Question: c. ACME informs ATRIUM that it is willing to consider a $17 PSF with the $1 annual stepups. However, under this proposal, ACME would require

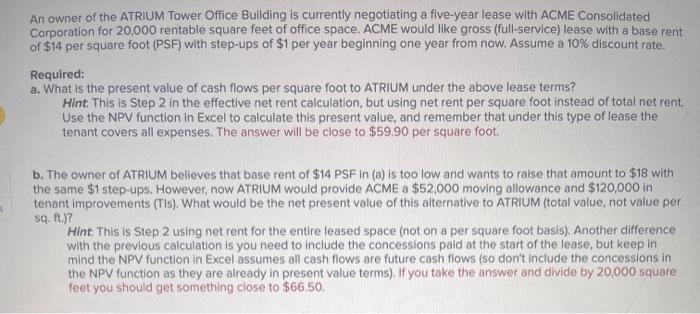

c. ACME informs ATRIUM that it is willing to consider a \$17 PSF with the \$1 annual stepups. However, under this proposal, ACME would require ATRIUM to buyout the one year remaining on its existing lease in another building. That lease is $9 PSF for 20,000 SF per year. If ATRIUM buys out ACME's old lease, ACME will not require a moving allowance or Tis. What would be the net present value of this proposal to ATRIUM on a per square foot basis? Hint. Calculate the NPV as in Part B, but divide by the square feet. The answer will be around $62.30 per square foot. Complete this question by entering your answers in the tabs below. What is the present value of cash flows to ATRIUM under the above lease terms? (Assume a 10% discount rate.) (Round your answer to 2 decimal places.) An owner of the ATRIUM Tower Office Building is currently negotiating a five-year lease with ACME Consolidated Corporation for 20,000 rentable square feet of office space. ACME would like gross (full-service) lease with a base rent of $14 per square foot (PSF) with step-ups of \$1 per year beginning one year from now. Assume a 10% discount rate. Required: a. What is the present value of cash flows per square foot to ATRIUM under the above lease terms? Hint. This is Step 2 in the effective net rent calculation, but using net rent per square foot instead of total net rent. Use the NPV function in Excel to calculate this present value, and remember that under this type of lease the tenant covers all expenses. The answer will be close to $59.90 per square foot. b. The owner of ATRIUM believes that base rent of $14PSF in (a) is too low and wants to raise that amount to $18 with the same $1 step-ups. However, now ATRIUM would provide ACME a $52,000 moving allowance and $120,000 in tenant improvements (T/s). What would be the net present value of this alternative to ATRIUM (total value, not value per sq. ft.)? Hint This is Step 2 using net rent for the entire leased space (not on a per square foot basis). Another difference with the previous calculation is you need to include the concessions paid at the start of the lease, but keep in mind the NPV function in Excel assumes all cash flows are future cash flows (so don't include the concessions in the NPV function as they are already in present value terms). If you take the answer and divide by 20,000 square feet you should get something close to $66.50. Complete this question by entering your answers in the tabs below. The owner of ATRIUM believes that base rent of $14 PSF in (a) is too low and wants to raise that amount to $18 with the same $1 step-ups. However, now ATRIUM would provide ACME a $52,000 moving allowance and $120,000 in tenant improvements (TIs). What would be the present value of this altemative to ATRIUM? Note: Round your answer to 2 decimal places. Complete this question by entering your answers in the tabs below. ACME informs ATRIUM that it is willing to consider a $17 PSF with the $1 annual stepups, However, under this proposal, ACME would require ATRIUM to buyout the one year remaining on its existing lease in another buliding. That lease is $9 PSF for 20,000 SF per year. If ATRIUM buys out ACME's old lease, ACME will not require a moving allowance or Tis. What would be the net present value of this proposal to ATRIUM? Note: Round your answer to 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts