Question: c) Describe the items that are needed in the calculation of custom duties . 6marks ) d) Discuss the concept and application of tax warranty

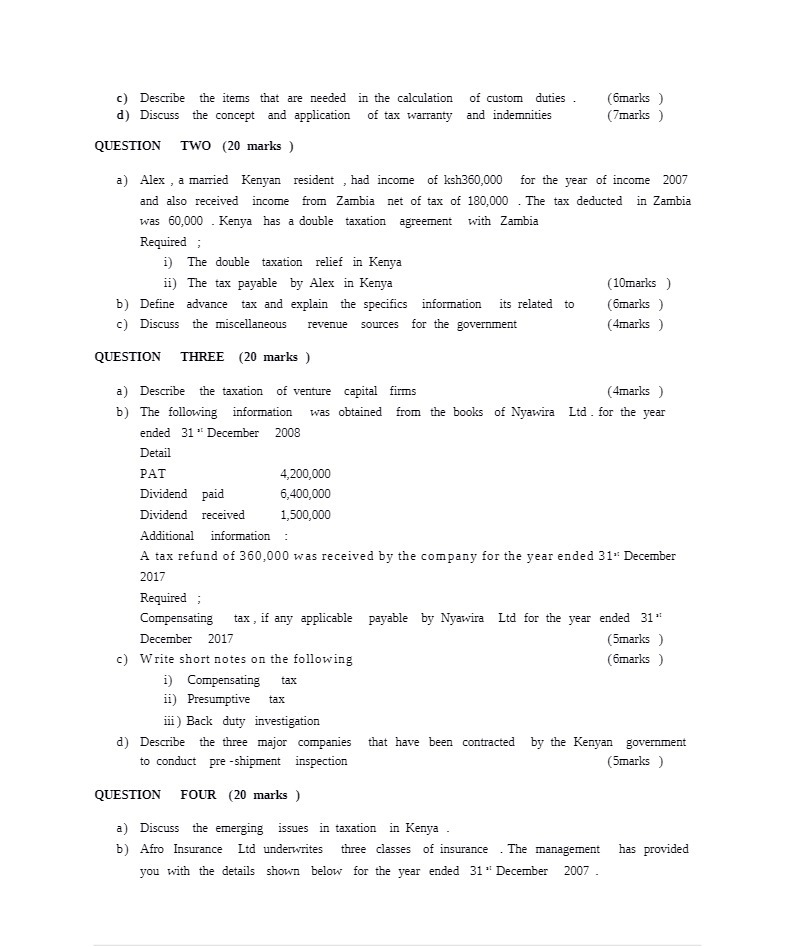

c) Describe the items that are needed in the calculation of custom duties . 6marks ) d) Discuss the concept and application of tax warranty and indemnities (7marks ) QUESTION TWO (20 marks ) a) Alex , a married Kenyan resident , had income of ksh360,000 for the year of income 2007 and also received income from Zambia net of tax of 180,000 . The tax deducted in Zambia was 60,000 . Kenya has a double taxation agreement with Zambia Required i) The double taxation relief in Kenya ii) The tax payable by Alex in Kenya (10marks ) b) Define advance tax and explain the specifics information its related to (6marks c) Discuss the miscellaneous revenue sources for the government (4marks ) QUESTION THREE (20 marks ) a) Describe the taxation of venture capital firms (4marks ) b) The following information was obtained from the books of Nyawira Ltd . for the year ended 31 " December 2008 Detail PAT 4,200,000 Dividend paid 6,400,000 Dividend received 1,500,000 Additional information A tax refund of 360,000 was received by the company for the year ended 31" December 2017 Required ; Compensating tax , if any applicable payable by Nyawira Lid for the year ended 31" December 2017 (5marks ) c) Write short notes on the following (6marks ) i) Compensating tax ii) Presumptive tax iii ) Back duty investigation d) Describe the three major companies that have been contracted by the Kenyan government to conduct pre -shipment inspection (5marks ) QUESTION FOUR (20 marks ) a) Discuss the emerging issues in taxation in Kenya b) Afro Insurance Lid underwrites three classes of insurance . The management has provided you with the details shown below for the year ended 31 " December 2007

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts