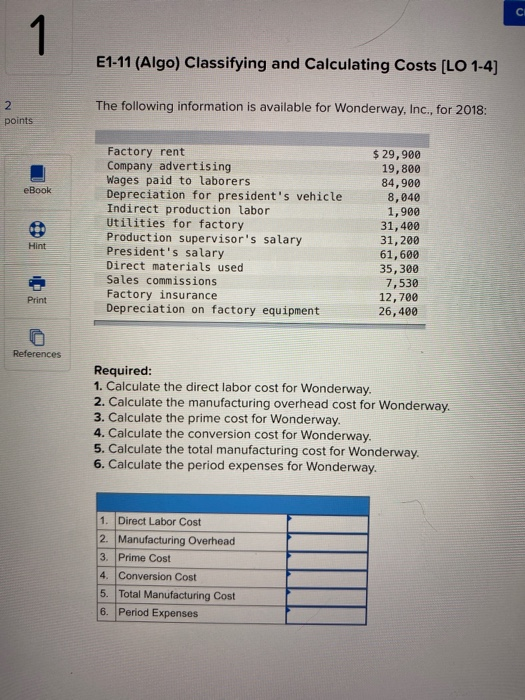

Question: C 1 E1-11 (Algo) Classifying and Calculating Costs [LO 1-4) 2 points The following information is available for Wonderway, Inc., for 2018: eBook Factory rent

C 1 E1-11 (Algo) Classifying and Calculating Costs [LO 1-4) 2 points The following information is available for Wonderway, Inc., for 2018: eBook Factory rent Company advertising Wages paid to laborers Depreciation for president's vehicle Indirect production labor Utilities for factory Production supervisor's salary President's salary Direct materials used Sales commissions Factory insurance Depreciation on factory equipment $ 29,900 19,800 84,900 8, 040 1,900 31,400 31, 200 61,600 35, 300 7,530 12,700 26,400 Hint Print References Required: 1. Calculate the direct labor cost for Wonderway. 2. Calculate the manufacturing overhead cost for Wonderway. 3. Calculate the prime cost for Wonderway. 4. Calculate the conversion cost for Wonderway. 5. Calculate the total manufacturing cost for Wonderway. 6. Calculate the period expenses for Wonderway. 1. Direct Labor Cost 2. Manufacturing Overhead 3. Prime Cost 4. Conversion Cost 5. Total Manufacturing Cost 6. Period Expenses

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts