Question: C. determining how the required rate of return changes over t D. determining how the cost of capital changes over time E A and B

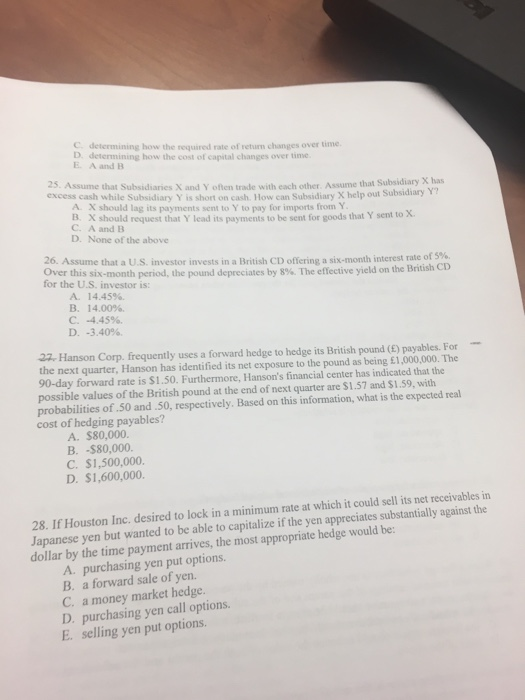

C. determining how the required rate of return changes over t D. determining how the cost of capital changes over time E A and B 25. Assume that Subsidiaries X and Y often trade with each other. Assume that Subsidiary excess cash while Subsidiary Y is short on cash. How can Subsidiary X help out Subsidiary A. X should lag its payments sent to Y to pay for imports from Y X has B. X should request that Y lead its payments to be sent for goods that Y sent to X A and B D. None of the above 26, Assume that a US investor invests in a British CD offering a six-month interest rate of 5%. Over this six-month period, the pound depreciates by 8% The effective yeld on the for the U.S. investor is: A. 14.45%. B. 14.00%. -4.45%. D. -3.40%. 22 Hanson Corp. frequently uses a forward hedge to hedge its British pound (5) payables. For the next quarter, Hanson has identified its net exposure to the pound as being 1,000,000. The 90-day forward rate is $1.50. Furthermore, Hanson's financial center has indicated that the possible values of the British pound at the end of next quarter are $1.57 and $1.59, with probabilities of.50 and .50, respectively. Based on this information, what is the expected real cost of hedging payables? A. $80,000 B. -$80,000. C. $1,500,000. D. $1,600,000. 28. If Houston Inc. desired to lock in a minimum rate at which it could sell its net receivables in Japanese yen but wanted to be able to capitalize if the yen appreciates substantially against the dollar by the time payment arrives, the most appropriate hedge would be A. purchasing yen put options. B. a forward sale of yen. C. a money market hedge. D. purchasing yen call options. E. selling yen put options. C. determining how the required rate of return changes over t D. determining how the cost of capital changes over time E A and B 25. Assume that Subsidiaries X and Y often trade with each other. Assume that Subsidiary excess cash while Subsidiary Y is short on cash. How can Subsidiary X help out Subsidiary A. X should lag its payments sent to Y to pay for imports from Y X has B. X should request that Y lead its payments to be sent for goods that Y sent to X A and B D. None of the above 26, Assume that a US investor invests in a British CD offering a six-month interest rate of 5%. Over this six-month period, the pound depreciates by 8% The effective yeld on the for the U.S. investor is: A. 14.45%. B. 14.00%. -4.45%. D. -3.40%. 22 Hanson Corp. frequently uses a forward hedge to hedge its British pound (5) payables. For the next quarter, Hanson has identified its net exposure to the pound as being 1,000,000. The 90-day forward rate is $1.50. Furthermore, Hanson's financial center has indicated that the possible values of the British pound at the end of next quarter are $1.57 and $1.59, with probabilities of.50 and .50, respectively. Based on this information, what is the expected real cost of hedging payables? A. $80,000 B. -$80,000. C. $1,500,000. D. $1,600,000. 28. If Houston Inc. desired to lock in a minimum rate at which it could sell its net receivables in Japanese yen but wanted to be able to capitalize if the yen appreciates substantially against the dollar by the time payment arrives, the most appropriate hedge would be A. purchasing yen put options. B. a forward sale of yen. C. a money market hedge. D. purchasing yen call options. E. selling yen put options

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts