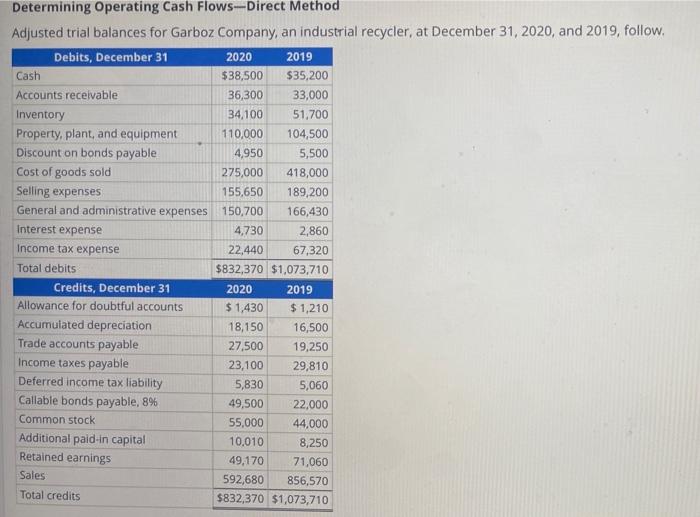

Question: c Determining Operating Cash Flows-Direct Method Adjusted trial balances for Garboz Company, an industrial recycler, at December 31, 2020, and 2019, follow. Debits, December 31

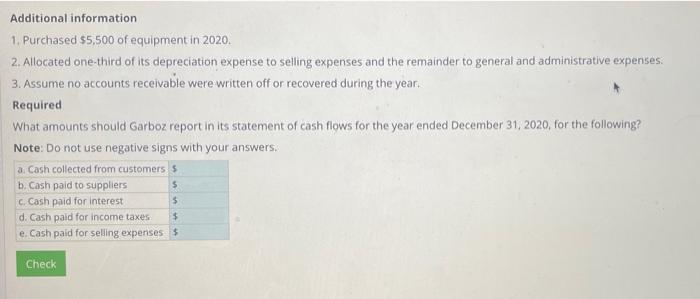

Determining Operating Cash Flows-Direct Method Adjusted trial balances for Garboz Company, an industrial recycler, at December 31, 2020, and 2019, follow. Debits, December 31 2019 Cash $35,200 Accounts receivable 33,000 Inventory 51,700 Property, plant, and equipment 104,500 Discount on bonds payable 5,500 Cost of goods sold 418,000 Selling expenses 189,200 General and administrative expenses 150,700 166,430 Interest expense 4,730 2,860 Income tax expense 22,440 67,320 Total debits $832,370 $1,073,710 2020 2019 $ 1,430 18,150 Credits, December 31 Allowance for doubtful accounts Accumulated depreciation Trade accounts payable Income taxes payable Deferred income tax liability Callable bonds payable, 8% Common stock Additional paid-in capital Retained earnings Sales Total credits 2020 $38,500 36,300 34,100 110,000 4,950 275,000 155,650 $1,210 16,500 19,250 29,810 5,060 22,000 44,000 10,010 8,250 49,170 71,060 592,680 856,570 $832,370 $1,073,710 27,500 23,100 5,830 49,500 55,000 Additional information. 1. Purchased $5,500 of equipment in 2020. 2. Allocated one-third of its depreciation expense to selling expenses and the remainder to general and administrative expenses. 3. Assume no accounts receivable were written off or recovered during the year. Required What amounts should Garboz report in its statement of cash flows for the year ended December 31, 2020, for the following? Note: Do not use negative signs with your answers. a. Cash collected from customers $ b. Cash paid to suppliers $ c. Cash paid for interest d. Cash paid for income taxes. e. Cash paid for selling expenses Check $ $ $ Determining Operating Cash Flows-Direct Method Adjusted trial balances for Garboz Company, an industrial recycler, at December 31, 2020, and 2019, follow. Debits, December 31 2019 Cash $35,200 Accounts receivable 33,000 Inventory 51,700 Property, plant, and equipment 104,500 Discount on bonds payable 5,500 Cost of goods sold 418,000 Selling expenses 189,200 General and administrative expenses 150,700 166,430 Interest expense 4,730 2,860 Income tax expense 22,440 67,320 Total debits $832,370 $1,073,710 2020 2019 $ 1,430 18,150 Credits, December 31 Allowance for doubtful accounts Accumulated depreciation Trade accounts payable Income taxes payable Deferred income tax liability Callable bonds payable, 8% Common stock Additional paid-in capital Retained earnings Sales Total credits 2020 $38,500 36,300 34,100 110,000 4,950 275,000 155,650 $1,210 16,500 19,250 29,810 5,060 22,000 44,000 10,010 8,250 49,170 71,060 592,680 856,570 $832,370 $1,073,710 27,500 23,100 5,830 49,500 55,000 Additional information. 1. Purchased $5,500 of equipment in 2020. 2. Allocated one-third of its depreciation expense to selling expenses and the remainder to general and administrative expenses. 3. Assume no accounts receivable were written off or recovered during the year. Required What amounts should Garboz report in its statement of cash flows for the year ended December 31, 2020, for the following? Note: Do not use negative signs with your answers. a. Cash collected from customers $ b. Cash paid to suppliers $ c. Cash paid for interest d. Cash paid for income taxes. e. Cash paid for selling expenses Check $ $ $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts