Question: (c) Assuming instead that, firm D declares a share dividend after the market closes at time 0. The share dividend takes the form of 10

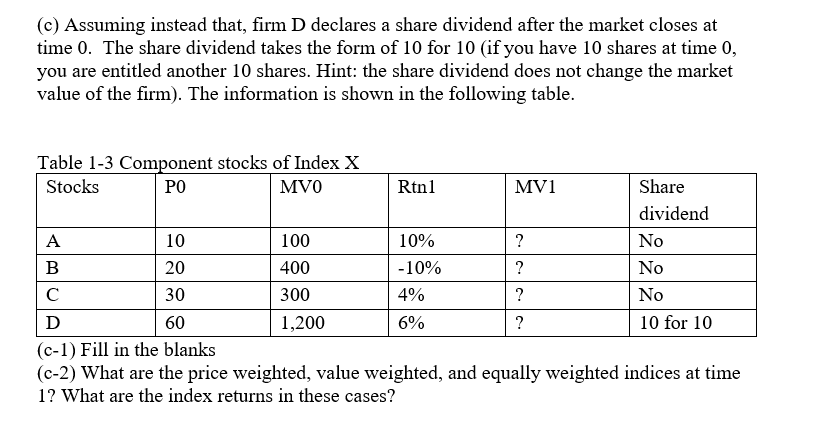

(c) Assuming instead that, firm D declares a share dividend after the market closes at time 0. The share dividend takes the form of 10 for 10 (if you have 10 shares at time , you are entitled another 10 shares. Hint: the share dividend does not change the market value of the firm). The information is shown in the following table. Table 1-3 Component stocks of Index X Stocks PO MVO Rtn1 MV1 Share dividend A 10 100 10% ? No B 20 400 -10% ? No 30 300 4% ? No D 60 1,200 6% ? 10 for 10 (c-1) Fill in the blanks (c-2) What are the price weighted, value weighted, and equally weighted indices at time 1? What are the index returns in these cases? (c) Assuming instead that, firm D declares a share dividend after the market closes at time 0. The share dividend takes the form of 10 for 10 (if you have 10 shares at time , you are entitled another 10 shares. Hint: the share dividend does not change the market value of the firm). The information is shown in the following table. Table 1-3 Component stocks of Index X Stocks PO MVO Rtn1 MV1 Share dividend A 10 100 10% ? No B 20 400 -10% ? No 30 300 4% ? No D 60 1,200 6% ? 10 for 10 (c-1) Fill in the blanks (c-2) What are the price weighted, value weighted, and equally weighted indices at time 1? What are the index returns in these cases

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts