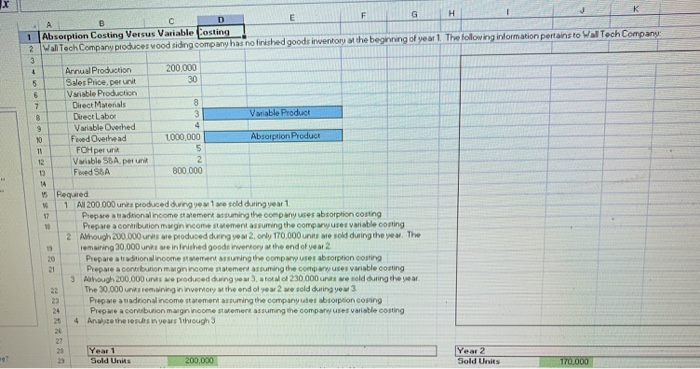

Question: C D 1 Absorption Costing Versus Variable Costing 2 Wan Tech Company produces wood siding company has no finished goods inventory at the beginning of

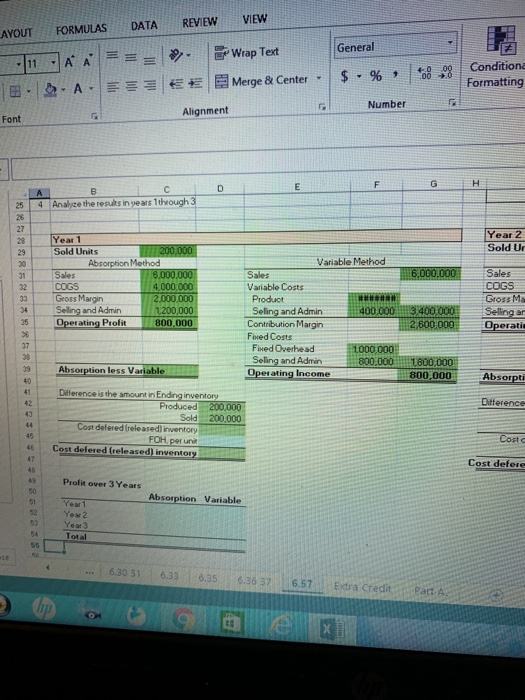

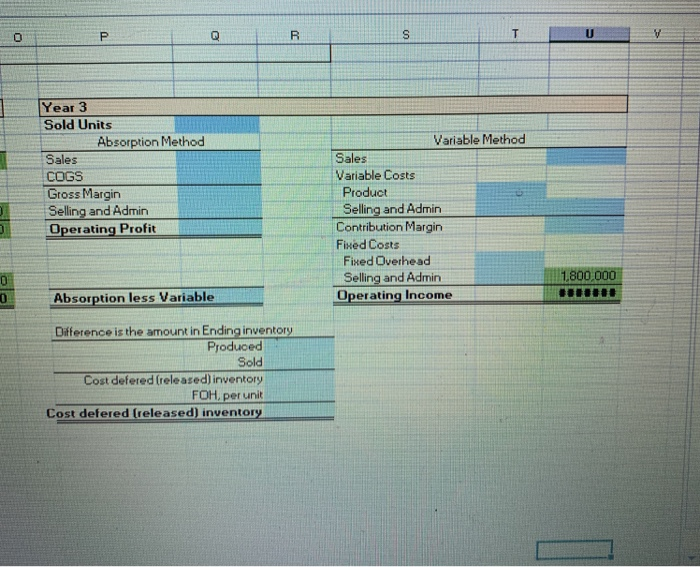

C D 1 Absorption Costing Versus Variable Costing 2 Wan Tech Company produces wood siding company has no finished goods inventory at the beginning of year 1. The following information pertains to WolTech Company 200.000 30 Variable Product Annual Production Sales Price per unit Variable Production Direct Materials Direct Labor Variable Overhed Foed Overhead FOH per unit Vwiable SBA per unit Feed S&A Absorption Product 800,000 15 1 Required 1 All 200.000 units produced during you are sold during year 1 Prepare a traditional income statement assuming the company wes absorption costing Prepare a contribution mugin income sementas ruming the compawuses variable costing Although 200.000 units we produced during you 2. only 170,000 units are sold during the year. The remaining 30.000 und weininished goodwentory the end of year 2 Prepare a traditional income tweet assuring the comp uter absorption costing Prepare a contribution mancome tatement assuming the compawuses variable costing 3 Arough 200.000 unts we produced during a total of 230.000 unts wereld during the year The 30.000 un semning in invernory the end of yem 2 wereld during ye 3 Prepare a taronal income sementarfuming the companyutes absorption costing Prepare a corbution margin income women arruming the companuses variable costing 25 4 Analyze the results in years through 3 Year 1 Sold Units Year 2 Sold Units 200,000 LAYOUT FORMULAS DATA REVIEW VIEW . Wrap Text Merge & Center - General $ . ar % 8 +0.09 08 Conditiona Formatting A.EE E 1. Font Number Alignment Anshee the results in years through 3 Year 2 Sold Ur 6,000,000 Year 1 Sold Units H 200,000 Absorption Method Sales 6,000,000 COGS 4.000.000 Gross Margin 2,000,000 Seling and Admin 1.200,000 Operating Profit 800,000 Variable Method Sales Variable Costs Product Seling and Admin 400,000 Contribution Margin Fixed Costs Fixed Overhead 1000 000 Seling and Admin 800.000 Operating Income Sales COGS Gross MS Sellingar Operatit 3.400.000 2.600.000 Absorption less Variable 1.800,000 800,000 Absorpti Difference Difference is the amount in Ending inventory Produced 200.000 Sold 200.000 Cost defered released inventory FOH, por un Cost defered (released) inventory Cost defere Profit over 3 Years Absorption Variable Year 1 You2 Yeu Total ... 6.30 31 6.33 6.356.3637 6.57 Extra Credit Cart A GP GIG R Year 3 Sold Units Absorption Method Variable Method Sales Sales COGS Gross Margin Selling and Admin Operating Profit Variable Costs Product Selling and Admin Contribution Margin Fixed Costs Fixed Overhead Selling and Admin Operating Income O 1.800.000 00888 Absorption less Variable Difference is the amount in Ending inventory Produced Sold Cost defered released) inventory FOH, per unit Cost defered (released) inventory

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts