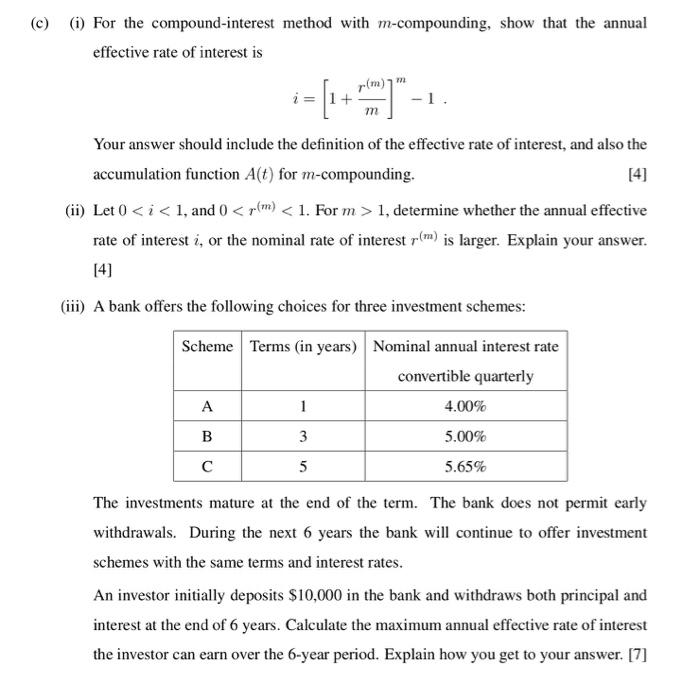

Question: (c) (i) For the compound-interest method with m-compounding, show that the annual effective rate of interest is := [1 + ) 1. Your answer should

(c) (i) For the compound-interest method with m-compounding, show that the annual effective rate of interest is := [1 + )" 1. Your answer should include the definition of the effective rate of interest, and also the accumulation function Alt) for m-compounding. [4] (ii) Let ( 1, determine whether the annual effective rate of interest i, or the nominal rate of interest r(m) is larger. Explain your answer. [4] (iii) A bank offers the following choices for three investment schemes: Scheme Terms (in years) Nominal annual interest rate convertible quarterly A 4.00% B 3 5.00% 5 5.65% The investments mature at the end of the term. The bank does not permit early withdrawals. During the next 6 years the bank will continue to offer investment schemes with the same terms and interest rates. An investor initially deposits $10,000 in the bank and withdraws both principal and interest at the end of 6 years. Calculate the maximum annual effective rate of interest the investor can earn over the 6-year period. Explain how you get to your answer. [7] (c) (i) For the compound-interest method with m-compounding, show that the annual effective rate of interest is := [1 + )" 1. Your answer should include the definition of the effective rate of interest, and also the accumulation function Alt) for m-compounding. [4] (ii) Let ( 1, determine whether the annual effective rate of interest i, or the nominal rate of interest r(m) is larger. Explain your answer. [4] (iii) A bank offers the following choices for three investment schemes: Scheme Terms (in years) Nominal annual interest rate convertible quarterly A 4.00% B 3 5.00% 5 5.65% The investments mature at the end of the term. The bank does not permit early withdrawals. During the next 6 years the bank will continue to offer investment schemes with the same terms and interest rates. An investor initially deposits $10,000 in the bank and withdraws both principal and interest at the end of 6 years. Calculate the maximum annual effective rate of interest the investor can earn over the 6-year period. Explain how you get to your answer. [7]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts