Question: C . For tax year 2 0 2 3 , my wife and I file as Married, filing jointly. We have no dependent children, no

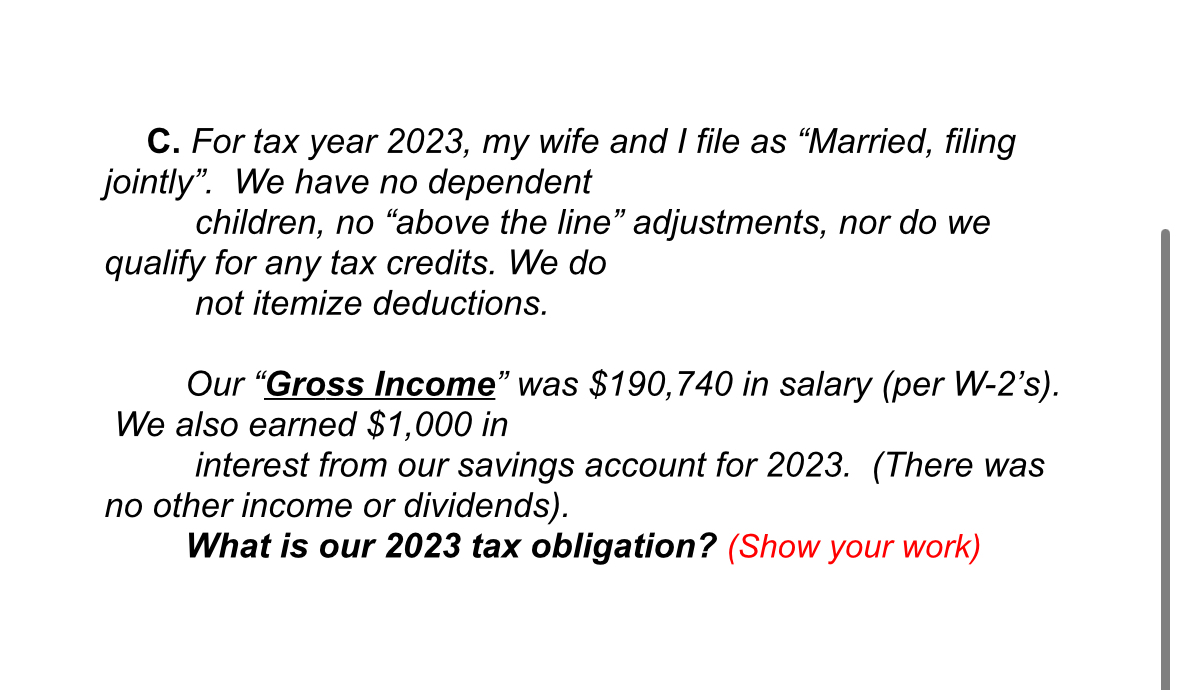

C For tax year my wife and I file as "Married, filing jointly". We have no dependent

children, no "above the line" adjustments, nor do we qualify for any tax credits. We do not itemize deductions.

Our "Gross Income" was $ in salary per Ws We also earned $ in interest from our savings account for There was no other income or dividends

What is our tax obligation? Show your work

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock