPE for $900 cash. Equipment costing $2,000 had accumulated depreciation of $1,200 by the time it was sold Certain PPE has declined in value. The PPE cost $1,500 and had accumulated depreciation 16 of $500. The company estimates that the fair value of the PPE is $400. 17 Make lease payment $539 cash, interest portion is $75 18 Accrue office staff salaries for last half of the month, $2,090 Ending Balances August 31 Assets Liabilities + Equity Right of Use PPE, at cost Asset Accumulated depreciation Accounts payable Accrued expenses Unearned revenue Lease obligation | Long-term debt Contributed capital Retained earnings 41,000 (8,500) 950 2,800 38,100 40,800 31,500 18,050 600 41,000 (8,500) 950 2,800 38,100 40,800 82,650 82,650

Step by Step Solution

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Based on the provided transactions here are the upd... View full answer

Get step-by-step solutions from verified subject matter experts