Question: By using the information below, please help me with questions 1 through 6. PLEASE EXPLAIN THOROUGHLY FOR A BETTER UNDERSTANDING THANK YOU!! PLEASE ASSIST ME

By using the information below, please help me with questions 1 through 6. PLEASE EXPLAIN THOROUGHLY FOR A BETTER UNDERSTANDING THANK YOU!!

PLEASE ASSIST ME WITH THE FOLLOWING 6 QUESTIONS USING THE PROVIDED INFORMATION BELOW. THANK YOU!

ARE Medical and Dental expenses (unreimbursed) ------- ARE THESE CONSIDERED ITEMIZED? ------- $200

Are the REIMBURSED TRAVEL COSTS OF $366 CONSIDERED ITEMIZED?

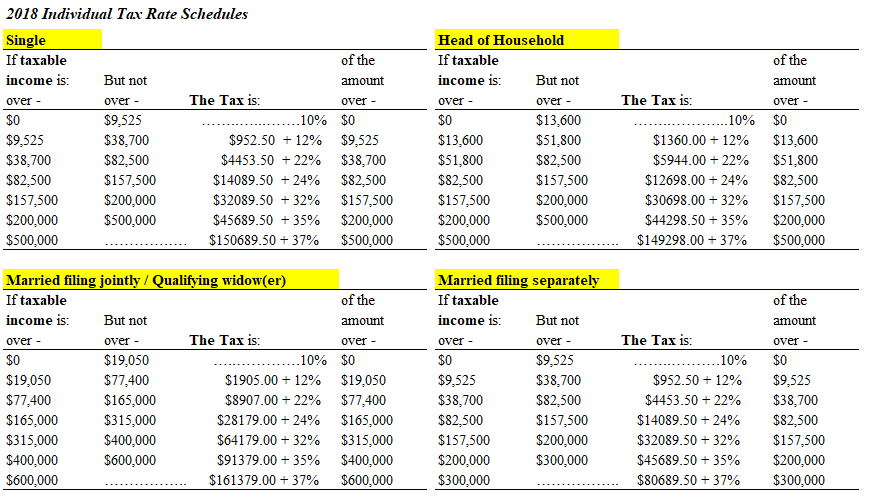

PLEASE DESCRIBE HOW AND WHY ON THE PERCENTAGE RATES WERE USED??

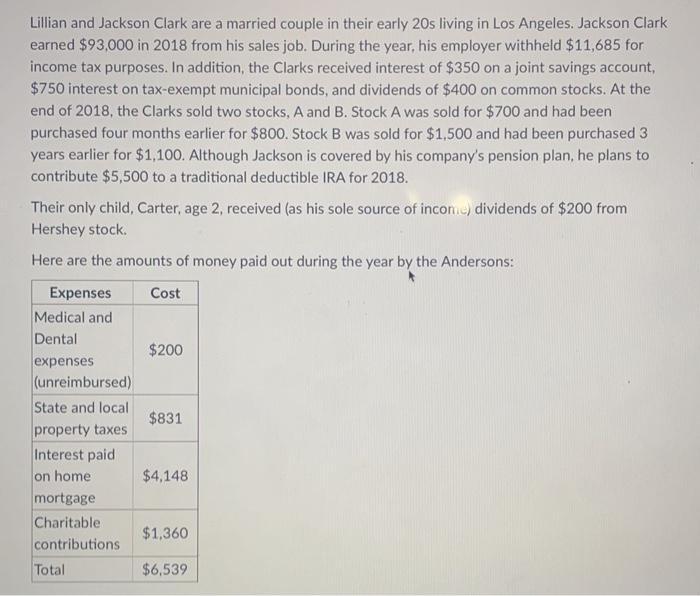

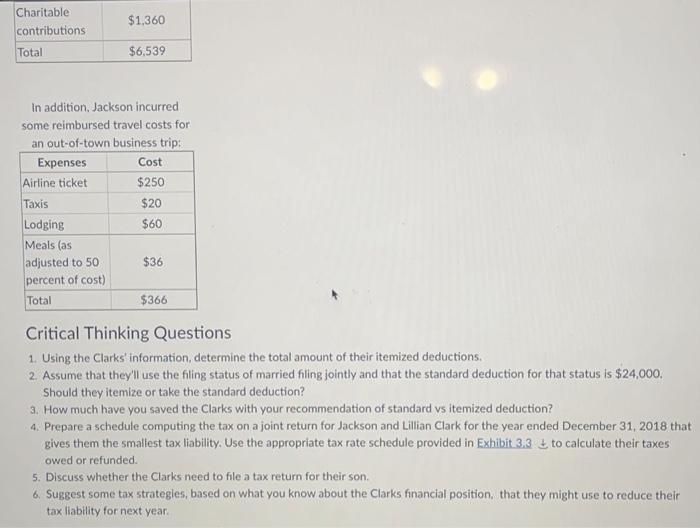

Lillian and Jackson Clark are a married couple in their early 20 s living in Los Angeles. Jackson Clark earned $93,000 in 2018 from his sales job. During the year, his employer withheld $11,685 for income tax purposes. In addition, the Clarks received interest of $350 on a joint savings account, $750 interest on tax-exempt municipal bonds, and dividends of $400 on common stocks. At the end of 2018, the Clarks sold two stocks, A and B. Stock A was sold for $700 and had been purchased four months earlier for $800. Stock B was sold for $1,500 and had been purchased 3 years earlier for $1,100. Although Jackson is covered by his company's pension plan, he plans to contribute $5,500 to a traditional deductible IRA for 2018. Their only child, Carter, age 2, received (as his sole source of incomic) dividends of $200 from Hershey stock. Here are the amounts of money paid out during the year by the Andersons: In addition. Jackson incurred some reimbursed travel costs for an out-of-town business trip: Critical Thinking Questions 1. Using the Clarks' information, determine the total amount of their itemized deductions. 2. Assume that they'll use the filing status of married filing jointly and that the standard deduction for that status is $24,000. Should they itemize or take the standard deduction? 3. How much have you saved the Clarks with your recommendation of standard vs itemized deduction? 4. Prepare a schedule computing the tax on a joint return for Jackson and Lillian Clark for the year ended December 31,2018 that gives them the smallest tax liability. Use the appropriate tax rate schedule provided in Exhibit 3.3 to calculate their taxes owed or refunded. 5. Discuss whether the Clarks need to file a tax return for their son. 6. Suggest some tax strategies, based on what you know about the Clarks financial position, that they might use to reduce their tax liability for next year. 2018 Individual Tax Rate Schedules Lillian and Jackson Clark are a married couple in their early 20 s living in Los Angeles. Jackson Clark earned $93,000 in 2018 from his sales job. During the year, his employer withheld $11,685 for income tax purposes. In addition, the Clarks received interest of $350 on a joint savings account, $750 interest on tax-exempt municipal bonds, and dividends of $400 on common stocks. At the end of 2018, the Clarks sold two stocks, A and B. Stock A was sold for $700 and had been purchased four months earlier for $800. Stock B was sold for $1,500 and had been purchased 3 years earlier for $1,100. Although Jackson is covered by his company's pension plan, he plans to contribute $5,500 to a traditional deductible IRA for 2018. Their only child, Carter, age 2, received (as his sole source of incomic) dividends of $200 from Hershey stock. Here are the amounts of money paid out during the year by the Andersons: In addition. Jackson incurred some reimbursed travel costs for an out-of-town business trip: Critical Thinking Questions 1. Using the Clarks' information, determine the total amount of their itemized deductions. 2. Assume that they'll use the filing status of married filing jointly and that the standard deduction for that status is $24,000. Should they itemize or take the standard deduction? 3. How much have you saved the Clarks with your recommendation of standard vs itemized deduction? 4. Prepare a schedule computing the tax on a joint return for Jackson and Lillian Clark for the year ended December 31,2018 that gives them the smallest tax liability. Use the appropriate tax rate schedule provided in Exhibit 3.3 to calculate their taxes owed or refunded. 5. Discuss whether the Clarks need to file a tax return for their son. 6. Suggest some tax strategies, based on what you know about the Clarks financial position, that they might use to reduce their tax liability for next year. 2018 Individual Tax Rate Schedules

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts