Question: c and d please Required information Problem 8-63 (LO 8-1) (LO 8-3) (Algo) [The following information applies to the questions displayed below] Henrich is a

![(Algo) [The following information applies to the questions displayed below] Henrich is](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66fb04fe43412_84566fb04fdd6231.jpg)

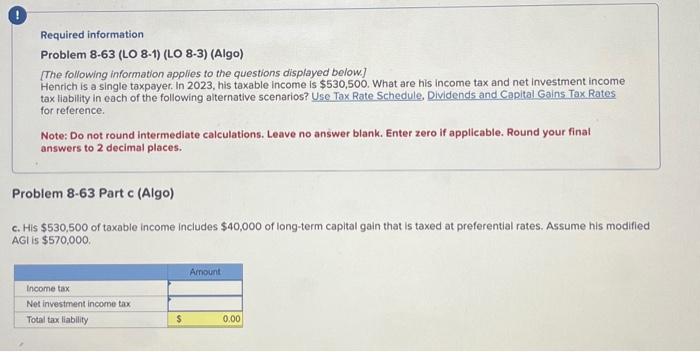

Required information Problem 8-63 (LO 8-1) (LO 8-3) (Algo) [The following information applies to the questions displayed below] Henrich is a single taxpayer. In 2023 , his taxable income is $530,500. What are his income tax and net investment income tax liability in each of the following alternative scenarios? Use Tax Rate Schedule, Dividends and Capital Gains Tax. Rates for reference. Note: Do not round intermediate calculations. Leave no answer blank. Enter zero if applicable. Round your final answers to 2 decimal places. roblem 8-63 Part c (Algo) His $530,500 of taxable income includes $40,000 of long-term capital gain that is taxed at preferential rates. Assume his modified Gl is $570,000. Required information Problem 8-63 (LO 8-1) (LO 8-3) (Algo) [The following information applies to the questions displayed below] Henrich is a single taxpayer. In 2023, his taxable income is $530,500. What are his income tax and net investment income tax liablity in each of the following alternative scenarios? Use Tax Rate Schedule, Dividends and Capital Gains Tax Rates for reference. Note: Do not round intermediate calculations. Leave no ansiwer blank. Enter zero if applicable. Round your final answers to 2 decimal places. Problem 8-63 Part d (Algo) 1. Henrich has $195,250 of taxable income, which includes $50,100 of long-term capital gain that is taxed at preferential rates. Assume is modified AGt is $210,500. Required information Problem 8-63 (LO 8-1) (LO 8-3) (Algo) [The following information applies to the questions displayed below] Henrich is a single taxpayer. In 2023 , his taxable income is $530,500. What are his income tax and net investment income tax liability in each of the following alternative scenarios? Use Tax Rate Schedule, Dividends and Capital Gains Tax. Rates for reference. Note: Do not round intermediate calculations. Leave no answer blank. Enter zero if applicable. Round your final answers to 2 decimal places. roblem 8-63 Part c (Algo) His $530,500 of taxable income includes $40,000 of long-term capital gain that is taxed at preferential rates. Assume his modified Gl is $570,000. Required information Problem 8-63 (LO 8-1) (LO 8-3) (Algo) [The following information applies to the questions displayed below] Henrich is a single taxpayer. In 2023, his taxable income is $530,500. What are his income tax and net investment income tax liablity in each of the following alternative scenarios? Use Tax Rate Schedule, Dividends and Capital Gains Tax Rates for reference. Note: Do not round intermediate calculations. Leave no ansiwer blank. Enter zero if applicable. Round your final answers to 2 decimal places. Problem 8-63 Part d (Algo) 1. Henrich has $195,250 of taxable income, which includes $50,100 of long-term capital gain that is taxed at preferential rates. Assume is modified AGt is $210,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts