Question: C++ English You will write a program to calculate the amount of taxes owed when a child tax credit is involved. The program needs to

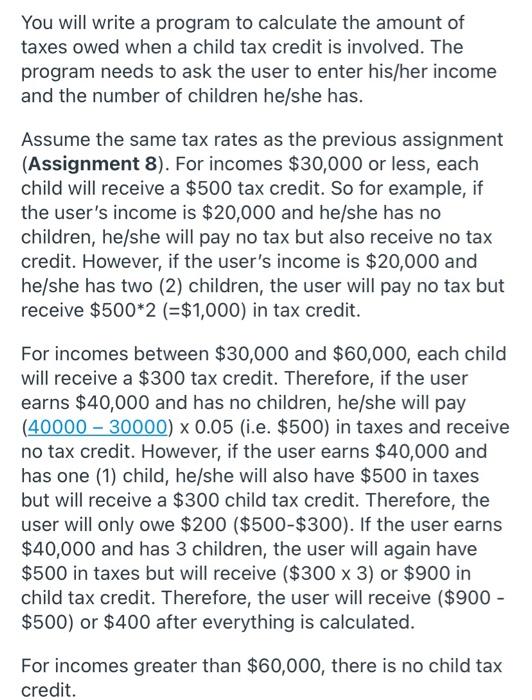

You will write a program to calculate the amount of taxes owed when a child tax credit is involved. The program needs to ask the user to enter his/her income and the number of children he/she has. Assume the same tax rates as the previous assignment (Assignment 8). For incomes $30,000 or less, each child will receive a $500 tax credit. So for example, if the user's income is $20,000 and he/she has no children, he/she will pay no tax but also receive no tax credit. However, if the user's income is $20,000 and he/she has two (2) children, the user will pay no tax but receive $500*2 (=$1,000) in tax credit. For incomes between $30,000 and $60,000, each child will receive a $300 tax credit. Therefore, if the user earns $40,000 and has no children, he/she will pay (40000 - 30000) x 0.05 (i.e. $500) in taxes and receive no tax credit. However, if the user earns $40,000 and has one (1) child, he/she will also have $500 in taxes but will receive a $300 child tax credit. Therefore, the user will only owe $200 ($500-$300). If the user earns $40,000 and has 3 children, the user will again have $500 in taxes but will receive ($300 x 3) or $900 in child tax credit. Therefore, the user will receive ($900 - $500) or $400 after everything is calculated. For incomes greater than $60,000, there is no child tax credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts