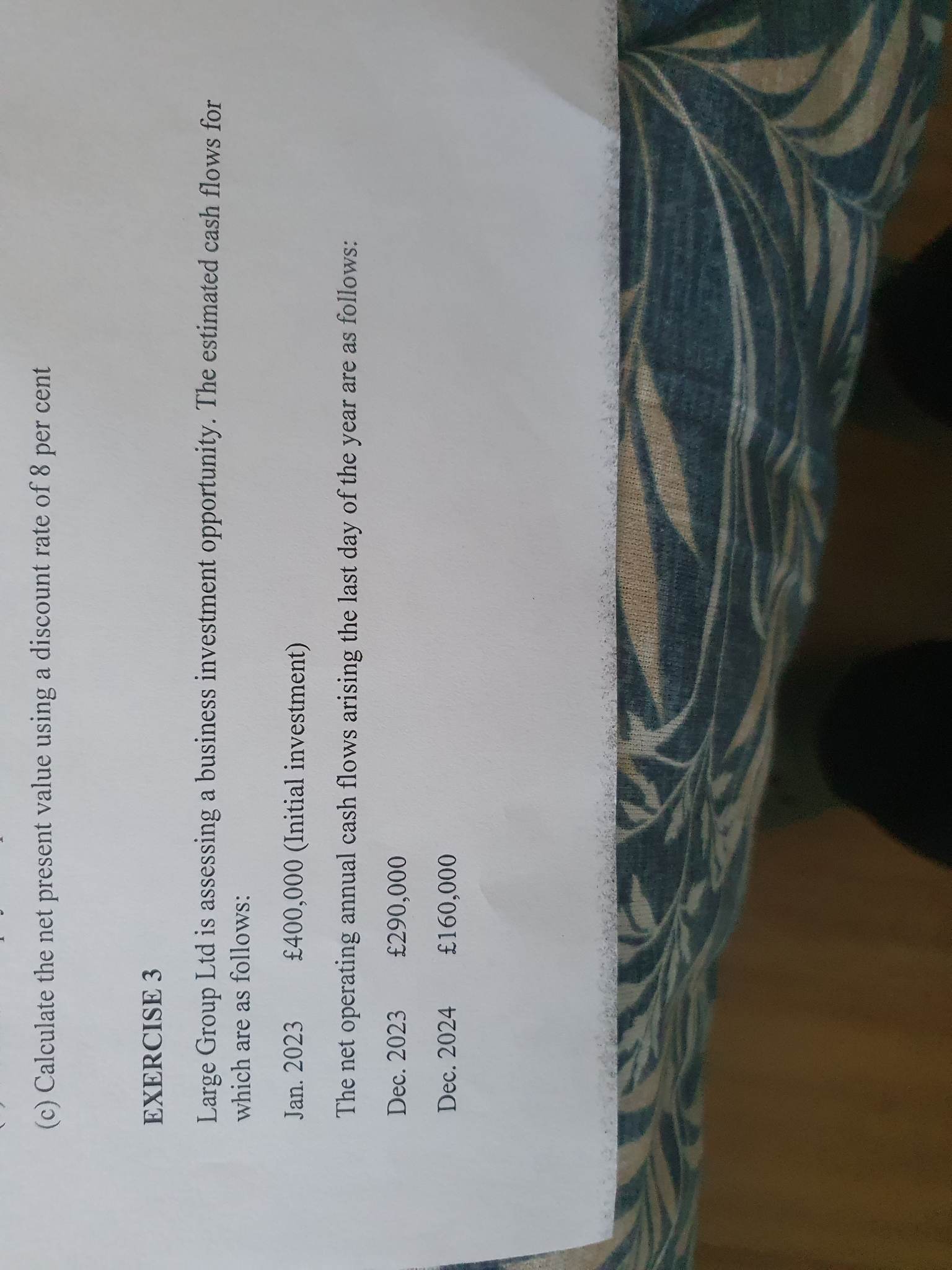

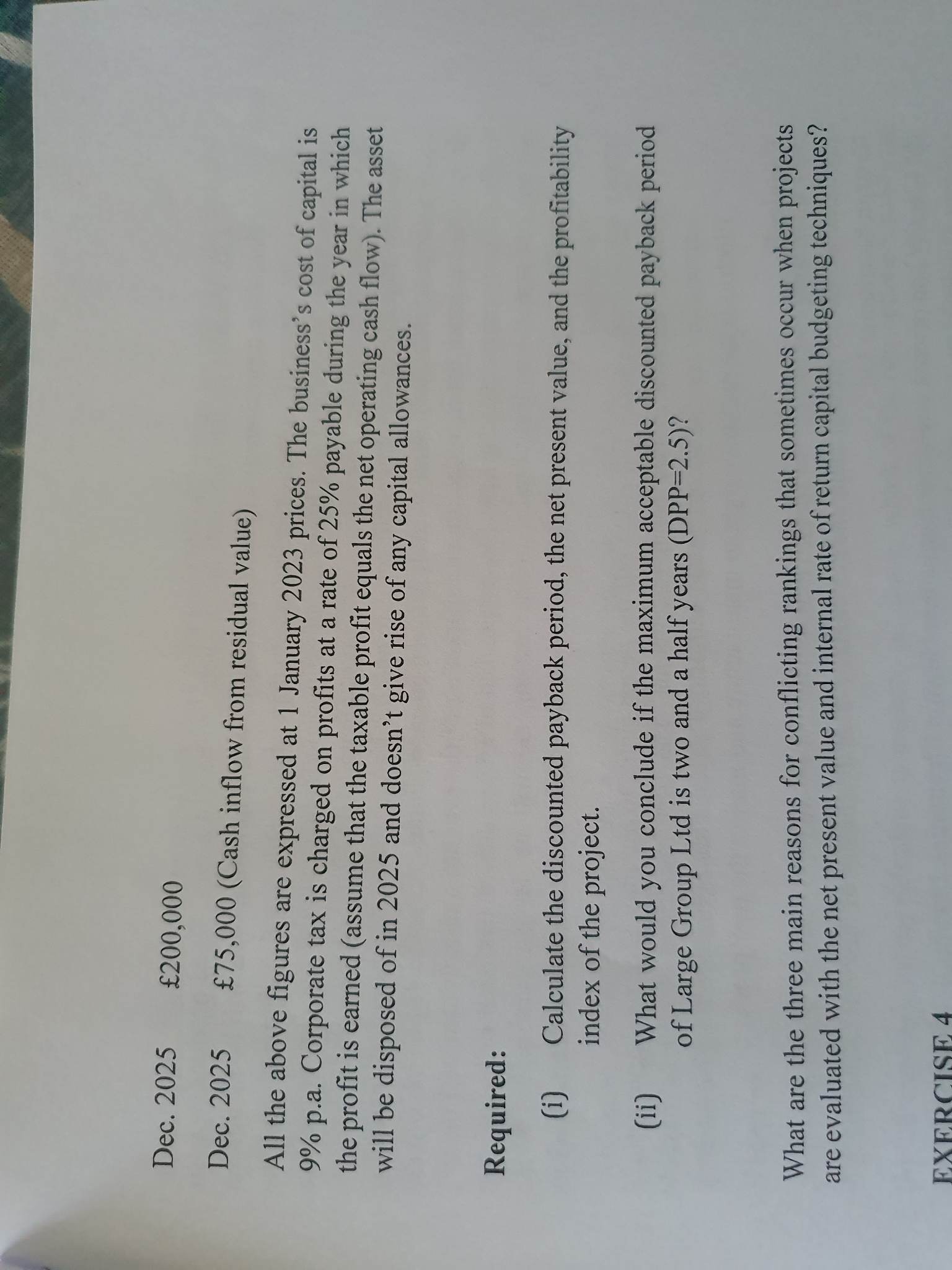

Question: (c) Calculate the net present value using a discount rate of 8 per cent EXERCISE 3 Large Group Lid is assessing a business investment opportunity.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts