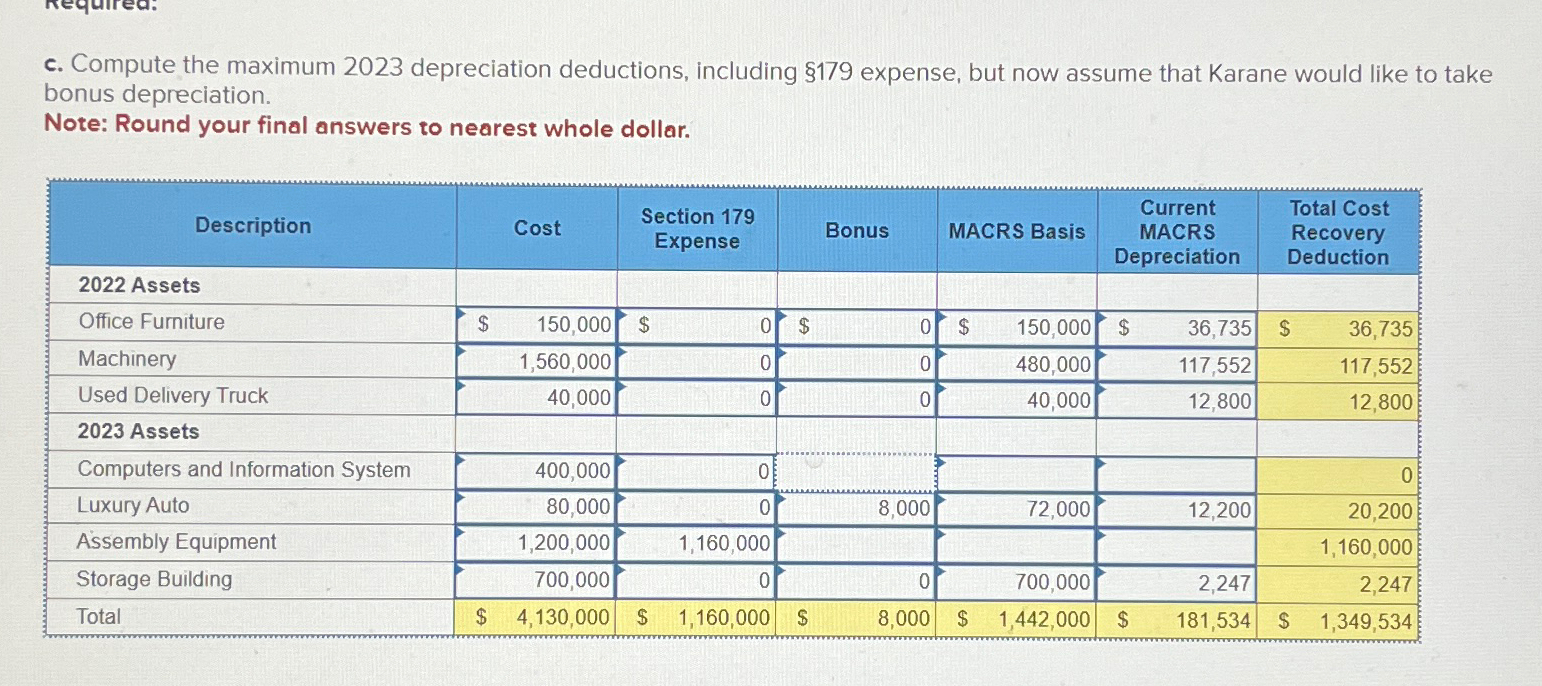

Question: c. Compute the maximum 2023 depreciation deductions, including $179 expense, but now assume that Karane would like to take bonus depreciation. Note: Round your

c. Compute the maximum 2023 depreciation deductions, including $179 expense, but now assume that Karane would like to take bonus depreciation. Note: Round your final answers to nearest whole dollar. Description Cost Section 179 Expense Bonus MACRS Basis Current MACRS Depreciation Total Cost Recovery Deduction 2022 Assets Office Furniture Machinery Used Delivery Truck $ 150,000 $ 0 $ 0 $ 1,560,000 0 0 150,000 $ 480,000 36,735 $ 36,735 117,552 117,552 40,000 0 0 40,000 12,800 12,800 2023 Assets Computers and Information System 400,000 0 0 Luxury Auto 80,000 0 8,000 72,000 12,200 Assembly Equipment 1,200,000 1,160,000 20,200 1,160,000 Storage Building 700,000 0 0 700,000 2,247 Total $ 4,130,000 $ 1,160,000 $ 8,000 $ 1,442,000 $ 181,534 $ 2,247 1,349,534

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts