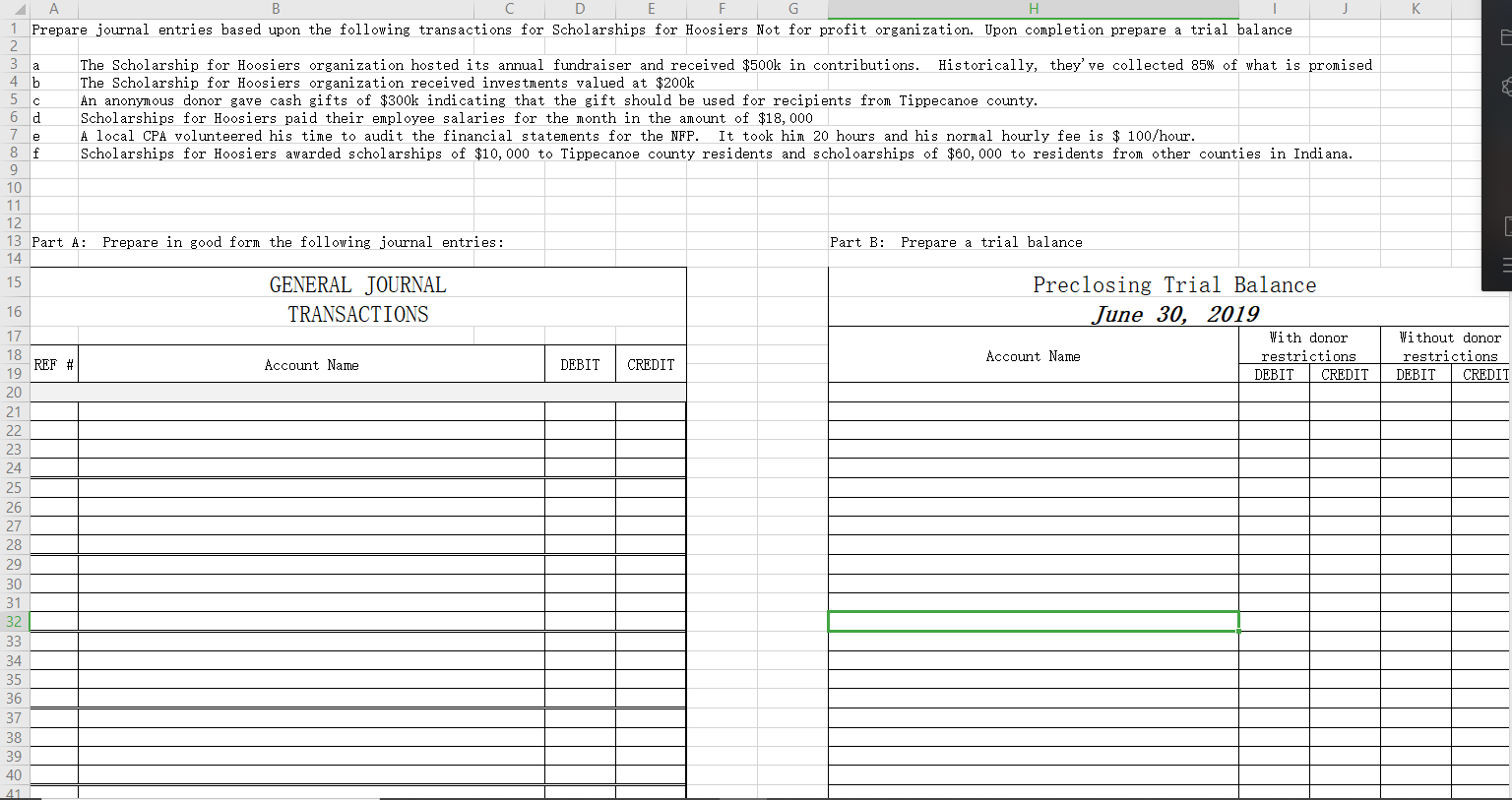

Question: C D E F G 1 Prepare journal entries based upon the following transactions for Scholarships for Hoosiers Not for profit organization. Upon completion prepare

C D E F G 1 Prepare journal entries based upon the following transactions for Scholarships for Hoosiers Not for profit organization. Upon completion prepare a trial balance a m to The Scholarship for Hoosiers organization hosted its annual fundraiser and received $500k in contributions. Historically, they've collected 85% of what is promised The Scholarship for Hoosiers organization received investments valued at $200k An anonymous donor gave cash gifts of $300k indicating that the gift should be used for recipients from Tippecanoe county. Scholarships for Hoosiers paid their employee salaries for the month in the amount of $18,000 A local CPA volunteered his time to audit the financial statements for the NFP. It took him 20 hours and his normal hourly fee is $ 100/hour. Scholarships for Hoosiers awarded scholarships of $10,000 to Tippecanoe county residents and scholoarships of $60,000 to residents from other counties in Indiana. Part B: Prepare a trial balance 13 Part A: Prepare in good form the following journal entries: 14 GENERAL JOURNAL TRANSACTIONS 15 Preclosing Trial Balance June 30, 2019 With donor restrictions DEBIT CREDIT Account Name Without donor restrictions DEBIT CREDIT REF Account Name CREDIT DEBIT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts