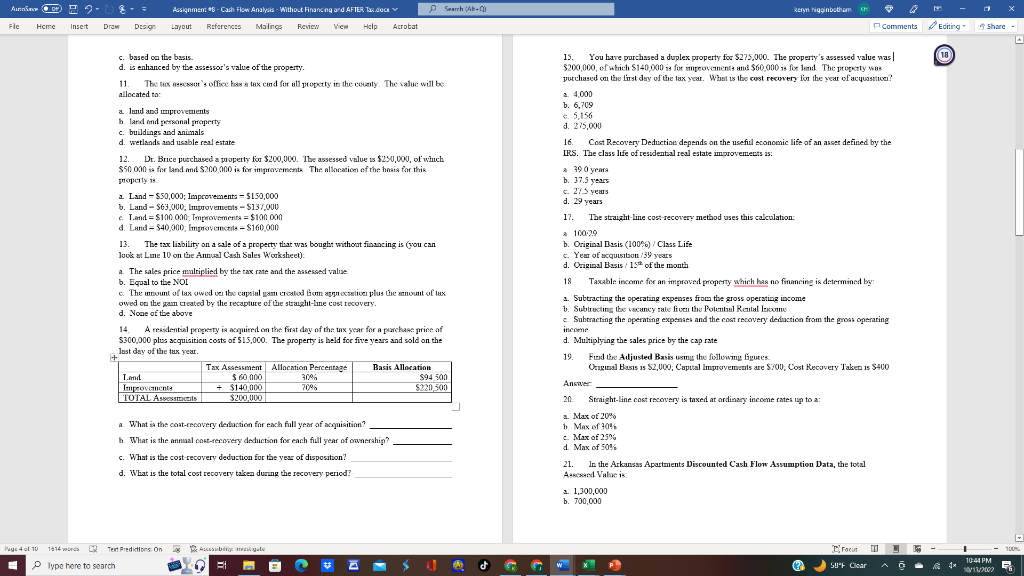

Question: c. based ca the busis. c. based ca the basis. 15. You have purchased a duplex property for $275,000. The property's assessed value nas allocated

c. based ca the busis. c. based ca the basis. 15. You have purchased a duplex property for \$275,000. The property's assessed value nas allocated ta: a land and mprevements c. buidings and animals c. buidings and animals d. wetlands and uszble real eatate 2. 4,000 c. What is the cost recovery dedustion for the year of disposition? a. Max of 20% d. What is the total cost recovery taken dusing the recovery period? c. Max of 25% d. Max of 50% 21. In the Arkansas Apartments Discounted Cash Flow Assumption Data, the total A.ekseded Valoe is 3. 1,300,000 b. 700,000 c. based ca the busis. c. based ca the basis. 15. You have purchased a duplex property for \$275,000. The property's assessed value nas allocated ta: a land and mprevements c. buidings and animals c. buidings and animals d. wetlands and uszble real eatate 2. 4,000 c. What is the cost recovery dedustion for the year of disposition? a. Max of 20% d. What is the total cost recovery taken dusing the recovery period? c. Max of 25% d. Max of 50% 21. In the Arkansas Apartments Discounted Cash Flow Assumption Data, the total A.ekseded Valoe is 3. 1,300,000 b. 700,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts