Question: C. Hedging Duration Risk I can hedge the duration risk of a bond purchase by selling interest rate futures contracts with an offsetting amount of

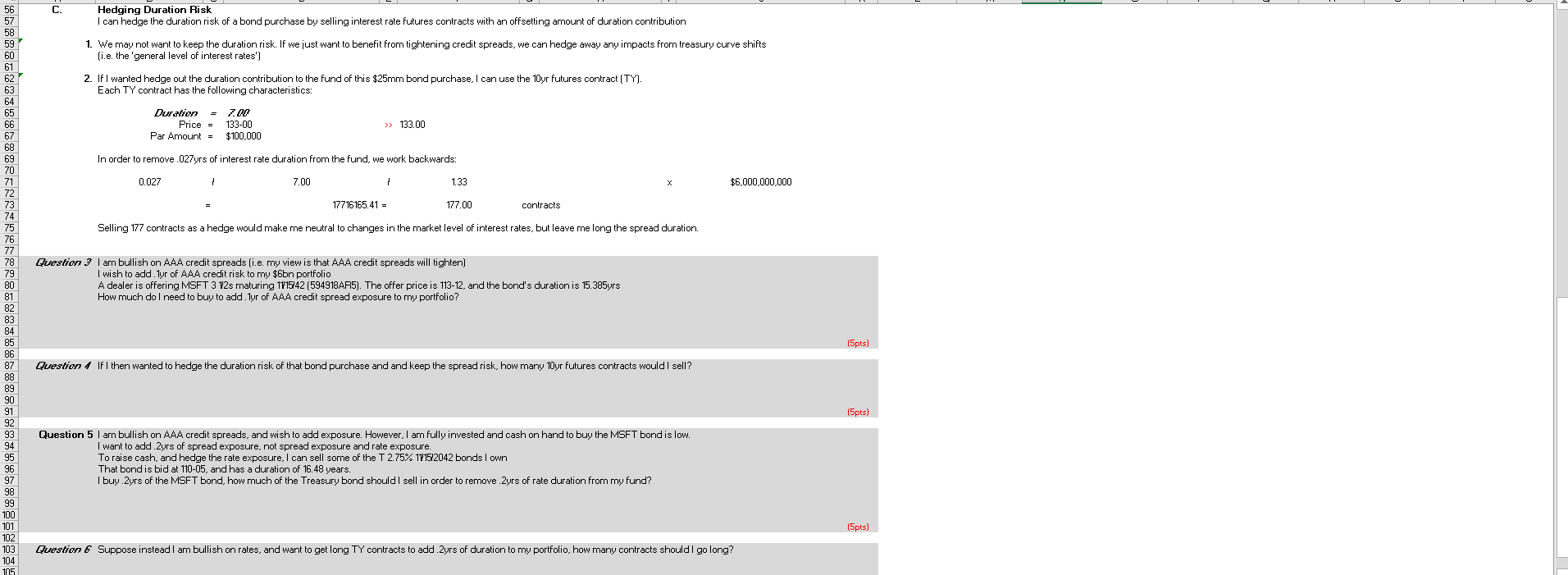

C. Hedging Duration Risk I can hedge the duration risk of a bond purchase by selling interest rate futures contracts with an offsetting amount of duration contribution 1. We may not want to keep the duration risk. If we just want to benefit from tightening credit spreads, we can hedge away any impacts from treasury curve shifts (i.e. the 'general level of interest rates') 2. If I wanted hedge out the duration contribution to the fund of this $25mm bond purchase. I can use the 10yr futures contract (TY). Each TY contract has the following characteristics: = Duration Price = Par Amount - >> 133.00 133-00 $100,000 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 In order to remove .027yrs of interest rate duration from the fund, we work backwards: 0.027 7.00 1.33 $6,000,000,000 17716165.41 = 177.00 contracts Selling 177 contracts as a hedge would make me neutral to changes in the market level of interest rates, but leave me long the spread duration. Question 3 I am bullish on AAA credit spreads (i.e. my view is that AAA credit spreads will tighten) I wish to add lyr of AAA credit risk to my $6bn portfolio A dealer is offering MSFT 3 Y2s maturing 1715/42 (5949184R5). The offer price is 113-12, and the bond's duration is 15.385yrs How much do I need to buy to add. Tyr of AAA credit spread exposure to my portfolio? (5pts) Question 4 If I then wanted to hedge the duration risk of that bond purchase and and keep the spread risk, how many 10yr futures contracts would I sell? (5pts) 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 Question 5 I am bullish on AAA credit spreads, and wish to add exposure. However, I am fully invested and cash on hand to buy the MSFT bond is low. I want to add. 2yrs of spread exposure, not spread exposure and rate exposure. To raise cash, and hedge the rate exposure I can sell some of the T 2.75% 1115/2042 bonds I own That bond is bid at 110-05, and has a duration of 16.48 years. I buy 2yrs of the MSFT bond, how much of the Treasury bond should I sell in order to remove 2yrs of rate duration from my fund? (5pts) Question & Suppose instead I am bullish on rates, and want to get long TY contracts to add. 2yrs of duration to my portfolio, how many contracts should I go long? C. Hedging Duration Risk I can hedge the duration risk of a bond purchase by selling interest rate futures contracts with an offsetting amount of duration contribution 1. We may not want to keep the duration risk. If we just want to benefit from tightening credit spreads, we can hedge away any impacts from treasury curve shifts (i.e. the 'general level of interest rates') 2. If I wanted hedge out the duration contribution to the fund of this $25mm bond purchase. I can use the 10yr futures contract (TY). Each TY contract has the following characteristics: = Duration Price = Par Amount - >> 133.00 133-00 $100,000 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 In order to remove .027yrs of interest rate duration from the fund, we work backwards: 0.027 7.00 1.33 $6,000,000,000 17716165.41 = 177.00 contracts Selling 177 contracts as a hedge would make me neutral to changes in the market level of interest rates, but leave me long the spread duration. Question 3 I am bullish on AAA credit spreads (i.e. my view is that AAA credit spreads will tighten) I wish to add lyr of AAA credit risk to my $6bn portfolio A dealer is offering MSFT 3 Y2s maturing 1715/42 (5949184R5). The offer price is 113-12, and the bond's duration is 15.385yrs How much do I need to buy to add. Tyr of AAA credit spread exposure to my portfolio? (5pts) Question 4 If I then wanted to hedge the duration risk of that bond purchase and and keep the spread risk, how many 10yr futures contracts would I sell? (5pts) 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 Question 5 I am bullish on AAA credit spreads, and wish to add exposure. However, I am fully invested and cash on hand to buy the MSFT bond is low. I want to add. 2yrs of spread exposure, not spread exposure and rate exposure. To raise cash, and hedge the rate exposure I can sell some of the T 2.75% 1115/2042 bonds I own That bond is bid at 110-05, and has a duration of 16.48 years. I buy 2yrs of the MSFT bond, how much of the Treasury bond should I sell in order to remove 2yrs of rate duration from my fund? (5pts) Question & Suppose instead I am bullish on rates, and want to get long TY contracts to add. 2yrs of duration to my portfolio, how many contracts should I go long

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts