Question: c (a) Calculate the net present value (NPV), internal rate of return (IRR) and the payback period for each project. Indicate which project is best

c

-

(a) Calculate the net present value (NPV), internal rate of return (IRR) and the payback period for each project. Indicate which project is best using NPV, IRR and payback period.

(6 marks)

-

(b) Which of the two mutually exclusive projects would you recommend that Singa Inc. undertake? Why?

(2 marks)

-

(c) What are the key problems associated with the use of the payback method? (4 marks)

-

(d) Assume a financial manager is calculating the NPV and IRR for two mutually exclusive projects of differing scale. Discuss how the IRR technique can still be utilized to obtain a valid result.

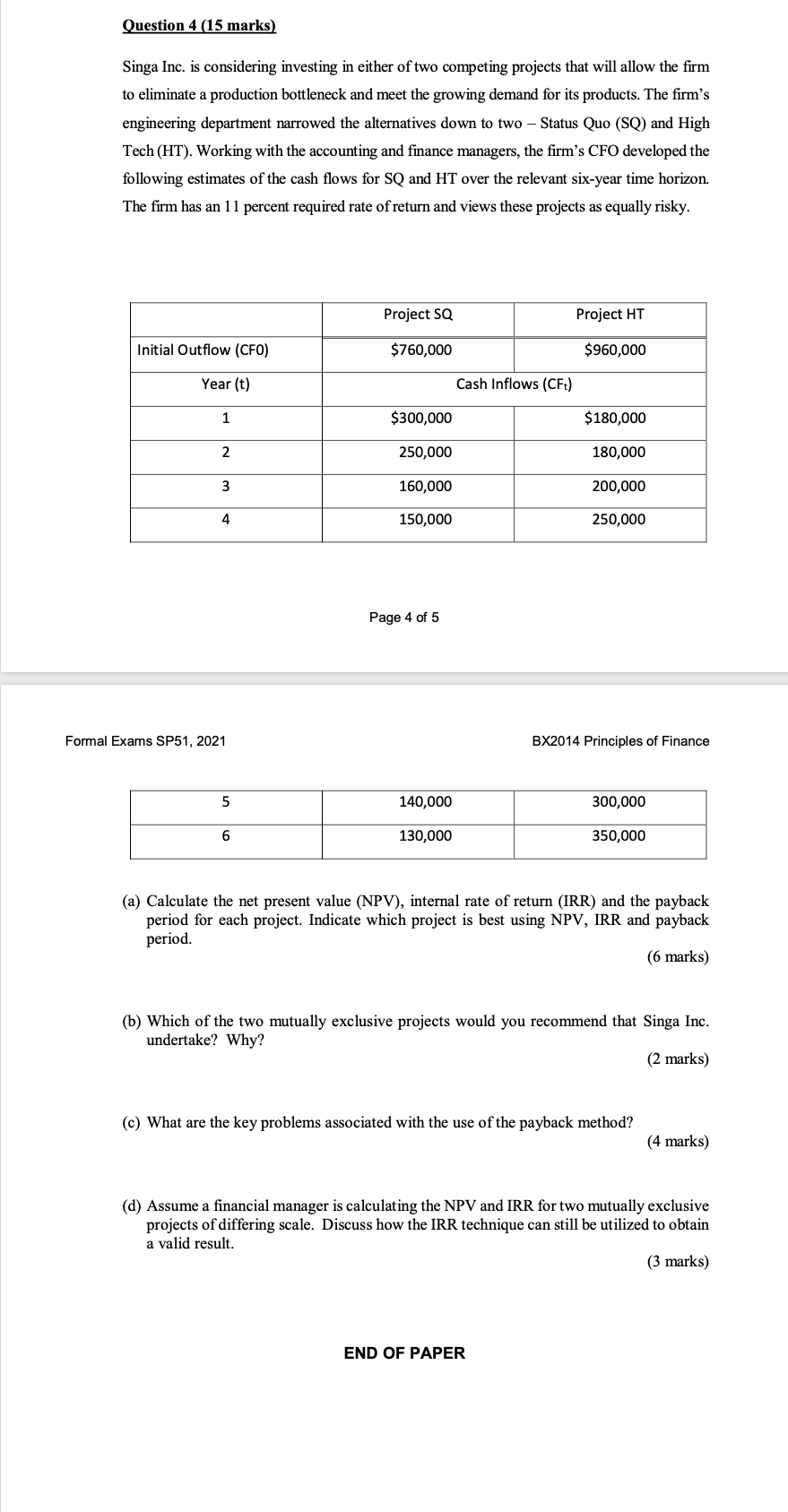

Question 4 (15 marks) Singa Inc. is considering investing in either of two competing projects that will allow the firm to eliminate a production bottleneck and meet the growing demand for its products. The firm's engineering department narrowed the alternatives down to two - Status Quo (SQ) and High Tech (HT). Working with the accounting and finance managers, the firm's CFO developed the following estimates of the cash flows for SQ and HT over the relevant six-year time horizon. The firm has an 11 percent required rate of return and views these projects as equally risky. Project SQ Project HT Initial Outflow (CFO) $760,000 $960,000 Year (t) Cash Inflows (CFt) 1 $300,000 $180,000 2 250,000 180,000 3 160,000 200,000 4 150,000 250,000 Page 4 of 5 Formal Exams SP51, 2021 BX2014 Principles of Finance 5 140,000 300,000 6 130,000 350,000 (a) Calculate the net present value (NPV), internal rate of return (IRR) and the payback period for each project. Indicate which project is best using NPV, IRR and payback period. (6 marks) (b) Which of the two mutually exclusive projects would you recommend that Singa Inc. undertake? Why? (2 marks) (c) What are the key problems associated with the use of the payback method? (4 marks) (d) Assume a financial manager is calculating the NPV and IRR for two mutually exclusive projects of differing scale. Discuss how the IRR technique can still be utilized to obtain a valid result. (3 marks) END OF PAPER

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts