Question: c 20) Common stock cannot be worth less than its book value. 70) 71) In general common stock and preferred stock are both valued by

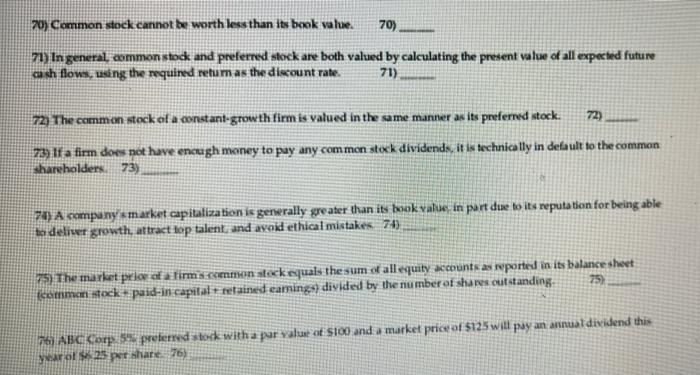

20) Common stock cannot be worth less than its book value. 70) 71) In general common stock and preferred stock are both valued by calculating the present value of all expected future cash flows, using the required retumas the discount rate. 71) 72) The common stock of a constant-growth firm is valued in the same manner as its preferred stock. 72) 73) If a firm does not have enough money to pay any common stock dividends, it is technically in default to the common shareholders 73) 7) A company's market capitalization is generally greater than its book value in part due to its reputation for being able to deliver growth, attract top talent and avoid ethical mistakes. 74). 75) The market prior of a firms common stekepuals the sum of all equity accounts as reported in its balance sheet common stock paid-in capitalt retained earning divided by the number of shares outstanding. 75) 76) ABC Corp 5 preferred stock with a par value of $100 and a market price of $125 will pay an annual dividend this yerel 25 per share. 76)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts