Question: c) (2 points) What should the forward price be? Question 3: (30 points) a) (15 points) The following table provides the daily commodity spot price

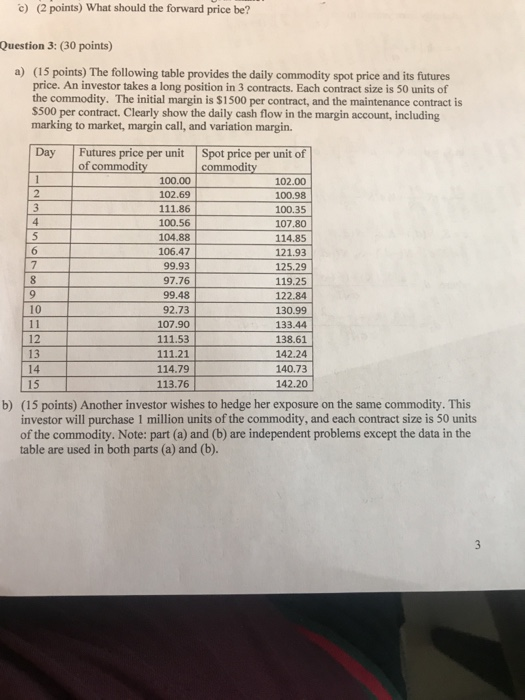

c) (2 points) What should the forward price be? Question 3: (30 points) a) (15 points) The following table provides the daily commodity spot price and its futures price. An investor takes a long position in 3 contracts. Each contract size is 50 units of the commodity. The initial margin is $1500 per contract, and the maintenance contract is $500 per contract. Clearly show the daily cash flow in the margin account, including marking to market, margin call, and variation margin. Day Futures price per unit of commodity 100.00 102.69 111.86 100.56 104.88 106.47 99.93 97.76 99.48 92.73 107.90 111.53 111.21 114.79 113.76 Spot price per unit of commodity 102.00 100.98 100.35 107.80 114.85 121.93 125.29 119.25 122.84 130.99 133.44 138.61 142.24 140.73 142.20 b) (15 points) Another investor wishes to hedge her exposure on the same commodity. This investor will purchase 1 million units of the commodity, and each contract size is 50 units of the commodity. Note: part (a) and (b) are independent problems except the data in the table are used in both parts (a) and (b)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts