Question: c . Determine before - tax profit at theoretical, practical, and normal capacity. Note: Only use a negative sign with any volume variance that is

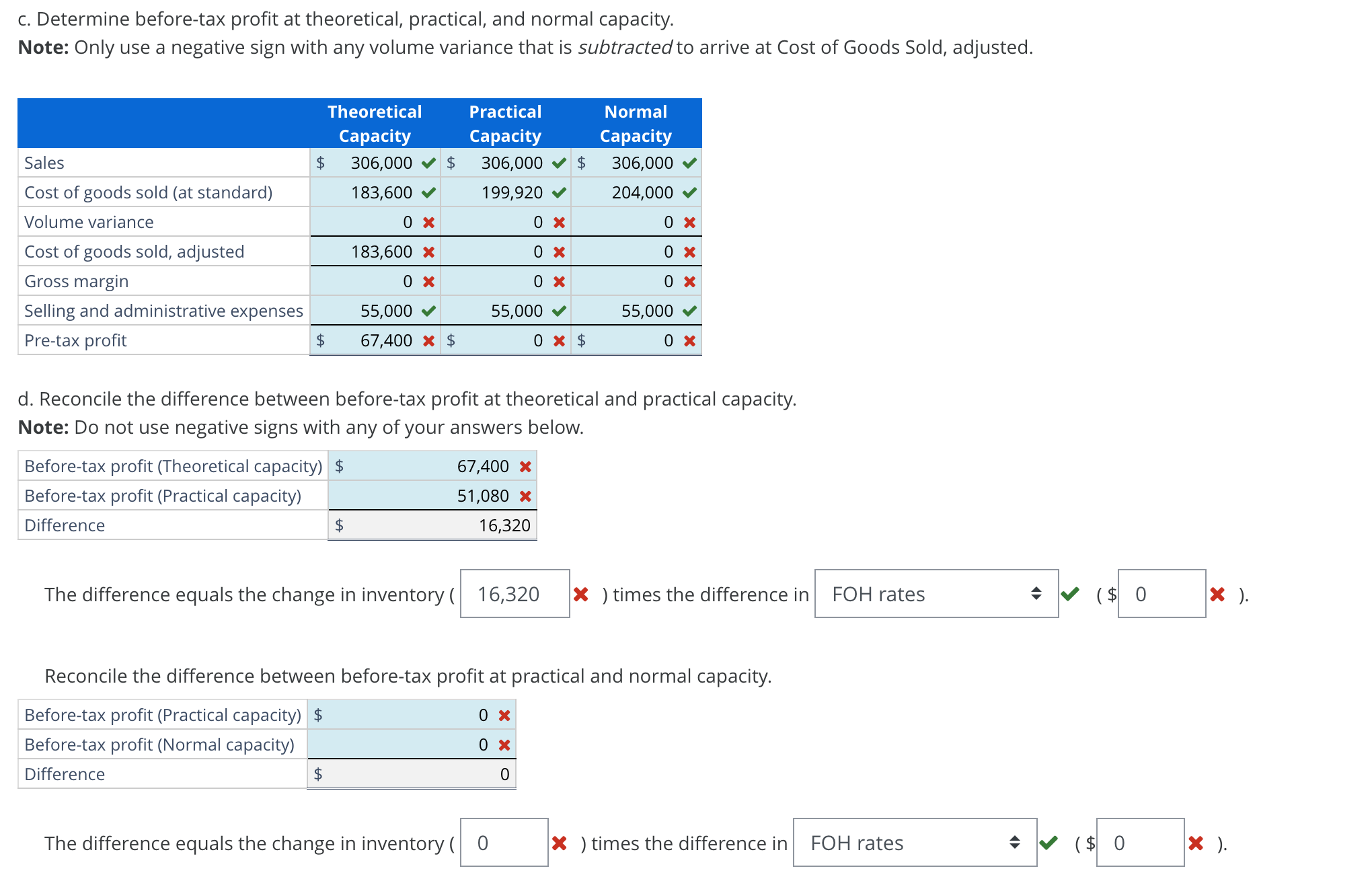

c Determine beforetax profit at theoretical, practical, and normal capacity.

Note: Only use a negative sign with any volume variance that is subtracted to arrive at Cost of Goods Sold, adjusted.

d Reconcile the difference between beforetax profit at theoretical and practical capacity.

Note: Do not use negative signs with any of your answers below.

The difference equals the change in inventory

boldsymbolX times the difference in$ x

Reconcile the difference between beforetax profit at practical and normal capacity.

The difference equals the change in inventory times the difference in FOH rates $ times Capacity measurements; beforetax profit

The following predictions were made in the prior year for one of the plants of Windsor Inc.

Actual results for the month of January were as follows.

Assume a sales price per unit of $ and fixed selling and administrative expenses of $ Cost of goods sold at standard is $ $ and $ at theoretical, practical, and normal capacity, respectively.

a Calculate the budgeted FOH rate based upon theoretical, practical, and normal capacity.

b What is the volume variance in January, if the budgeted FOH rate is based upon theoretical, practical, and normal capacity? Use the FOH rates exactly as shown above in part a Assume that budgeted FOH is incurred evenly throughout the year.

Note: Enter any unfavorable variances with a negative sign.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock