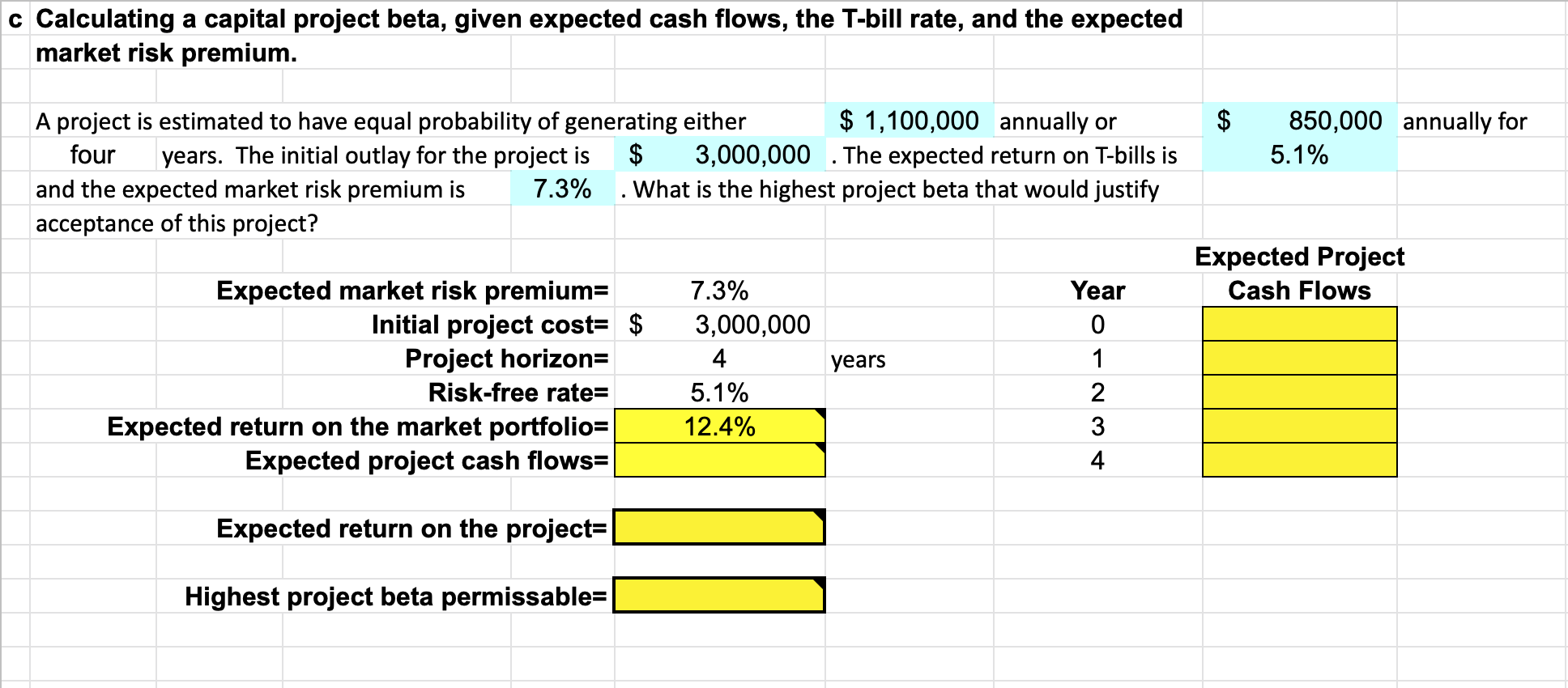

Question: c Calculating a capital project beta, given expected cash flows, the T-bill rate, and the expected market risk premium. $ 850,000 annually for 5.1% A

c Calculating a capital project beta, given expected cash flows, the T-bill rate, and the expected market risk premium. $ 850,000 annually for 5.1% A project is estimated to have equal probability of generating either $ 1,100,000 annually or four years. The initial outlay for the project is $ 3,000,000 . The expected return on T-bills is and the expected market risk premium is 7.3% . What is the highest project beta that would justify acceptance of this project? Expected Project Cash Flows Year 7.3% 3,000,000 years Expected market risk premium= Initial project cost= $ Project horizon= Risk-free rate= Expected return on the market portfolio= Expected project cash flows= 5.17 5.1% 12.4% A WN-o Expected return on the project= Highest project beta permissable=

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts