Question: C. $21.04 D. $22.27 E. $26.14 QUESTION 17 The following refers to questions 17-19 Jack's Construction Co. has 10-year bonds outstanding that are selling at

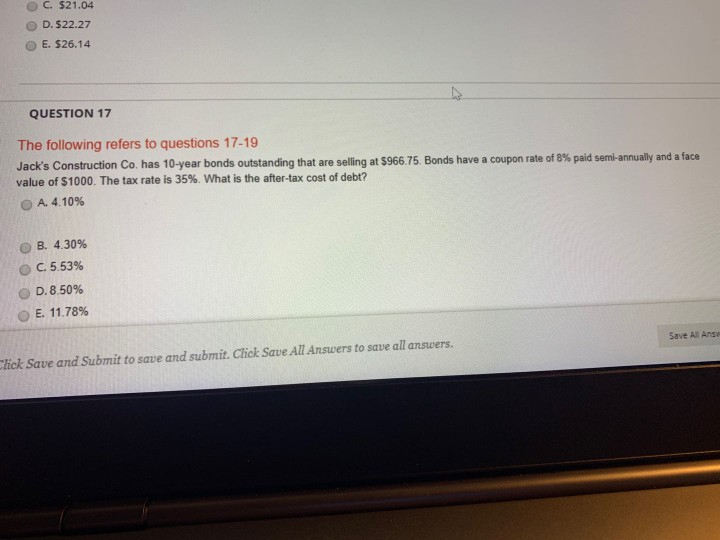

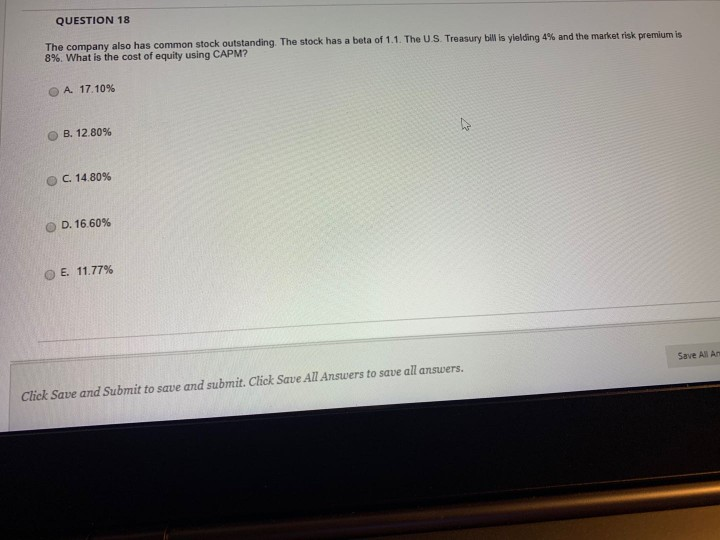

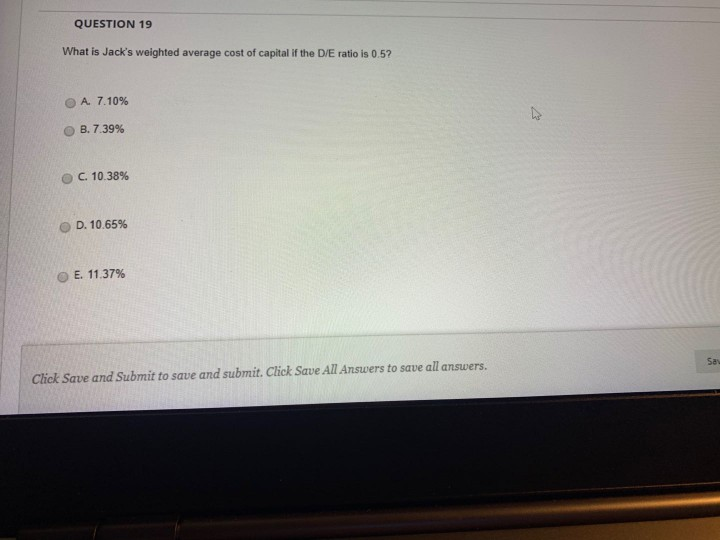

C. $21.04 D. $22.27 E. $26.14 QUESTION 17 The following refers to questions 17-19 Jack's Construction Co. has 10-year bonds outstanding that are selling at $966.75. Bonds have a coupon rate of 8% paid semi-annually and a face value of $1000. The tax rate is 35%. What is the after-tax cost of debt? A. 4.10% B. 4.30% C. 5.53% D. 8.50% E. 11.78% Save Al Ans Click Save and Submit to save and submit. Click Save All Answers to save all answers. QUESTION 18 The company also has common stock outstanding. The stock has a beta of 1.1. The US Treasury bill is yielding 4% and the market risk premium is 8%. What is the cost of equity using CAPM? A 17.10% B. 12. 80% O C. 14.80% D. 16.60% E. 11.77% Save All A Click Save and Submit to save and submit. Click Save All Answers to save all answers. QUESTION 19 What is Jack's weighted average cost of capital if the D/E ratio is 0.5? A. 7.10% B.7.39% C. 10.38% D. 10.65% E. 11.37% Say Click Save and Submit to save and submit. Click Save All Answers to save all answers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts