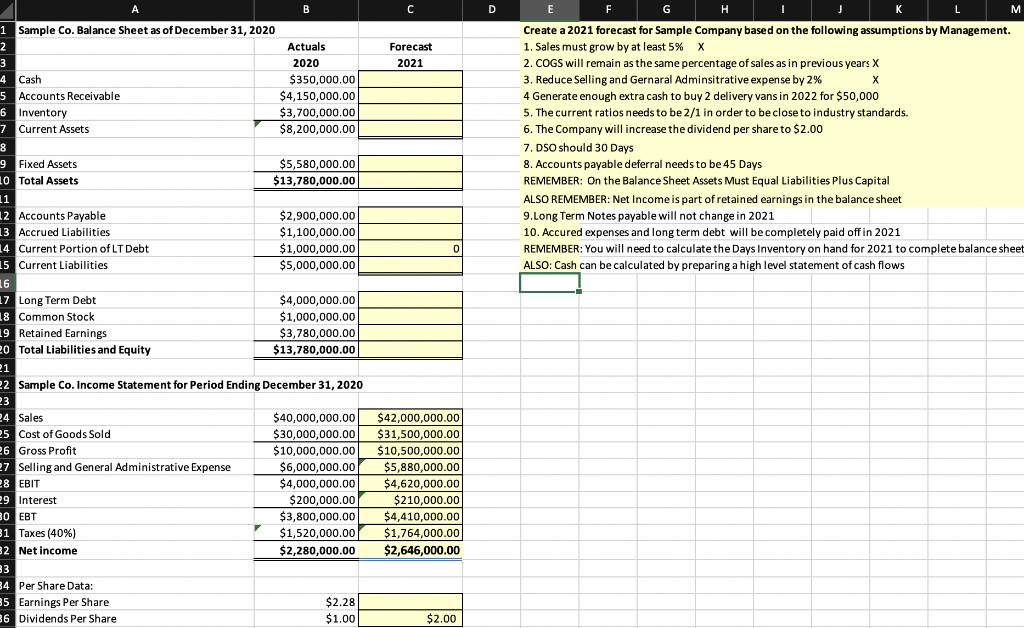

Question: C D E H L M Forecast 2021 6 Inventory Create a 2021 forecast for Sample Company based on the following assumptions by Management. 1.

C D E H L M Forecast 2021 6 Inventory Create a 2021 forecast for Sample Company based on the following assumptions by Management. 1. Sales must grow by at least 5% X 2. COGS will remain as the same percentage of sales as in previous years X 3. Reduce Selling and Gernaral Adminsitrative expense by 2% 4 Generate enough extra cash to buy 2 delivery vans in 2022 for $50,000 5. The current ratios needs to be 2/1 in order to be close to industry standards. 6. The Company will increase the dividend per share to $2.00 7. DSO should 30 Days 8. Accounts payable deferral needs to be 45 Days REMEMBER: On the Balance Sheet Assets Must Equal Liabilities Plus Capital ALSO REMEMBER: Net Income is part of retained earnings in the balance sheet 9. Long Term Notes payable will not change in 2021 10. Accured expenses and long term debt will be completely paid off in 2021 REMEMBER: You will need to calculate the Days Inventory on hand for 2021 to complete balance sheet ALSO: Cash can be calculated by preparing a high level statement of cash flows 0 A B 1 Sample Co. Balance Sheet as of December 31, 2020 2 Actuals 3 2020 4 Cash $350,000.00 5 Accounts Receivable $4,150,000.00 $3,700,000.00 7 Current Assets $8,200,000.00 8 9 Fixed Assets $5,580,000.00 10 Total Assets $13,780,000.00 11 12 Accounts Payable $2,900,000.00 13 Accrued Liabilities $1,100,000.00 14 Current Portion of LT Debt $1,000,000.00 15 Current Liabilities $5,000,000.00 16 17 Long Term Debt $4,000,000.00 18 Common Stock $1,000,000.00 19 Retained Earnings $3,780,000.00 0 Total Liabilities and Equity $13,780,000.00 21 2 Sample Co. Income Statement for Period Ending December 31, 2020 23 24 Sales $40,000,000.00 25 Cost of Goods Sold $30,000,000.00 26 Gross Profit $10,000,000.00 27 Selling and General Administrative Expense $6,000,000.00 28 EBIT $4,000,000.00 29 Interest $200,000.00 BO EBT $3,800,000.00 31 Taxes (40%) $1,520,000.00 32 Net income 2 $2,280,000.00 3 34 Per Share Data: 35 Earnings Per Share $2.28 6 Dividends Per Share $1.00 $42,000,000.00 $31,500,000.00 $10,500,000.00 $5,880,000.00 $4,620,000.00 $210,000.00 $4,410,000.00 $1,764,000.00 $2,646,000.00 $2.00 C D E H L M Forecast 2021 6 Inventory Create a 2021 forecast for Sample Company based on the following assumptions by Management. 1. Sales must grow by at least 5% X 2. COGS will remain as the same percentage of sales as in previous years X 3. Reduce Selling and Gernaral Adminsitrative expense by 2% 4 Generate enough extra cash to buy 2 delivery vans in 2022 for $50,000 5. The current ratios needs to be 2/1 in order to be close to industry standards. 6. The Company will increase the dividend per share to $2.00 7. DSO should 30 Days 8. Accounts payable deferral needs to be 45 Days REMEMBER: On the Balance Sheet Assets Must Equal Liabilities Plus Capital ALSO REMEMBER: Net Income is part of retained earnings in the balance sheet 9. Long Term Notes payable will not change in 2021 10. Accured expenses and long term debt will be completely paid off in 2021 REMEMBER: You will need to calculate the Days Inventory on hand for 2021 to complete balance sheet ALSO: Cash can be calculated by preparing a high level statement of cash flows 0 A B 1 Sample Co. Balance Sheet as of December 31, 2020 2 Actuals 3 2020 4 Cash $350,000.00 5 Accounts Receivable $4,150,000.00 $3,700,000.00 7 Current Assets $8,200,000.00 8 9 Fixed Assets $5,580,000.00 10 Total Assets $13,780,000.00 11 12 Accounts Payable $2,900,000.00 13 Accrued Liabilities $1,100,000.00 14 Current Portion of LT Debt $1,000,000.00 15 Current Liabilities $5,000,000.00 16 17 Long Term Debt $4,000,000.00 18 Common Stock $1,000,000.00 19 Retained Earnings $3,780,000.00 0 Total Liabilities and Equity $13,780,000.00 21 2 Sample Co. Income Statement for Period Ending December 31, 2020 23 24 Sales $40,000,000.00 25 Cost of Goods Sold $30,000,000.00 26 Gross Profit $10,000,000.00 27 Selling and General Administrative Expense $6,000,000.00 28 EBIT $4,000,000.00 29 Interest $200,000.00 BO EBT $3,800,000.00 31 Taxes (40%) $1,520,000.00 32 Net income 2 $2,280,000.00 3 34 Per Share Data: 35 Earnings Per Share $2.28 6 Dividends Per Share $1.00 $42,000,000.00 $31,500,000.00 $10,500,000.00 $5,880,000.00 $4,620,000.00 $210,000.00 $4,410,000.00 $1,764,000.00 $2,646,000.00 $2.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts