Question: C and D form the equal CD general partnership. C contributed $1,000 cash, and D contributed property with a value of $3,500, a basis

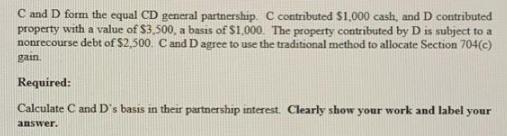

C and D form the equal CD general partnership. C contributed $1,000 cash, and D contributed property with a value of $3,500, a basis of $1,000. The property contributed by D is subject to a nonrecourse debt of $2,500. C and D agree to use the traditional method to allocate Section 704(c) gain. Required: Calculate C and D's basis in their partnership interest. Clearly show your work and label your answer.

Step by Step Solution

3.34 Rating (163 Votes )

There are 3 Steps involved in it

To calculate C and Ds basis in their partnership interest we need to consider the contributed property the nonrecourse debt and the allocation under S... View full answer

Get step-by-step solutions from verified subject matter experts