Question: c. Calculate the expected dividend yield (D1/ ), ), the capital gains yield expected during the first year, and the expected total return (dividend yield

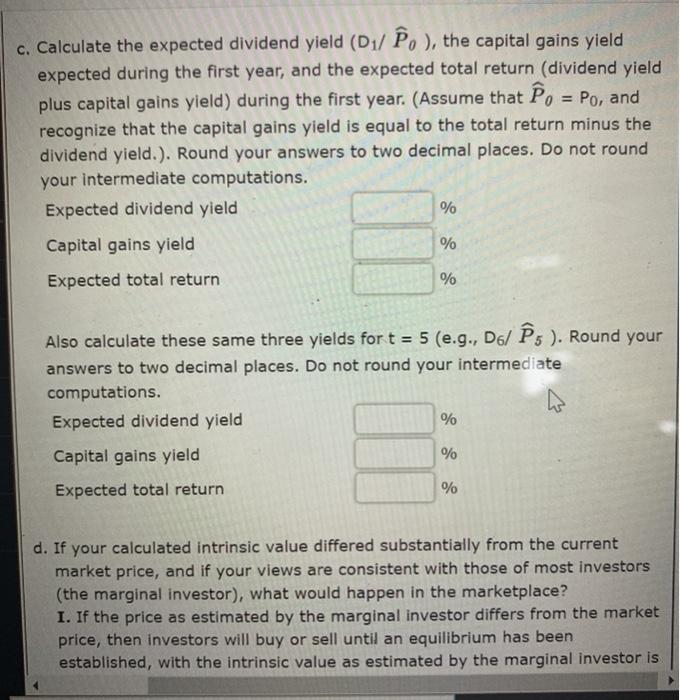

c. Calculate the expected dividend yield (D1/ ), ), the capital gains yield expected during the first year, and the expected total return (dividend yield plus capital gains yield) during the first year. (Assume that he = Po, and recognize that the capital gains yield is equal to the total return minus the dividend yield.). Round your answers to two decimal places. Do not round your intermediate computations. Expected dividend yield % Capital gains yield % Expected total return % Also calculate these same three yields for t = 5 (e.g., D6/ 5 ). Round your answers to two decimal places. Do not round your intermediate computations. Expected dividend yield % Capital gains yield % Expected total return % d. If your calculated intrinsic value differed substantially from the current market price, and if your views are consistent with those of most investors (the marginal investor), what would happen in the marketplace? I. If the price as estimated by the marginal investor differs from the market price, then investors will buy or sell until an equilibrium has been established, with the intrinsic value as estimated by the marginal investor is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts