Question: c d e f Consider an institution with three option positions against the same underlying stock. The maturities of all the options exceed one year.

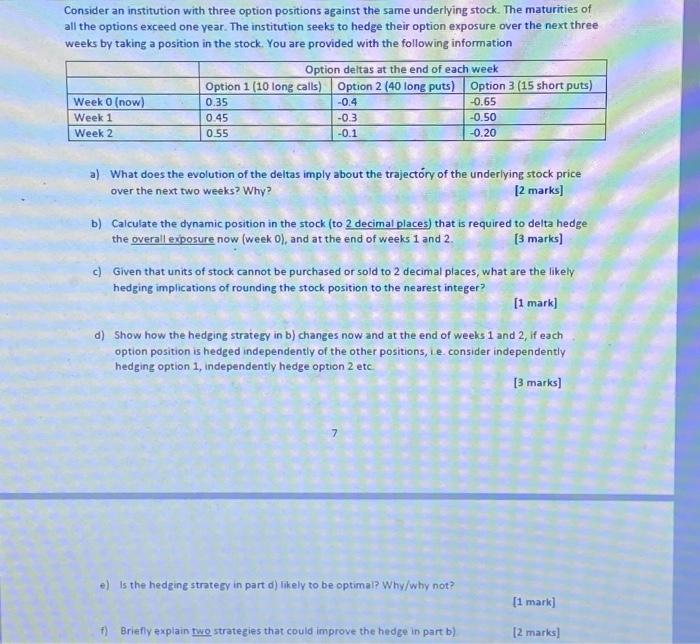

Consider an institution with three option positions against the same underlying stock. The maturities of all the options exceed one year. The institution seeks to hedge their option exposure over the next three weeks by taking a position in the stock. You are provided with the following information a) What does the evolution of the deltas imply about the trajectorry of the underlying stock price over the next two weeks? Why? [ 2 marks] b) Calculate the dynamic position in the stock (to 2 decimal places) that is required to delta hedge the overall exposure now (week 0 ), and at the end of weeks 1 and 2 . [ 3 marks] c) Given that units of stock cannot be purchased or sold to 2 decimal places, what are the likely hedging implications of rounding the stock position to the nearest integer? [1 mark] d) Show how the hedging strategy in b) changes now and at the end of weeks 1 and 2 , if each option position is hedged independently of the other positions, le. consider independently hedging option 1, independently hedge option 2 etc [3 marks] 7 e) Is the hedging strategy in part d) likely to be optimal? Why/why not? [ 1 mark] f) Briefly explain two strategies that could improve the hedge in part b) [2 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts