Question: c) Consider a state with two school districts. District 1 has a property tax base of 250,000 per student and taxes itself at 1.5%. District

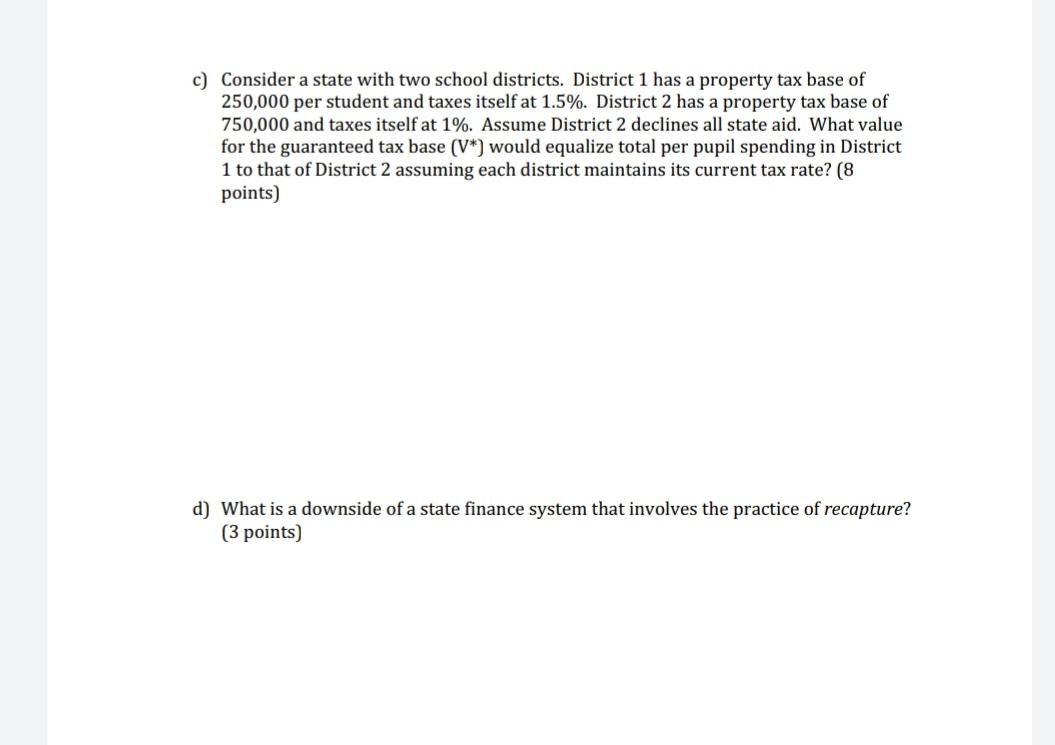

c) Consider a state with two school districts. District 1 has a property tax base of 250,000 per student and taxes itself at 1.5%. District 2 has a property tax base of 750,000 and taxes itself at 1%. Assume District 2 declines all state aid. What value for the guaranteed tax base (V*) would equalize total per pupil spending in District 1 to that of District 2 assuming each district maintains its current tax rate? (8 points) d) What is a downside of a state finance system that involves the practice of recapture? (3 points) c) Consider a state with two school districts. District 1 has a property tax base of 250,000 per student and taxes itself at 1.5%. District 2 has a property tax base of 750,000 and taxes itself at 1%. Assume District 2 declines all state aid. What value for the guaranteed tax base (V*) would equalize total per pupil spending in District 1 to that of District 2 assuming each district maintains its current tax rate? (8 points) d) What is a downside of a state finance system that involves the practice of recapture? (3 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts