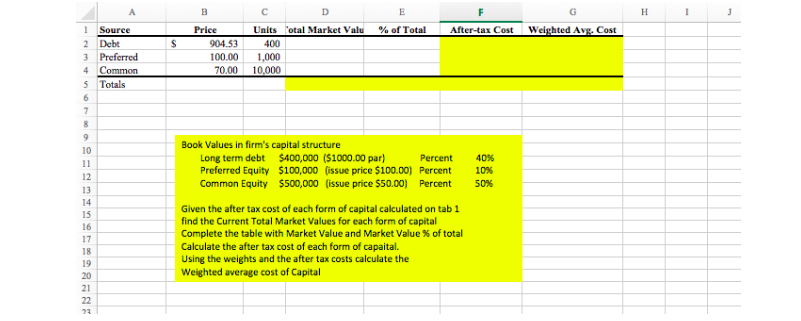

Question: C H A E Weighted Avg. Cost Source Price Units otal Market Valu % of Total After-tax Cost Debt S 904.53 400 Preferred 100.00 1,000

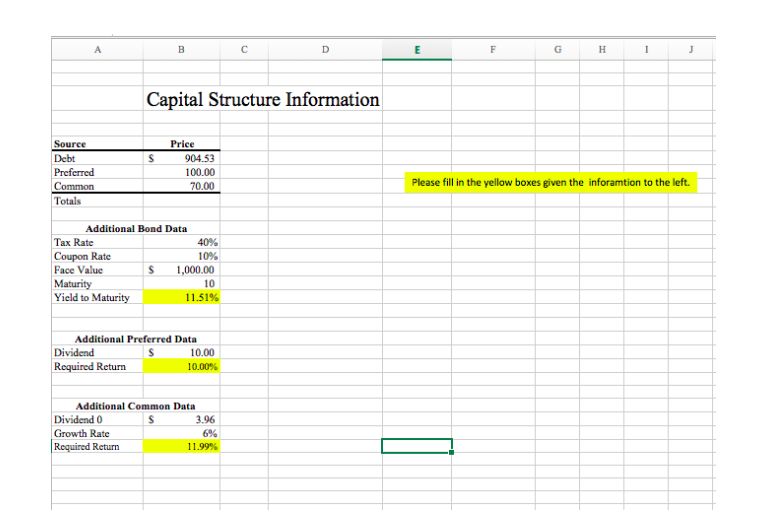

C H A E Weighted Avg. Cost Source Price Units otal Market Valu % of Total After-tax Cost Debt S 904.53 400 Preferred 100.00 1,000 4 Common 70.00 10,000 Totals 5 7 9 Book Values in firm's capital structure 10 Long term debt Preferred Equity $100,000 (issue price $100.00) Percent Common Equity $500,000 (issue price $50.00) Percent $400,000 ($1000.00 par) Percent 40 % 11 10% 12 50 % 13 14 15 Given the after tax cost of each form of capital calculated on tab 1 find the Current Total Market Values for each form of capital Complete the table with Market Value and Market Value % of total Calculate the after tax cost of each form of capaital. Using the weights and the after tax costs calculate the Weighted average cost of Capital 16 17 18 19 20 21 22 23 E G H D F Capital Structure Information Source Price Debt S 904.53 Preferred Common Totals 100.00 Please fill in the yellow boxes given the inforamtion to the left. 70,00 Additional Bond Data Tax Rate Coupon Rate Face Value Maturity Yield to Maturity 40% 10% 1,000.00 10 11.51% Additional Preferred Data Dividend 10.00 Required Return 10.00% Additional Common Data Dividend 0 Growth Rate Required Return 3.96 6% 11.99%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts