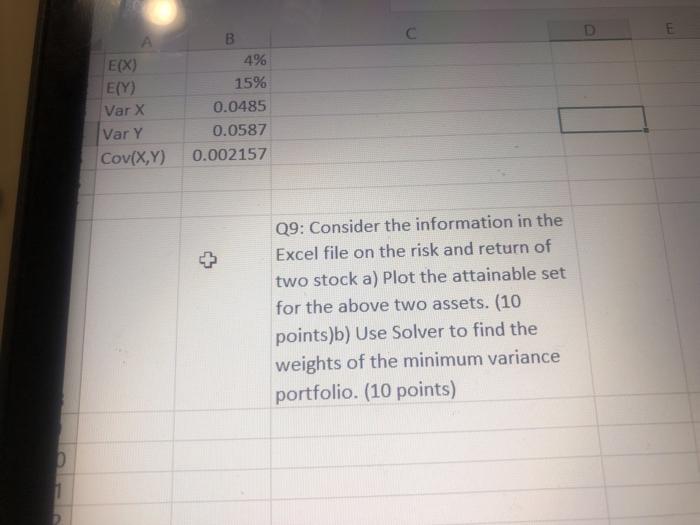

Question: C E E E(X) E(Y) Var X Var Y Cov(X,Y) B 4% 15% 0.0485 0.0587 0.002157 Q9: Consider the information in the Excel file on

C E E E(X) E(Y) Var X Var Y Cov(X,Y) B 4% 15% 0.0485 0.0587 0.002157 Q9: Consider the information in the Excel file on the risk and return of two stock a) Plot the attainable set for the above two assets. (10 points)b) Use Solver to find the weights of the minimum variance portfolio. (10 points) 0 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts