Question: C ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fkeiseruniversity.blackboard.com% Chapter 13 HW i Saved Help In 2020, Andrew contributed equipment with an adjusted basis of $30,000 and an FMV of $28,000 to

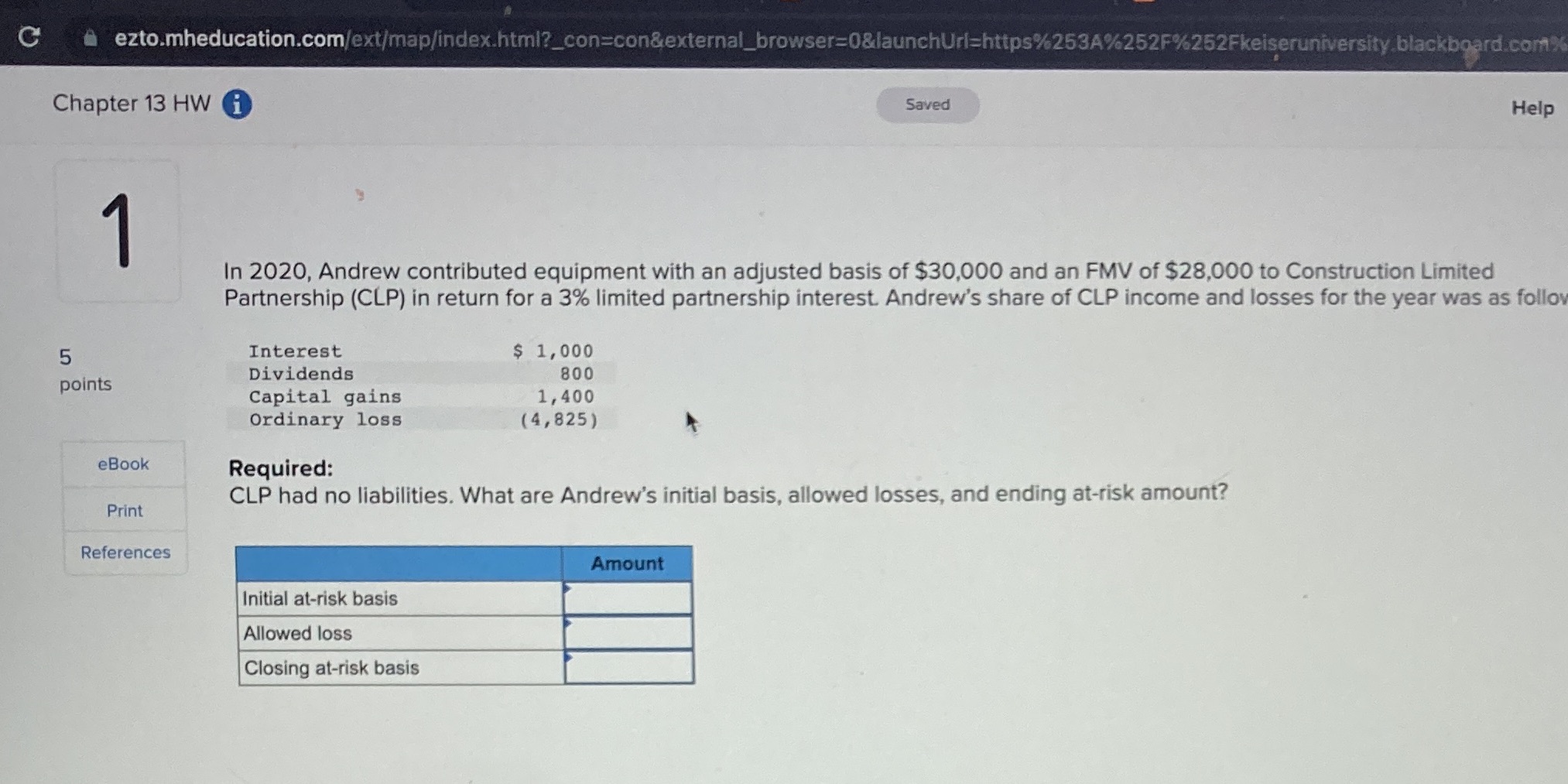

C ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fkeiseruniversity.blackboard.com% Chapter 13 HW i Saved Help In 2020, Andrew contributed equipment with an adjusted basis of $30,000 and an FMV of $28,000 to Construction Limited Partnership (CLP) in return for a 3% limited partnership interest. Andrew's share of CLP income and losses for the year was as follow 5 Interest $ 1, 000 Dividends 800 points Capital gains 1, 400 Ordinary loss (4,825) eBook Required: CLP had no liabilities. What are Andrew's initial basis, allowed losses, and ending at-risk amount? Print References Amount Initial at-risk basis Allowed loss Closing at-risk basis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts