Question: (c) A company is considering a project that has a useful life of 7 years. If undertaken, the project would require an initial investment of

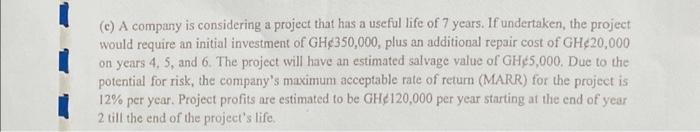

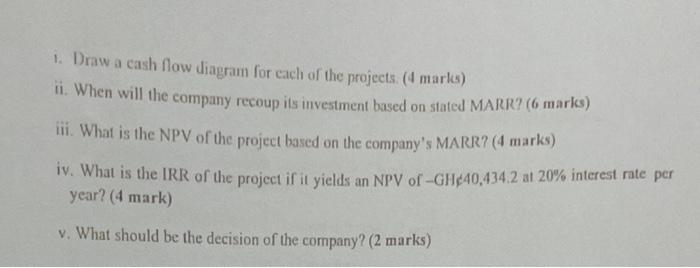

(c) A company is considering a project that has a useful life of 7 years. If undertaken, the project would require an initial investment of GHc 350,000 , plus an additional repair cost of GHc20,000 on years 4,5 , and 6 . The project will have an estimated salvage value of GH,5,000. Due to the potential for risk, the company's maximum acceptable rate of return (MARR) for the project is 12% per year. Project profits are estimated to be GHC120,000 per year starting at the end of year 2 till the end of the project's life. 1. Draw a cash flow diagram for cach of the projects. (4 marks) ii. When will the company recoup its investment based on stated MARR? ( 6 marks) iii. What is the NPV of the project based on the company's MARR? (4 marks) iv. What is the IRR of the project if it yields an NPV of GH440,434.2at20% interest rate per year? (4 mark) v. What should be the decision of the company? (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts