Question: c . How would these entries be different if instead Sabina had signed a lease with the same terms? On May 3 1 , 2

c How would these entries be different if instead Sabina had signed a lease with the same

terms?

On May Gary's Grills financed the purchase of equipment by issuing a $

installment note payable. Terms of the note require annual payments with the first payment due

immediately.

a At what amount should Gary report the equipment's historical cost on his balance sheet

dated December xignoring depreciation

b Calculate the amount of Gary's annual payment.

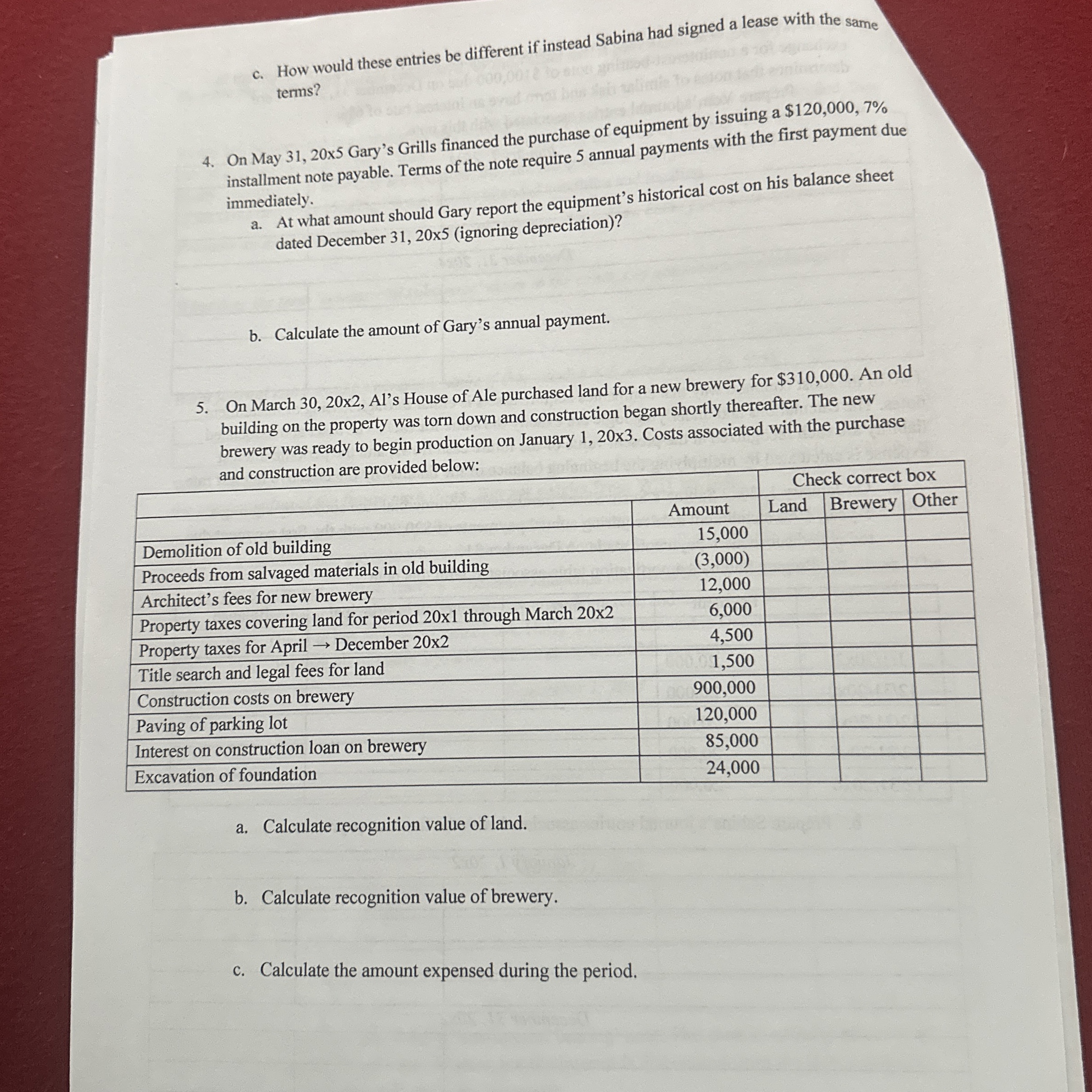

On March x Al's House of Ale purchased land for a new brewery for $ An old

building on the property was torn down and construction began shortly thereafter. The new

brewery was ready to begin production on January x Costs associated with the purchase

and construction are provided below:

a Calculate recognition value of land.

b Calculate recognition value of brewery.

c Calculate the amount expensed during the period.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock