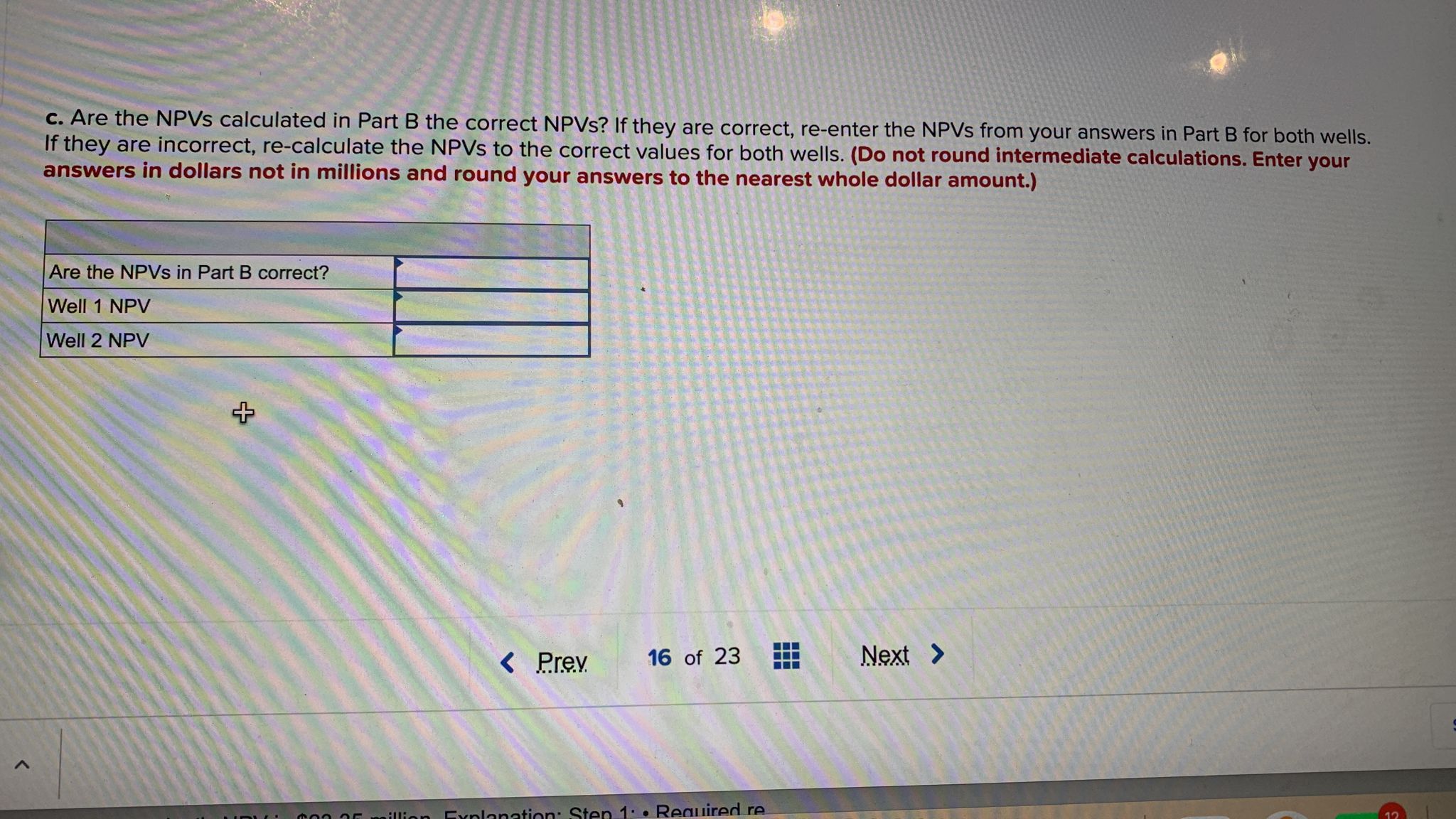

Question: c. Are the NPVs calculated in Part B the correct NPVs? If they are correct, re-enter the NPVs from your answers in Part B for

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock